As an avid crypto trader, I’ve always been fascinated by the constant evolution of the digital asset market. While the crypto world operates 24/7, not all trading hours are created equal. In fact, understanding the best crypto trading hours can mean the difference between maximizing your returns and missing out on lucrative opportunities.

This article will share the data-driven insights I’ve uncovered through my extensive research and personal experiences in the crypto trading realm. Whether you’re a seasoned trader or just starting your journey, these strategies will empower you to make more informed decisions and potentially achieve greater success in your crypto ventures.

Debunking the Myth of 24/7 Trading: Time Matters More Than You Think

The crypto market’s non-stop nature may lead some to believe that trading hours are irrelevant. However, the data tells a different story. Cryptocurrency trading activity is far from evenly distributed across the 24-hour cycle. Factors like liquidity, volatility, and institutional participation can vary significantly throughout the day and week, dramatically impacting the trading opportunities available to us.

For instance, weekends are often characterized by lower trading volume and higher volatility, which can make it more challenging to execute profitable trades. Conversely, during weekday hours when major global markets are open, the influx of institutional investors can drive increased liquidity and more stable price movements.

Identifying the Best Crypto Trading Hours

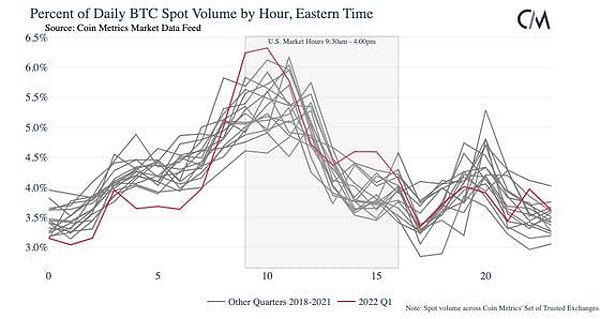

Bitcoin’s spot volume over three years

Bitcoin’s spot volume over three years

By closely analyzing data from leading cryptocurrency exchanges, I’ve been able to pinpoint the specific hours when trading activity is at its peak. According to my research, the busiest time for crypto trading is typically around the opening of the US stock market, between 9 AM and 12 PM Eastern Standard Time (EST).

During this timeframe, trading volume on platforms like Coinbase and Binance tends to surge, offering greater liquidity and potential for profitable trades. This trend is consistent across various cryptocurrencies, including Bitcoin, Ethereum, and altcoins.

However, it’s important to note that the “best” trading hours can vary slightly depending on the specific cryptocurrency and exchange. For instance, certain altcoins may see increased activity during Asian market hours, while Bitcoin trading might peak during the overlap between US and European market hours.

Leveraging Global Market Hours for Competitive Advantage

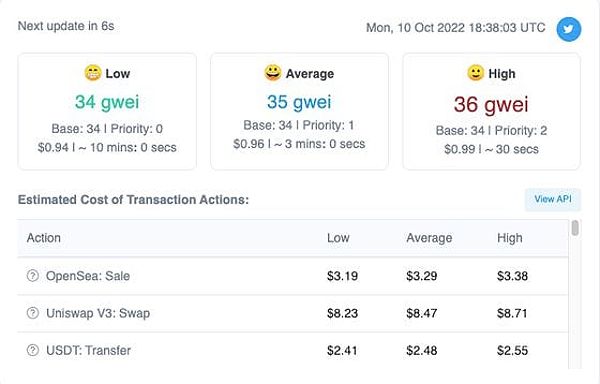

EtherScan display of Ethereum gas fees on October 10, 2022

EtherScan display of Ethereum gas fees on October 10, 2022

The crypto market’s 24/7 nature means that it’s heavily influenced by the opening and closing of traditional financial markets around the world. By understanding how global market hours impact cryptocurrency trading, I’ve been able to develop strategies to capitalize on these fluctuations.

For example, the US stock market’s opening at 9:30 AM EST often coincides with a spike in crypto trading activity, as institutional investors and algorithmic traders become more active. Similarly, the closing of the Asian markets in the evening (EST) can also trigger price movements in the crypto space.

As an experienced trader, I’ve learned to adapt my strategies to these global market cycles, using them as opportunities to enter or exit positions at favorable times. By closely monitoring global market events and their impact on crypto prices, I’ve been able to identify potential trading opportunities and time my transactions more effectively.

Optimizing Your Crypto Trading for Your Time Zone

While the crypto market is global, traders in different time zones can leverage their geographic advantage to identify the most profitable trading hours. For instance, as a trader based in Asia, I’ve found that the early morning hours (local time) offer the best liquidity and trading opportunities, as they align with the closing of European markets and the opening of the US market.

Similarly, my European counterparts might focus on the afternoon and evening hours, when both Asian and US markets are active. By understanding the trading patterns in our respective time zones, we can time our market entries and exits more effectively, potentially enhancing our overall performance.

To optimize your trading strategy for your local time zone, I recommend considering factors such as:

- Identifying the most active hours for your region’s crypto market

- Understanding how global market events impact price movements in your time zone

- Adjusting your trading schedules and risk management practices to suit your local market conditions

Navigating the Volatility of Weekend Crypto Trading

The crypto market’s 24/7 nature extends to weekends, but this can present both opportunities and challenges for traders like myself. While weekend trading can offer the potential for significant price swings and higher returns, it also comes with increased volatility and lower liquidity.

During weekends, the market is often dominated by algorithmic trading bots and retail investors, as institutional participation tends to wane. This can result in wider bid-ask spreads and more pronounced price fluctuations, making it more difficult to execute trades profitably.

As an experienced crypto trader, I’ve learned to approach weekend trading with caution, employing robust risk management strategies to mitigate the heightened volatility. This may involve adjusting position sizes, using stop-loss orders, or even avoiding the market altogether during periods of low liquidity.

Beyond the Hours: Factors for Successful Crypto Trading

While understanding the best trading hours is a crucial component of my overall strategy, it’s just one piece of the puzzle. Successful crypto traders must also consider a range of other factors, including fundamental analysis, technical analysis, risk management, and market sentiment.

Fundamental analysis, which involves studying the underlying technology, use cases, and adoption of a cryptocurrency, helps me identify promising long-term investment opportunities. Technical analysis, on the other hand, provides valuable insights into price patterns and trends, aiding in the timing of my market entries and exits.

Risk management is also paramount in the volatile crypto market. Strategies like position sizing, diversification, and the use of stop-loss orders have been instrumental in protecting my capital and mitigating potential losses.

Finally, staying attuned to market sentiment — the overall mood and sentiment of investors — provides valuable clues about the direction of the market, informing my trading decisions and timing.

By combining these elements with an understanding of the best trading hours, I’ve been able to develop a comprehensive strategy that enhances my chances of success in the dynamic crypto market.

Does Cryptocurrency Have Trading Hours?

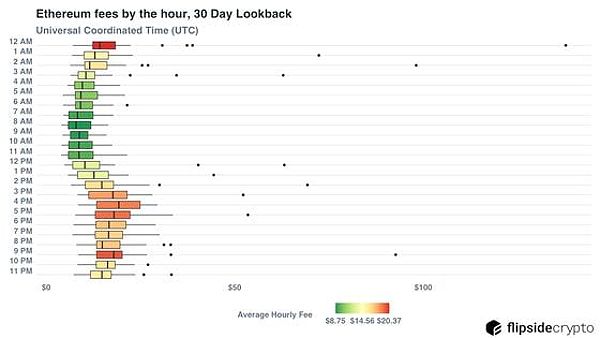

Hourly ETH fees

Hourly ETH fees

FAQ

Q: What are the best hours for day trading crypto?

A: According to my research, the busiest time for crypto trading is typically around the opening of the US stock market, between 9 AM and 12 PM Eastern Standard Time (EST). This timeframe often offers greater liquidity and potential for profitable trades.

Q: How do I find the busiest trading hours for a specific cryptocurrency?

A: The busiest trading hours can vary slightly depending on the specific cryptocurrency and exchange. As a general rule, consider the overlap between major global market hours, as this is when institutional participation and trading volume tend to peak. Monitor data from leading exchanges to identify the most active periods for your cryptocurrency of interest.

Q: Is it worth trading crypto on weekends?

A: Trading crypto on weekends can present both opportunities and challenges. While the potential for significant price swings and higher returns exists, the market is also characterized by increased volatility and lower liquidity during these periods. As an experienced trader, I often approach weekend crypto trading with caution, employing risk management strategies to mitigate the heightened volatility.

Q: How can I manage risk when trading crypto during volatile periods?

A: Effective risk management is essential when trading crypto, especially during volatile periods. Strategies such as position sizing, diversification, and the use of stop-loss orders have been instrumental in protecting my capital. It’s also crucial to stay informed about market sentiment and be prepared to adjust your trading approach accordingly.

Conclusion

In the ever-evolving world of cryptocurrency trading, understanding the best trading hours can provide a significant advantage. By leveraging the data-driven insights and personalized strategies I’ve shared in this article, you can optimize your trading approach and potentially maximize your returns.

Remember, successful crypto trading requires a multifaceted approach, incorporating fundamental analysis, technical analysis, and robust risk management practices. By combining these elements with an understanding of the optimal trading hours, you can position yourself for greater success in the dynamic and exciting crypto market.

As the crypto landscape continues to evolve, staying informed and adaptable will be key to your long-term trading success. Keep exploring, learning, and refining your strategies to navigate the ever-changing crypto terrain and unlock your full potential as a trader.