As CryptoNic, a seasoned crypto enthusiast and researcher, I’ve observed the Indian crypto market with a critical eye. The world of digital assets is rapidly expanding, and more and more Indians are seeking to capitalize on the opportunities it presents. However, the landscape is complex, and finding the right crypto broker can be daunting, especially for newcomers. In this article, I’ll share my insights and guide you through the process of selecting the best broker for crypto trading in India.

Understanding the Indian Crypto Conundrum

The Indian crypto landscape has been a tapestry of ever-changing regulations, ambiguity, and growing pains. While the government has grappled with the legality of cryptocurrencies, the overall sentiment has become more positive in recent years. The Reserve Bank of India (RBI) is now exploring the possibility of a central bank digital currency (CBDC), signaling a shift in the regulatory approach.

Navigating the tax implications of crypto trading in India is equally crucial. Profits are subject to a 30% tax, along with a 4% surcharge. Additionally, a 1% Tax Deducted at Source (TDS) applies to the sale of crypto assets worth more than 50,000 rupees. Unlike some other countries, crypto losses are not deductible in India, making it essential for investors to understand the tax consequences of their trades.

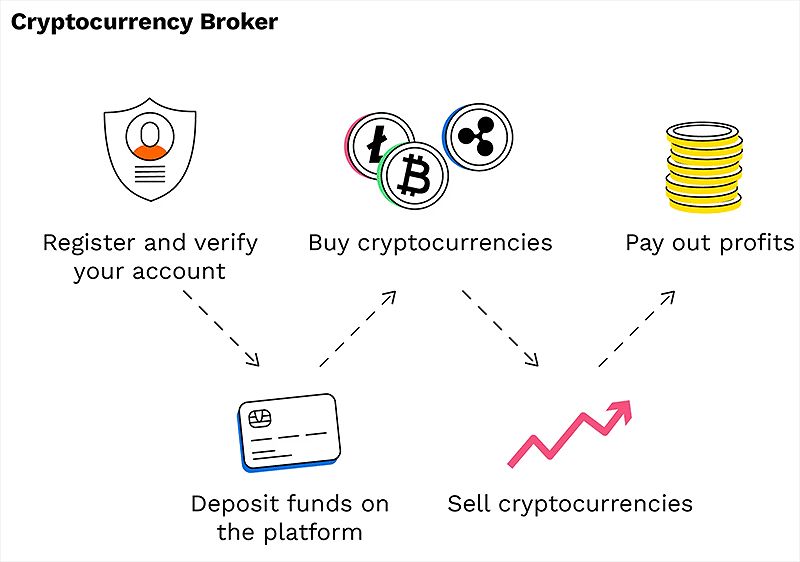

Key Factors to Consider When Choosing a Crypto Broker

As I’ve delved into the Indian crypto landscape, certain factors have emerged as the cornerstones of a successful crypto trading experience. Let’s explore these critical elements:

Security and Trustworthiness

In the high-stakes world of crypto, security is paramount. I’ve scrutinized the security measures employed by various brokers, looking for robust features like two-factor authentication (2FA), cold storage for asset protection, and comprehensive insurance coverage against potential hacks or cyber threats. Equally important is the broker’s reputation, regulatory compliance, and a track record of safeguarding user funds.

Crypto Security

Crypto Security

Ease of Use and User Experience

The user interface and overall trading experience can make or break a crypto platform, especially for beginners. I’ve tested various brokers, assessing their navigation, mobile app availability, and the quality of educational resources they provide. A seamless, intuitive, and accessible platform can instill confidence and empower traders to make informed decisions.

Fees and Trading Costs

Crypto trading can be subject to a myriad of fees, from trading commissions to deposit and withdrawal charges. I’ve meticulously compared the fee structures of different brokers to identify the most cost-effective options that align with my trading activity and preferences. Transparent and competitive pricing are crucial for maximizing profits.

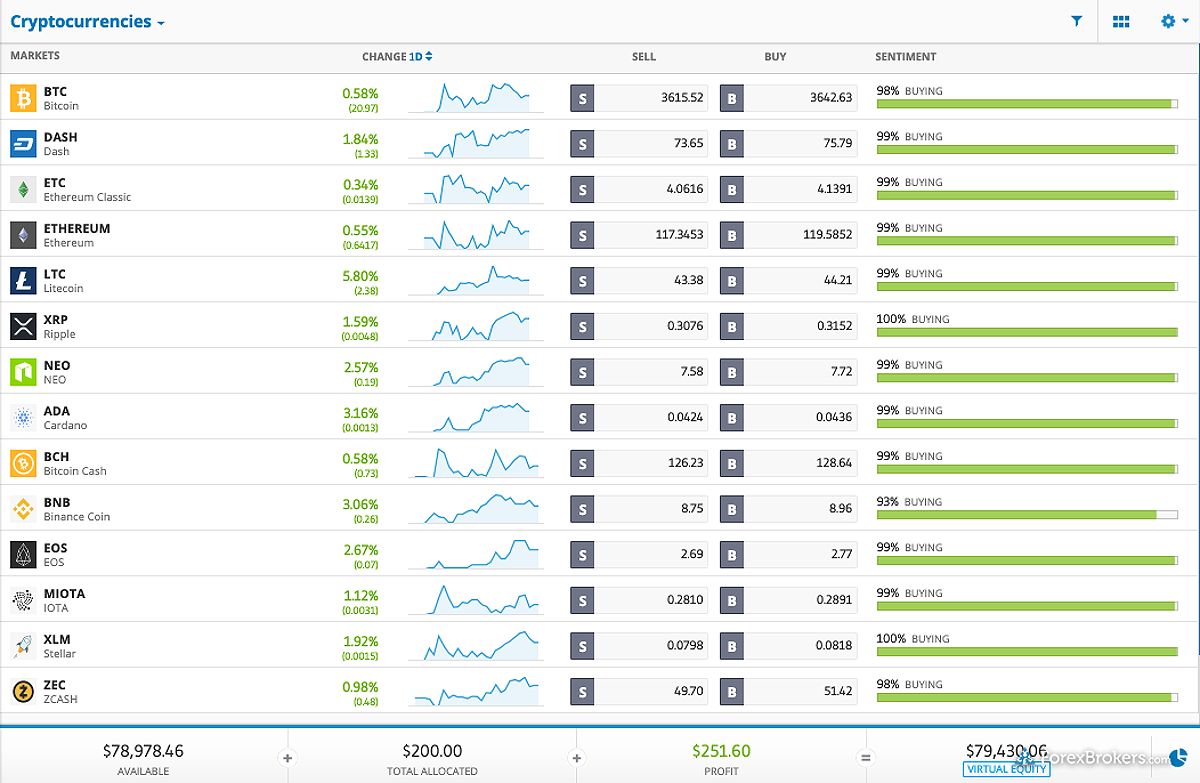

Cryptocurrency Selection and Trading Pairs

The breadth of cryptocurrencies and trading pairs offered by a broker can significantly impact an investor’s portfolio diversification and investment opportunities. I’ve prioritized brokers that provide a wide selection of popular coins and altcoins, as well as the ability to trade cryptocurrencies against the Indian rupee (INR) for seamless transactions.

Crypto Selection

Crypto Selection

Navigating the Crypto Broker Landscape in India

With these key factors in mind, let’s delve into the top crypto brokers in India and assess their suitability for various trader profiles.

WazirX: A Dominant Player with Regulatory Challenges

WazirX is one of the leading cryptocurrency exchanges in India, boasting over 10 million users. Its user-friendly interface, both on desktop and mobile, has garnered praise from many traders. With a flat trading fee of 0.2%, WazirX offers a cost-effective solution for those seeking to buy, sell, and trade a wide range of cryptocurrencies, including over 450 trading pairs.

WazirX India

WazirX India

However, WazirX has faced some regulatory hurdles in the past, with the Enforcement Directorate freezing its bank assets during an investigation. While the platform has since resolved these issues, the incident highlights the importance of maintaining a vigilant eye on regulatory developments and their potential impact on crypto brokers.

CoinDCX: A Promising Platform with Withdrawal Limitations

CoinDCX, another prominent crypto exchange in India, serves over 14 million users. It has earned a reputation for its user-friendly interface and low trading fees of 0.2%. CoinDCX also offers a referral program, providing a 20% lifetime commission on trading fees from referred users. While the platform is praised for its responsive customer support, its current inability to allow users to withdraw their crypto assets may be a deterrent for some investors.

CoinDCX India

CoinDCX India

Binance India: Global Reach with INR-Based Transactions

As the world’s largest cryptocurrency exchange, Binance has also established a presence in India. Binance India offers low trading fees, typically 0.1%, and supports the purchase of Bitcoin and other cryptocurrencies using Indian rupees (INR) through its peer-to-peer (P2P) marketplace. The platform’s extensive selection of over 500 cryptocurrencies is a significant draw for traders seeking diverse investment options.

Binance India

Binance India

However, as a foreign exchange, Binance India does not automatically deduct TDS, which means users must calculate and pay taxes on their own. This additional administrative burden may be a consideration for some investors.

Zebpay: A Mobile-Centric Offering with Crypto Lending and Borrowing

Zebpay is a mobile-only cryptocurrency exchange that was founded in India but is now headquartered in Singapore. It supports over 150 cryptocurrencies and charges no fees on deposits, withdrawals, or crypto-to-crypto trades. Zebpay also offers crypto lending and borrowing features, allowing users to earn up to 8.5% interest on their crypto holdings.

Zebpay India

Zebpay India

While Zebpay’s customer service has faced some complaints in the past, its INR support and TDS deduction make it a viable option for Indian investors seeking a user-friendly, mobile-focused trading experience.

Unocoin: Indias Oldest Exchange with Crypto Baskets

Unocoin is India’s oldest cryptocurrency exchange, serving over 2 million investors. It offers a relatively low fee structure of 0.5% on most transactions and stores 95% of its funds offline, enhancing security. Unocoin also provides “cryptocurrency baskets,” which are pre-selected portfolios of digital assets based on risk tolerance and preferences.

Unocoin India

Unocoin India

However, Unocoin’s cryptocurrency selection is limited to around 50 assets, and it lacks some advanced trading features compared to other exchanges. For investors seeking a secure, no-frills crypto trading platform with a focus on portfolio diversification, Unocoin may be a suitable choice.

Choosing the Best Broker for Crypto Trading in India

When selecting the best crypto broker in India, I recommend considering the following factors:

- Your trading experience and goals: Assess whether you are a beginner seeking a user-friendly platform with educational resources or an experienced trader prioritizing advanced features and low fees.

- Security measures and regulatory compliance: Ensure the broker has robust security protocols and a strong track record of compliance with Indian regulations.

- Fee structures and trading costs: Analyze the broker’s fee schedules, including hidden charges, to find the most cost-effective option.

- Cryptocurrency selection and trading pairs: Verify that the broker offers the digital assets you want to trade and supports INR-based pairs.

- User reviews and testimonials: Gather insights from other investors about their experiences with the broker.

Staying Informed and Adapting to the Evolving Crypto Landscape

The Indian crypto market is dynamic and rapidly evolving, with new developments and opportunities constantly emerging. To make the most of your crypto trading journey, it’s crucial to stay informed and engaged with the broader crypto community.

Follow reputable news sources, industry publications, and online forums to stay abreast of regulatory changes, market trends, and emerging technologies. Participate in discussions, attend events, and connect with other traders to share insights and learn from their experiences.

Continuously assess your trading strategy and adapt it based on market conditions and your evolving investment goals. The crypto world is unpredictable, and being able to pivot and adjust your approach can be the difference between success and missed opportunities.

FAQ

Q: Is cryptocurrency trading legal in India? A: Yes, cryptocurrency trading is legal in India, although the government has previously proposed banning certain cryptocurrencies. The industry is regulated, and investors should be aware of the tax implications.

Q: What are the tax implications of crypto trading in India? A: In India, profits from crypto trading are subject to a 30% tax and a 4% surcharge. There is also a 1% TDS on the sale of crypto assets worth more than 50,000 rupees.

Q: Are there any Indian-specific features to look for in a crypto broker? A: Yes, look for brokers that support INR transactions, have TDS deduction features, and offer educational resources tailored to the Indian market.

Conclusion

As an experienced crypto enthusiast, I’ve navigated the complexities of the Indian crypto landscape and gained valuable insights into finding the best broker for your trading needs. By prioritizing security, user experience, fees, and regulatory compliance, you can make informed decisions and embark on a successful crypto trading journey.

Remember, the crypto market is in constant flux, so staying informed, engaging with the community, and adapting your strategy are crucial to maximizing your returns. I encourage you to thoroughly research and compare the top crypto brokers in India, and don’t hesitate to seek personalized guidance from financial advisors or experienced traders.

The future of cryptocurrency in India is promising, and by choosing the right broker, you can position yourself for long-term success in this rapidly evolving digital asset landscape.