As an avid crypto enthusiast and trader, I”ve been closely following the evolution of automated trading platforms in the ever-dynamic world of digital assets. The year 2024 has already ushered in a new era of sophisticated tools and strategies that are revolutionizing the way investors approach the cryptocurrency market.

In my exploration of this exciting landscape, I”ve discovered a handful of advanced automated crypto trading platforms that have caught my attention and sparked my curiosity. These platforms harness the power of cutting-edge algorithms, data analytics, and artificial intelligence to help traders of all skill levels capitalize on market opportunities with unparalleled efficiency, making them the best automated crypto trading platform in the current market.

Navigating The Automated Crypto Trading Landscape

The cryptocurrency market can be a daunting and volatile realm, but automated trading platforms offer a remarkable solution to this challenge. By automating the trading process, these platforms can help investors overcome the emotional biases, human errors, and time constraints that often plague manual trading.

Through the implementation of sophisticated algorithms, these platforms can analyze market data, identify trading signals, and execute transactions automatically, allowing investors to maximize their returns while minimizing the effort required. The potential for passive income and long-term wealth creation is truly compelling.

Automated crypto trading platforms

Automated crypto trading platforms

Choosing The Best Automated Crypto Trading Platform

When it comes to selecting the best automated crypto trading platform, there are several key factors to consider. Regulatory compliance, security, and transparency are of utmost importance, as investors must be able to trust the platform with their hard-earned funds.

Additionally, the platform should offer a wide range of trading tools and strategies, allowing users to tailor their approach to their individual risk tolerance and investment goals. This level of customization and flexibility is crucial in the ever-evolving cryptocurrency market.

Exploring The Top Automated Crypto Trading Platforms

After careful research and analysis, I’ve identified several standout automated crypto trading platforms that are poised to make waves in 2024. Each of these platforms offers a unique set of features and capabilities, catering to the diverse needs of crypto traders.

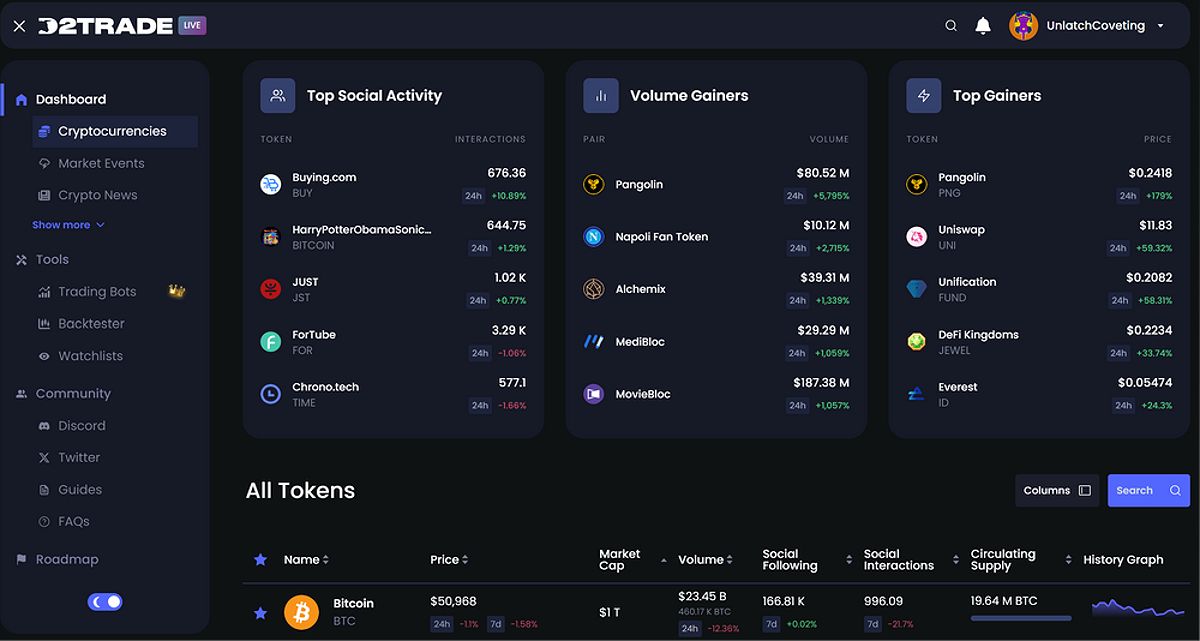

Dash2trade

Dash2Trade is a platform that has caught my attention with its advanced social analytics, technical signals, and intuitive no-code strategy backtesting tool. Its ability to help traders capitalize on emerging market trends and crypto presales is particularly compelling.

Dash2Trade Dashboard

Dash2Trade Dashboard

Wienerai

WienerAI, on the other hand, has piqued my interest with its AI-powered trading bot. By curating prices from multiple exchanges and offering MEV protection, this platform aims to provide users with a distinct edge in the market.

WienerAI bot

WienerAI bot

Coinrule

For traders seeking a more user-friendly approach, Coinrule may be the answer. This platform focuses on simplifying the trading process with its IFTTT-based automated trading bots and pre-built trading strategies, making it an attractive option for beginners.

Coinrule

Coinrule

Cryptohopper

Cryptohopper offers a unique drag-and-drop interface for building custom automated trading bots, catering to traders who prefer a more hands-on approach to strategy development.

Cryptohopper review

Cryptohopper review

Binance Trading Bot

Binance Trading Bot, a platform within the Binance exchange, has caught my attention with its impressive ecosystem of over 87,000 automated trading bots developed by third-party traders. This diverse range of strategies and approaches is a testament to the platform’s versatility.

Mastering Automated Crypto Trading Strategies

While automated trading platforms can simplify the investment process, it’s essential for users to understand the complexities of the strategies employed by these tools. From grid trading and dollar-cost averaging to trend-following and market-making, each approach has its own unique characteristics and risk profiles.

For beginners in the world of automated crypto trading, it may be helpful to start with simpler strategies, such as grid trading or dollar-cost averaging, before exploring more advanced techniques. By gradually building their knowledge and experience, traders can develop a deeper understanding of the market dynamics and fine-tune their automated trading strategies to maximize their returns.

Mitigating Risks In Automated Crypto Trading

As with any investment strategy, automated crypto trading carries its own set of risks. Algorithmic errors, market volatility, and unexpected events can all have a significant impact on the performance of automated trading bots. To mitigate these risks, it’s crucial for users to implement robust risk management strategies, such as setting stop-loss orders, diversifying their portfolios, and regularly monitoring their automated trading activities.

The Future Of Automated Crypto Trading

As the cryptocurrency market continues to evolve, the role of automated trading platforms is likely to become even more significant. With ongoing advancements in artificial intelligence, machine learning, and blockchain technology, these platforms are expected to become more sophisticated, efficient, and user-friendly, enabling investors of all skill levels to participate in the dynamic world of digital assets.

In the fast-paced and volatile cryptocurrency market, automated trading platforms have emerged as a powerful tool for investors seeking to optimize their returns and minimize their risk. By leveraging advanced algorithms and data-driven strategies, these platforms can help traders stay ahead of the curve, regardless of their experience level or market conditions.

Faq

What are the best automated crypto trading platforms for beginners?

Some of the best automated crypto trading platforms for beginners include Dash2Trade, Coinrule, and Cryptohopper. These platforms offer user-friendly interfaces, pre-built trading strategies, and educational resources to help newcomers navigate the world of automated trading.

How can I develop my own automated crypto trading strategy?

Developing your own automated crypto trading strategy typically involves backtesting, parameter optimization, and ongoing monitoring and adjustment. Platforms like Dash2Trade and Kryll offer no-code strategy editors and backtesting tools to help traders create and refine their own customized strategies.

What are the risks of automated crypto trading?

The primary risks of automated crypto trading include algorithm errors, market volatility, and unexpected events that can disrupt the performance of trading bots. It’s essential to implement robust risk management measures, such as stop-loss orders and portfolio diversification, to mitigate these risks.

Conclusion

In this article, we have explored some of the best automated crypto trading platforms available in 2024. By leveraging the power of cutting-edge technologies and data-driven strategies, these platforms offer investors a remarkable opportunity to optimize their returns and navigate the dynamic cryptocurrency market with greater efficiency and confidence.

While the risks and complexities of automated trading cannot be overlooked, with the right approach and a commitment to continuous learning and optimization, traders can unlock new avenues for passive income and long-term wealth creation. The future of crypto trading is automated, and those who embrace this transformative shift will be well-positioned to thrive in the years to come.