As a seasoned cryptocurrency trader, I know firsthand the challenges of navigating the ever-evolving crypto markets. In the past couple of years, I’ve witnessed the rise of crypto trading groups as invaluable resources for traders seeking to gain a competitive edge. These online communities, primarily hosted on platforms like Telegram, have become hubs of insightful analysis, real-time market updates, and, most importantly, actionable trading signals.

In this comprehensive guide, I’ll take you on a journey through the best crypto trading groups that I’ve personally vetted and found to be consistently reliable and profitable. Whether you’re a beginner looking to dip your toes into the world of crypto trading or an experienced trader seeking to refine your strategies, this article will equip you with the knowledge to identify and join the right group for your needs.

Understanding the Power of Crypto Trading Groups

Cryptocurrency trading is a dynamic and constantly shifting landscape, where staying ahead of the curve is crucial for success. Crypto trading groups serve as a vital resource for traders, providing a platform to connect with like-minded individuals, share insights, and access expert analysis.

By joining a reputable crypto trading group, you’ll gain access to a wealth of benefits that can significantly enhance your trading performance. These groups often offer real-time trading signals, which can save you valuable time and effort in identifying profitable opportunities. Moreover, the community aspect fosters an environment of collaboration and learning, where you can engage with experienced traders, ask questions, and gain new perspectives on the ever-evolving crypto market.

Crypto trading group discussion

Crypto trading group discussion

Key Features of the Best Crypto Trading Groups

When it comes to selecting the best crypto trading groups, there are several crucial features to consider. As someone who has been actively involved in the crypto trading scene for years, I’ve learned to prioritize the following aspects:

Signal Quality and Consistency

The quality and reliability of trading signals are the bedrock of a successful crypto trading group. Look for groups with a proven track record of delivering consistently profitable signals. Assess their win rates, risk management strategies, and the transparency they provide in showcasing their historical performance.

Crypto trading signals

Crypto trading signals

Expert-Level Analysis and Guidance

The best crypto trading groups boast a team of experienced analysts and traders who offer in-depth market commentary, technical analysis, and fundamental research. This caliber of expertise can provide invaluable insights, helping you better understand market dynamics and make more informed trading decisions.

Expert analysis

Expert analysis

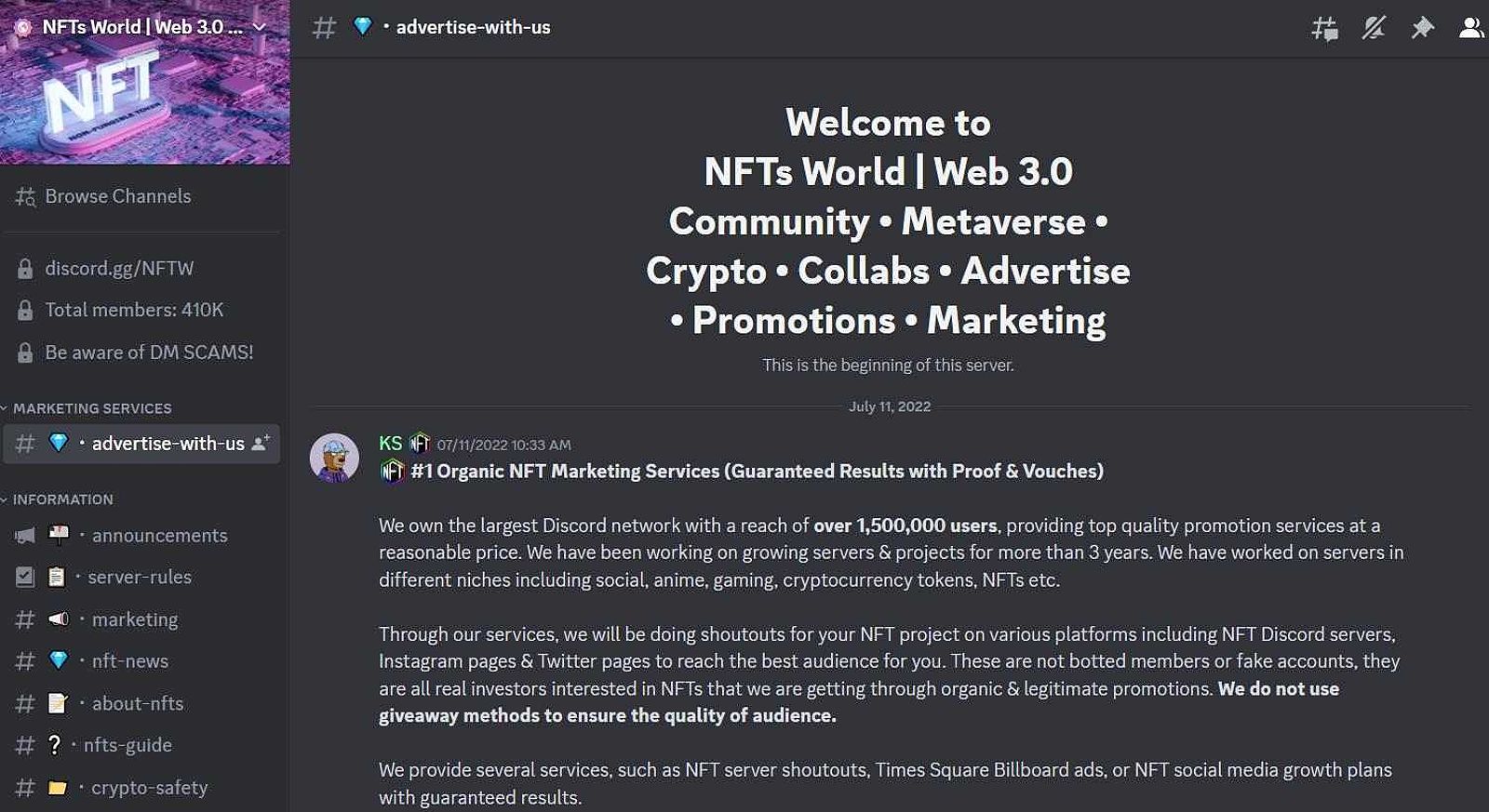

Vibrant Community Engagement

A thriving and engaged community is a hallmark of the top crypto trading groups. Look for groups where traders actively participate in discussions, share ideas, and support one another. This collaborative environment can foster learning, networking, and the exchange of valuable insights.

Community engagement

Community engagement

Transparency and Accountability

Transparency is paramount when choosing a crypto trading group. Reputable groups should be open about their signal history, win rates, and overall trading approach. This level of accountability helps build trust and confidence in the group’s ability to deliver reliable and sustainable trading guidance.

Exploring the Best Crypto Trading Telegram Channels

With the abundance of crypto trading groups available, it can be overwhelming to determine which ones are truly worth your time and investment. Drawing from my personal experiences and extensive research, I’ve curated a list of the top Telegram channels that stand out for their signal quality, expert analysis, and community engagement.

Fat Pig Signals

Fat Pig Signals is a standout choice for traders seeking leveraged trading strategies, particularly on platforms like BitMEX and Bybit. They optimize their signals for margin exchanges while providing tools to help traders manage their open positions across their portfolios. Fat Pig’s proprietary position sizing calculator ensures traders can adjust their risk exposure based on their account balance and risk tolerance.

Pros:

- Impressive win rate

- Specialized tools for leveraged trading

- Comprehensive portfolio management and analysis

- Complimentary access to an educational group

Cons:

- Relatively high subscription costs

- Primarily focused on BitMEX and Bybit

- Limited coverage of altcoin signals compared to some competitors

CoinCodeCap Crypto Signals

CoinCodeCap strikes a balance between machine-based intelligence and human oversight, producing technically sound yet practical crypto trading signals. Their algorithms generate calls, while experienced traders provide guidance on interpreting market conditions. This approach makes CoinCodeCap an ideal choice for newcomers, as they offer seamless integration with leading auto-traders to instantly mirror signals. Along with 3-4 premium signals daily focused on swing trades and scalps, members gain access to abundant educational resources delving into chart patterns, indicators, and general trading psychology.

Pros:

- Hybrid of algorithmic signals and human expertise

- Impressive win rate of around 75%

- Convenient auto-trading integration

- Comprehensive educational resources

Cons:

- Limited coverage of altcoin signals

- No free trial period

- Occasional delays in customer support response times

OnwardBTC

Led by a team of veteran traders, OnwardBTC emphasizes sustainable growth through strict risk management protocols informed by statistical metrics. They track detailed records on risk-reward ratios, win rates, average gains, and more. This data-driven approach translates to consistent performance, with OnwardBTC achieving monthly returns between 5-15%.

Traders can select personalized risk allowances while receiving signals focused on prudent entries and exits. Users only pay commissions on profitable trades, aligning incentives for long-term profitability. OnwardBTC offers a free trial plus customer support through email, chat, and voice call. Their transparency and reliability explain the loyalty of members over multiple market cycles.

Pros:

- Rigorous, data-driven approach to risk management

- Personalized risk allowances for each trader

- Commission-based pricing model

- Excellent customer support and responsiveness

Cons:

- Moderate win rate compared to some competitors

- Limited coverage of altcoin signals

- Smaller user base than some of the larger crypto trading groups

Cryptomedics

Cryptomedics employs a team of professional analysts and data scientists to generate daily swing trade ideas focused on mid-cap altcoins. They offer extensive fundamental research reports that set them apart, providing deep dives into on-chain activity, developer communities, and real-world use cases.

Key Features:

- Collaboration of professional analysts and data experts

- Daily swing trade signals targeting mid-cap altcoins

- Comprehensive fundamental research reports

- Insights on on-chain activity, developer communities, and real-world utility

Crypto research report

Crypto research report

Bitcoin Bravado

Bitcoin Bravado has cultivated a vibrant 24/7 community of experienced trader moderators, providing insights into macro trends, on-chain data, and speculative microcap altcoins. The completely free access and constantly engaged chat atmosphere foster true interactive crypto learning.

Key Features:

- Vibrant 24/7 community of seasoned trader moderators

- Insights on macro trends, on-chain data, and speculative microcaps

- Completely free access for all members

- Engaging, collaborative learning environment

Bitcoin Bravado community

Bitcoin Bravado community

MYC Signals

MYC Signals is likely the largest free crypto signal group on Telegram, boasting over 150,000 members. Despite the crowded chat, the group provides a diverse range of opportunities spanning major cryptocurrencies and small-cap altcoins, which can serve as a valuable supplement to other paid services.

Key Features:

- The largest free crypto signal group on Telegram (150k+ users)

- Opportunities across a wide range of major and small-cap cryptocurrencies

- Useful for supplementing paid services and gaining additional insights

MYC Signals community

MYC Signals community

Evaluating Crypto Trading Groups: The Crucial Factors

When selecting a crypto trading group, it’s essential to conduct thorough research to ensure you choose a reputable and reliable provider. Drawing from my personal experiences, here are the key factors I always consider:

Track Record and Win Rates: Verify the group’s historical performance, including their win rates, risk-adjusted returns, and transparency in showcasing their trading records. This will give you a clear understanding of their consistency and reliability.

Risk Management Strategies: Assess the group’s approach to risk management, including their guidance on stop-loss placement, position sizing, and overall risk-reward targeting. Prudent risk management is crucial for sustainable trading success.

Community Feedback and Reputation: Examine user testimonials, reviews, and the overall sentiment within the group’s community to gauge their credibility and customer satisfaction. A thriving, engaged community is a strong indicator of a reputable provider.

Transparency and Accountability: Look for groups that openly document their past trades, wins, and losses, demonstrating a commitment to accountability and transparency. This level of openness builds trust and confidence in the group’s abilities.

Free vs- Paid Crypto Trading Groups: Weighing the Options

As you navigate the world of crypto trading groups, you’ll encounter both free and paid options, each with their own advantages and disadvantages. It’s important to carefully consider the pros and cons of each to determine which approach aligns best with your trading goals and risk tolerance.

Free crypto trading groups can serve as a good starting point, especially for newcomers to the crypto trading scene. These groups often provide basic information, community interaction, and a taste of the types of insights and signals available. However, they typically lack the reliability, accountability, and expert guidance found in paid crypto trading groups.

On the other hand, paid crypto trading groups typically offer access to higher-quality signals, in-depth market analysis, and financial accountability from the providers. While the subscription fees may be higher, the potential for consistent and profitable trading guidance can make the investment worthwhile for experienced traders.

Conclusion: Unlocking Your Crypto Trading Potential

In the dynamic and ever-evolving world of cryptocurrency trading, finding the right crypto trading group can be a game-changer. By prioritizing signal quality, expert analysis, community engagement, and transparency, you can discover the best crypto trading groups on Telegram and unlock your full trading potential.

Remember, it’s crucial to always conduct thorough research, manage your risk, and continue to develop your own trading skills. The crypto market is constantly shifting, and staying informed, adaptable, and disciplined is the key to long-term success.

FAQ

Q: What are the best free crypto trading groups on Telegram? A: While free groups can offer some value, they often lack the reliability and accountability of paid groups. Consider exploring MYC Signals for a large free group or Fat Pig Signals for free educational resources.

Q: How can I find reputable crypto trading groups? A: Research group track records, win rates, and user reviews. Look for transparency in terms of signal history and risk management strategies.

Q: What are the risks of joining a crypto trading group? A: Risks include unreliable signals, potential scams, and the temptation to over-leverage. It’s crucial to manage your risk and not blindly follow signals.