In this article, I”ll share my perspective, offering an alternative view on what constitutes the ultimate crypto trading experience. Prepare to delve into the nuances of advanced functionalities, liquidity, and fee structures — the criteria that separate the leading crypto trading apps.

Transcending The Ordinary: Advanced Trading Features For The Seasoned Investor

Seasoned traders like myself demand more than just the basics. We seek platforms that empower us to execute intricate maneuvers, to capitalize on the mercurial nature of the crypto markets. It’s not enough to have a simple buy-and-sell interface; we crave the ability to wield the tools of the trade with precision.

Margin trading, futures contracts, and sophisticated technical analysis — these are the features that allow us to fine-tune our strategies and navigate the turbulent seas of volatility. A crypto trading app that falls short in these areas simply won’t meet our needs.

Liquidity: The Lifeblood Of Crypto Transactions

In the realm of cryptocurrency, liquidity is the unsung hero — the silent cornerstone upon which our trading triumphs are built. As an experienced investor, I’ve witnessed the perils of illiquid markets, where order execution becomes a game of chance and slippage erodes our hard-earned gains.

The crypto trading app I champion must possess a deep order book and substantial trading volumes, ensuring that my transactions are executed swiftly and with minimal impact on the market. Anything less is simply unacceptable.

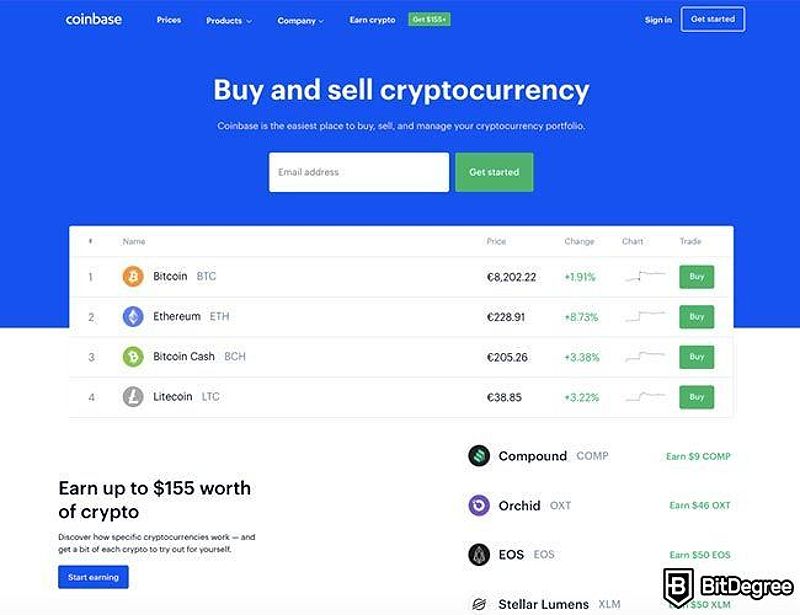

Coinbase – A Well-Rounded Crypto Exchange App Image: Coinbase – A Well-Rounded Crypto Exchange App

Coinbase – A Well-Rounded Crypto Exchange App Image: Coinbase – A Well-Rounded Crypto Exchange App

Optimizing Profitability: The Quest For Competitive Fees

For the seasoned crypto trader, every basis point counts. We engage in countless transactions, our portfolios in constant flux as we navigate the volatile waters of the digital asset ecosystem. In this high-stakes game, the fees charged by our trading app can make or break our bottom line.

I seek out platforms that offer competitive maker and taker fee structures, with discounts for traders who demonstrate high trading volumes. The best crypto trading app must understand the needs of experienced investors and reward our commitment with fee structures that maximize our returns.

Binance: The Global Exchange that Caters to Experienced Crypto Traders Image: Binance: The Global Exchange that Caters to Experienced Crypto Traders

Binance: The Global Exchange that Caters to Experienced Crypto Traders Image: Binance: The Global Exchange that Caters to Experienced Crypto Traders

Unveiling The Best Crypto Trading Apps That Meet My Exacting Standards

After thorough research and comparison, a select few crypto trading apps have emerged as true contenders for the title of “best crypto trading app.” Let me share my insights on these industry-leading platforms and why they deserve the attention of seasoned investors like myself.

Binance: The Global Exchange That Caters To Experienced Crypto Traders

Binance has long been a fixture in the crypto trading landscape, and for good reason. This global exchange has amassed an impressive selection of over 350 cryptocurrency trading pairs, catering to the diverse investment needs of savvy traders like myself.

What sets Binance apart is its commitment to advanced trading functionalities. The platform’s robust offering of margin trading, futures, and comprehensive technical analysis tools empowers me to execute complex strategies and stay ahead of the curve. Coupled with Binance’s industry-leading liquidity and competitive fee structure, it’s no wonder this exchange has become a go-to destination for experienced crypto investors.

Kraken: Trusted for its Security and Regulatory Compliance Image: Kraken: Trusted for its Security and Regulatory Compliance

Kraken: Trusted for its Security and Regulatory Compliance Image: Kraken: Trusted for its Security and Regulatory Compliance

Kraken: Trusted For Its Security And Regulatory Compliance

Kraken has earned a reputation as a bastion of security and regulatory compliance in the crypto trading space, and this is a key factor that has earned my trust as an experienced investor. In a world where trust is a precious commodity, Kraken’s dedication to safeguarding user funds and adhering to stringent compliance measures provides the peace of mind that I require.

Beyond its security credentials, Kraken also excels in its advanced trading features, including margin trading, futures, and a sophisticated charting interface that allows me to make informed decisions. The platform’s maker and taker fee structures, which become more favorable as trading volume increases, further solidify its appeal as a cost-effective solution for active crypto traders like myself.

Bybit: The Specialist In Margin Trading And Futures

For experienced traders like myself who prioritize margin trading and futures, Bybit has emerged as a standout option. This platform’s specialized focus on these advanced trading instruments aligns perfectly with my expertise and risk management needs.

Bybit’s user-friendly interface, combined with its robust order types and risk management tools, caters seamlessly to the requirements of seasoned crypto investors. The platform’s competitive fee structure, with maker rebates and low taker fees, further enhances its appeal as a destination for experienced traders seeking to maximize their profitability.

Navigating The Crypto Trading App Landscape: Tips For The Discerning Investor

As I’ve delved deeper into the world of crypto trading apps, I’ve developed a set of guiding principles that I believe every experienced investor should consider:

- Thorough Research: Comprehensive research and comparison of features, fees, security measures, and user reviews are essential to identifying the crypto trading app that best aligns with your unique trading style and requirements.

- Liquidity Assessment: Evaluating the trading volume and order book depth of a platform is crucial to ensuring seamless order execution and minimal slippage.

- Consulting User Feedback: Exploring online reviews and forums can provide valuable insights into the reliability, customer support, and overall user experience of a crypto trading app.

Frequently Asked Questions

Q: What sets apart the best crypto trading apps for experienced investors? A: The key differentiators for the best crypto trading apps catering to experienced investors are advanced trading functionalities, high liquidity, and competitive fee structures.

Q: How can I assess the liquidity of a crypto trading app? A: To evaluate the liquidity of a crypto trading app, look for indicators such as the overall trading volume, order book depth, and the bid-ask spreads across various trading pairs.

Q: What security measures should I prioritize in a crypto trading app? A: As an experienced investor, I prioritize crypto trading apps that offer robust security features, including two-factor authentication, cold storage of user funds, and a proven track record of compliance with regulatory requirements.

Conclusion: Embracing The Future Of Crypto Trading

In the dynamic and ever-evolving world of cryptocurrency, I, as a seasoned investor, have come to understand the importance of finding the perfect crypto trading app — one that not only caters to my advanced trading needs but also ensures high liquidity and competitive fee structures.

Through my research and experience, I’ve identified the industry-leading platforms that have earned my trust and respect. Binance, Kraken, and Bybit have each demonstrated the capabilities to elevate my crypto trading journey, empowering me to execute sophisticated strategies, navigate the volatile markets with confidence, and optimize my profitability.

As I continue to explore the crypto landscape, I remain steadfast in my pursuit of the best crypto trading app. By adhering to my principles of thorough research, liquidity assessment, and user feedback consultation, I am confident that I can identify the platform that will be the perfect companion in my quest for investment success. The future of crypto trading is bright, and I am ready to embrace it with the guidance of the right trading app by my side.