In the rapidly evolving world of cryptocurrency trading, best crypto grid trading bots have emerged as powerful tools to enhance trading strategies and unlock new levels of profitability.

Understanding The Diverse Grid Trading Bot Ecosystem

In the dynamic and ever-evolving world of cryptocurrency trading, the quest for optimal strategies and tools to navigate the volatile markets has become a pressing priority for traders. As the industry continues to mature, the emergence of advanced crypto grid trading bots has garnered significant attention, promising to revolutionize the way traders approach the crypto landscape.

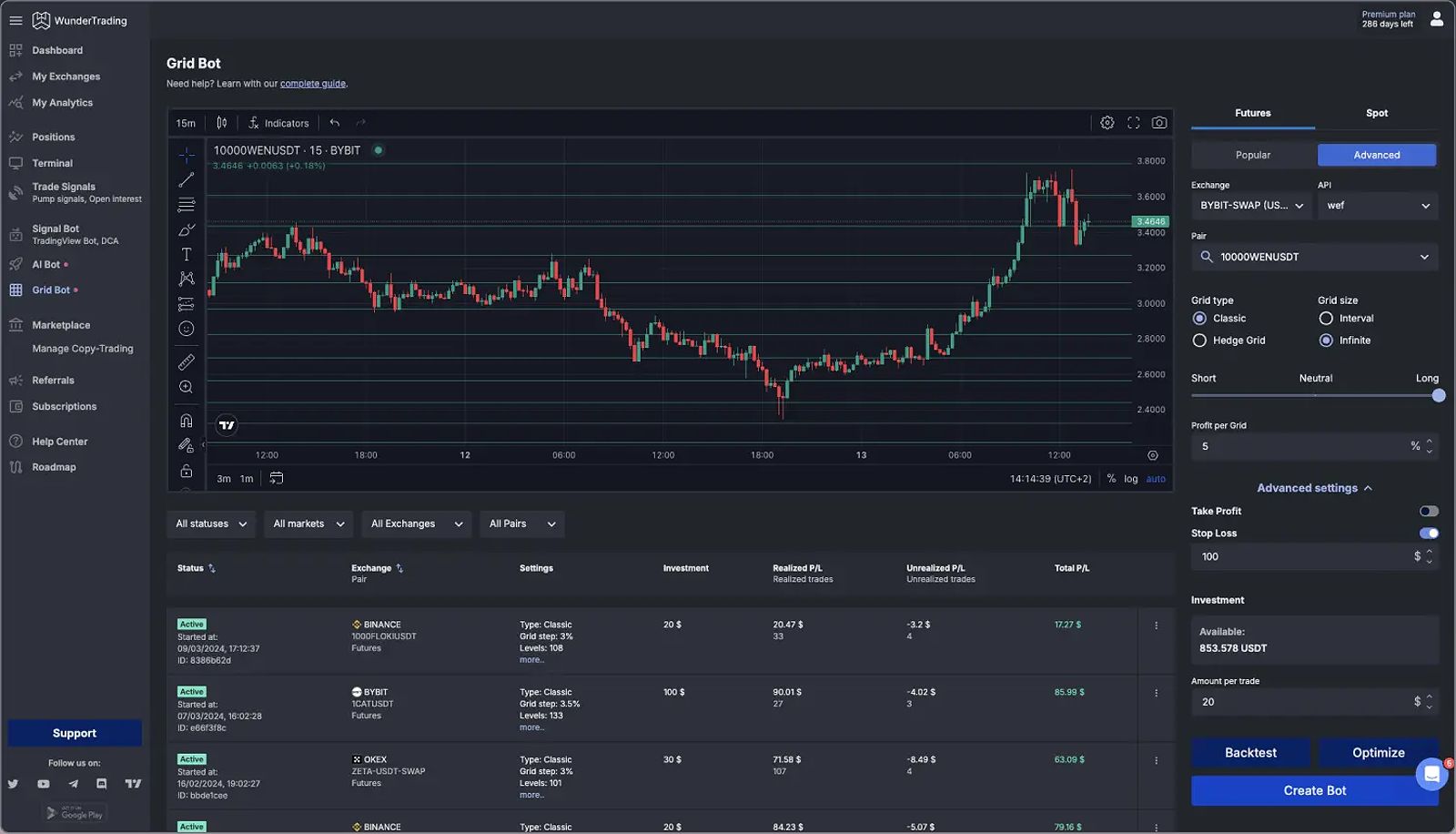

The crypto grid trading bot ecosystem has blossomed into a rich tapestry, offering a wide array of options to cater to the diverse needs and trading styles of market participants. From the classic spot grid bots designed to thrive in the spot market to the futures grid bots tailored for the futures domain, there is a bot to suit every trader’s preference.

Grid bot interface

Grid bot interface

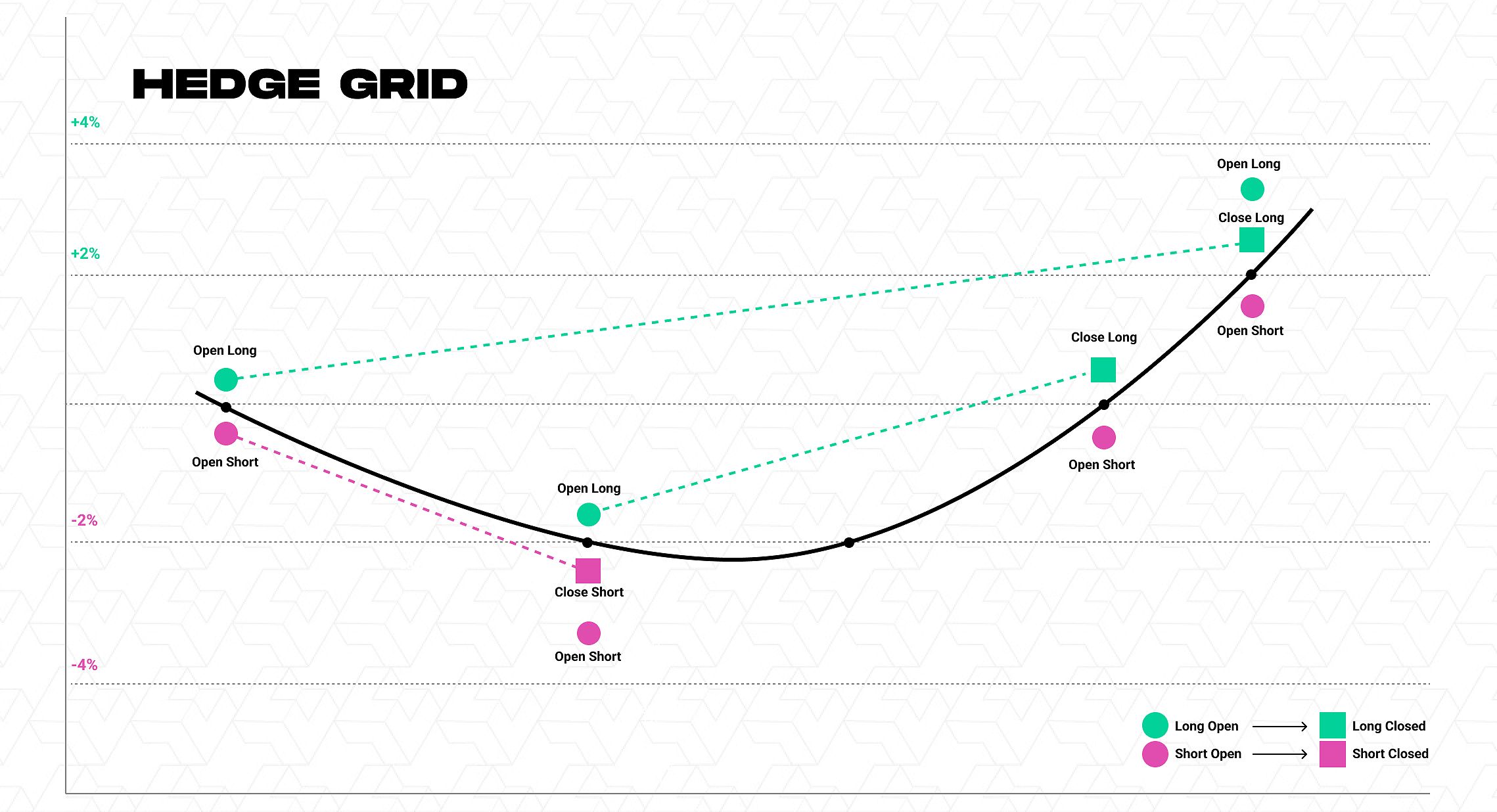

The unidirectional focus of the traditional grid bot stands in stark contrast to the more versatile hedge grid bot, which adeptly navigates both bullish and bearish market conditions. Delving deeper, the interval grid bot offers a unique approach, capitalizing on the ebb and flow of price fluctuations within predefined price ranges. For traders seeking the ultimate in adaptability, the infinity grid bot seamlessly adjusts its grid of orders, ensuring a continuous flow of profit-generating opportunities, regardless of the market’s direction.

Unlocking The Transformative Power Of Grid Trading Bots

The allure of crypto grid trading bots lies in their ability to streamline the trading process, freeing up valuable time and mental resources for traders. These bots can tirelessly execute trading strategies 24/7, ensuring that no opportunity is missed in the fast-paced crypto markets. By automating the repetitive tasks of monitoring market trends, identifying opportunities, and executing trades, grid trading bots allow traders to focus on the strategic aspects of their craft.

Moreover, these bots offer a powerful antidote to the emotional biases that can plague manual trading. Emotions such as fear and greed can lead to ill-timed decisions, but grid trading bots operate with cold, rational precision, executing trades based on predefined parameters and market conditions. This disciplined approach can help traders maintain a level head, even in the face of volatile market swings.

Key Considerations When Choosing The Best Crypto Grid Trading Bots

As traders navigate the crypto grid trading bot landscape, several critical factors come into play. Compatibility with the preferred exchanges is a crucial consideration, as traders will want a bot that seamlessly integrates with the platforms they use. Equally important are the trading fees and commissions associated with the bot, as these can significantly impact the overall profitability of the trading strategy.

Coinrule crypto trading bot

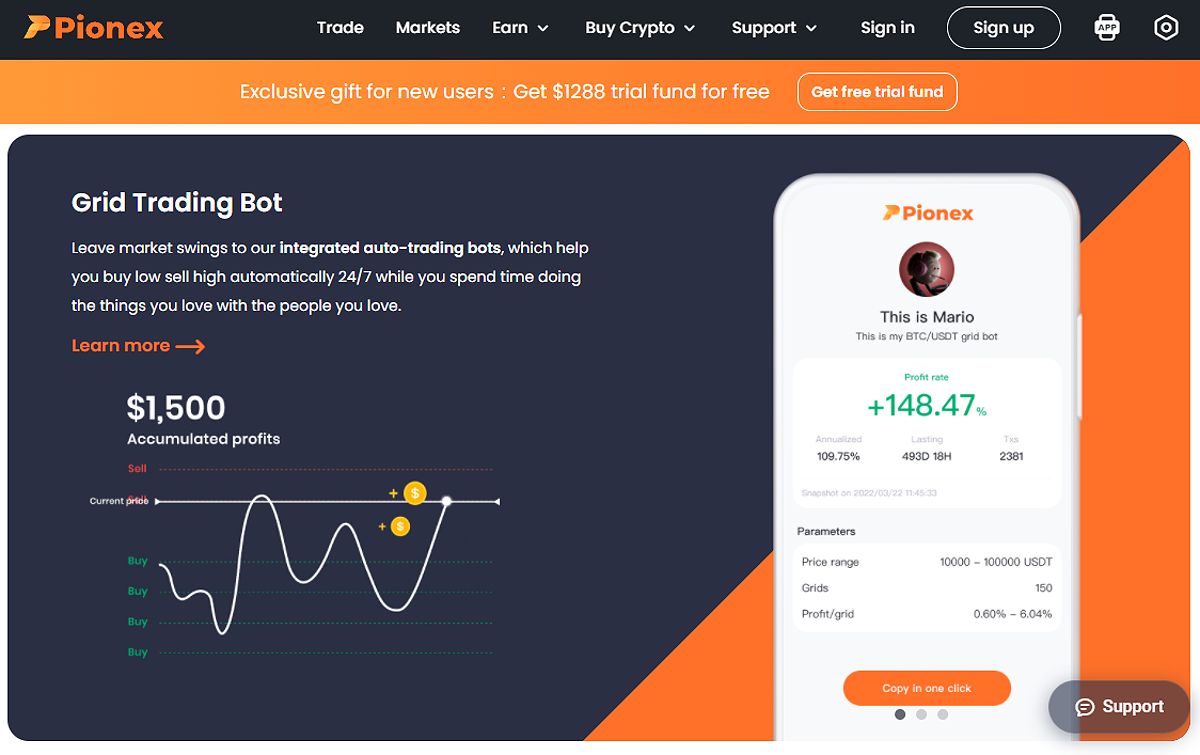

Coinrule crypto trading bot  Pionex Trading Bot

Pionex Trading Bot

Customization options are another key factor, as traders seek bots that allow them to tailor their trading strategies to their unique risk tolerance and market outlook. Features such as backtesting, signal integration, and portfolio management tools can further enhance the effectiveness of bot-driven trading.

Reputation and reliability are paramount when selecting a crypto grid trading bot. Thorough research into the provider’s track record, community feedback, and security measures is essential to ensure the safety of traders’ assets. Partnering with a trustworthy platform that can consistently deliver the desired results is a top priority.

Mastering The Art Of Effective Grid Trading Bot Deployment

Once the right crypto grid trading bot has been identified, the focus shifts to effective deployment. Traders must begin by setting realistic trading goals and parameters that align with their overall investment strategy. Careful monitoring of market conditions and a willingness to adjust the bot’s settings as necessary are essential to ensure it remains responsive to the ever-evolving crypto landscape.

Hedge grid bot chart

Hedge grid bot chart

Diligent risk management is crucial when leveraging crypto grid trading bots. Incorporating stop-loss orders and other safeguards to mitigate potential losses is a must, and traders should never risk more than they can afford to lose. Regular reviews of the bot’s performance, coupled with optimization through backtesting and parameter fine-tuning, can help ensure the continued effectiveness of the trading strategy.

Navigating The Evolving Landscape With Confidence

As traders embark on their journey with crypto grid trading bots, a clear understanding of the risks and potential rewards is essential. While these powerful tools can be transformative, a measured and disciplined approach is required to unlock their full potential.

By staying informed, diversifying their strategies, and exercising prudent risk management, traders can harness the power of crypto grid trading bots to enhance their trading success and potentially unlock new levels of profitability in the dynamic world of cryptocurrency.

Faq

What are the risks of using crypto grid trading bots? Crypto grid trading bots, like any automated trading system, carry inherent risks such as the potential for system failures, unexpected market events, and the possibility of losses if the trading parameters are not properly configured. Thorough understanding of the bot’s functionality, extensive backtesting, and close monitoring are essential to mitigate these risks.

How do I avoid scams when choosing a crypto grid trading bot? To avoid scams, it is crucial to research the provider’s reputation, read reviews from other users, and ensure the bot is transparent about its features, performance, and security measures. Beware of any bot that promises unrealistic returns or appears too good to be true.

Can I use crypto grid trading bots on all cryptocurrency exchanges? No, the compatibility of crypto grid trading bots varies across different exchanges. It is essential to choose a bot that supports the exchanges used and integrates seamlessly with the trading accounts.

How much do crypto grid trading bots typically cost? The pricing for crypto grid trading bots can range from free-to-use options to subscription-based models with varying features and levels of support. Evaluating the cost-benefit ratio and choosing a solution that fits the trading budget and needs is important.

What are some of the best crypto grid trading bots for beginners? For beginners, it is recommended to start with user-friendly, beginner-oriented crypto grid trading bots that offer comprehensive tutorials, intuitive interfaces, and easy-to-understand trading strategies. Examples might include Pionex, Phemex, and TradeSanta.

Conclusion

The evolving landscape of crypto grid trading bots presents a compelling opportunity for traders seeking to enhance their trading strategies and unlock new levels of profitability in the dynamic cryptocurrency markets. By understanding the diverse ecosystem of grid trading bots, mastering their effective deployment, and navigating the key considerations with a discerning eye, traders can harness the transformative power of these innovative tools.