The Top 9 Crypto Margin Trading Exchanges for Savvy Investors

As the cryptocurrency market continues to evolve rapidly, savvy traders are increasingly turning to margin trading as a strategy to amplify their earnings. By leveraging borrowed funds, these traders can potentially magnify their profits, even on the slightest market movements. However, this power of leverage also comes with heightened risks, making the choice of the best 9 crypto margin trading exchanges a critical decision for investors.

In this comprehensive guide, we’ll explore the top 9 crypto margin trading exchanges that are poised to help you navigate the dynamic crypto landscape with confidence in 2024. Whether you’re a seasoned trader or new to the world of leveraged trading, this article will provide you with the knowledge and insights to make informed decisions and potentially maximize your profits.

In this comprehensive guide, we’ll explore the top 9 crypto margin trading exchanges that are poised to help you navigate the dynamic crypto landscape with confidence in 2024. Whether you’re a seasoned trader or new to the world of leveraged trading, this article will provide you with the knowledge and insights to make informed decisions and potentially maximize your profits.

Understanding The Allure And Risks Of Crypto Margin Trading

Margin trading, also known as leveraged trading, is a powerful investment strategy that allows traders to control a larger position size than their account balance would typically permit. By borrowing funds from a broker, traders can amplify their market exposure, potentially multiplying their gains — but also their losses.

In the world of cryptocurrencies, margin trading works much like in traditional financial markets. The trader deposits a small percentage of the total trade value as collateral (the “margin”), while the broker provides the rest of the funds. This leverage can range from as low as 2x to as high as 100x, depending on the exchange and the asset being traded.

The allure of crypto margin trading lies in its ability to magnify even the slightest market movements, allowing traders to potentially reap outsized returns. However, this power of leverage also comes with heightened risks, as losses can be similarly amplified if the trade goes against the trader’s predictions.

Crypto Margin Trading

Crypto Margin Trading

Selecting The Right Crypto Margin Trading Exchange

When evaluating the top crypto margin trading platforms, there are several key factors to consider:

- Leverage Ratios: Look for exchanges that offer a wide range of leverage options, from low-risk 2x or 3x leverage to high-risk 50x or 100x leverage, catering to traders with varying risk appetites.

- Tradable Assets: Ensure the exchange supports the cryptocurrencies you want to trade, whether it’s the leading assets like Bitcoin and Ethereum or lesser-known altcoins.

- Trading Fees: Compare the spot, futures, and margin trading fees across different exchanges to find the most cost-effective option that aligns with your trading volume and strategy.

- Security and Regulation: Choose a platform that prioritizes user security, is compliant with relevant financial regulations, and has a proven track record of safeguarding customer funds.

- User-Friendly Interface: An intuitive and well-designed trading platform can make a significant difference in your overall trading experience, especially for beginner margin traders.

- Additional Features: Explore exchanges that offer advanced tools like copy trading, trading bots, and risk management features to enhance your trading capabilities and decision-making.

By carefully evaluating these factors, you can identify the crypto margin trading exchange that best suits your needs and empowers you to navigate the volatile crypto markets with confidence.

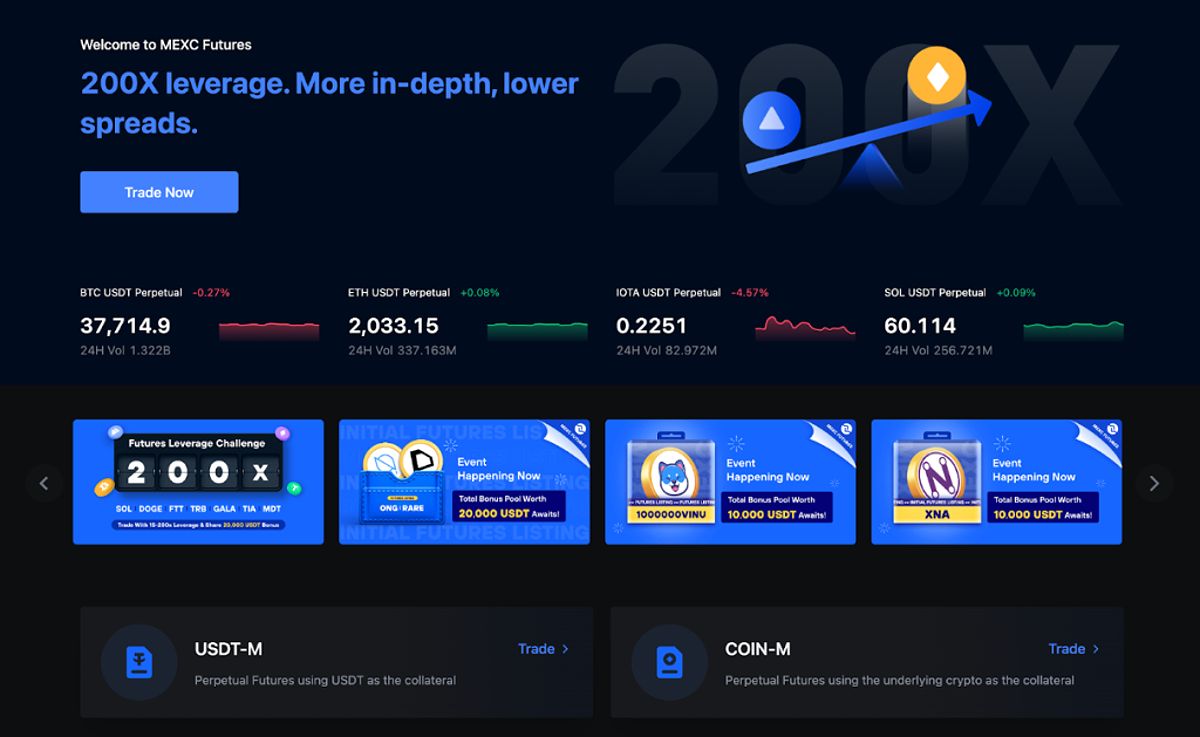

MEXC Crypto Exchange

MEXC Crypto Exchange

The Best 9 Crypto Margin Trading Exchanges To Watch In 2024

-

MEXC: Offering up to 200x leverage, MEXC boasts a vast selection of over 1,000 cryptocurrencies for spot trading and more than 200 perpetual futures contracts. Its low trading fees and user-friendly platform make it a top choice for margin traders seeking to maximize their profits.

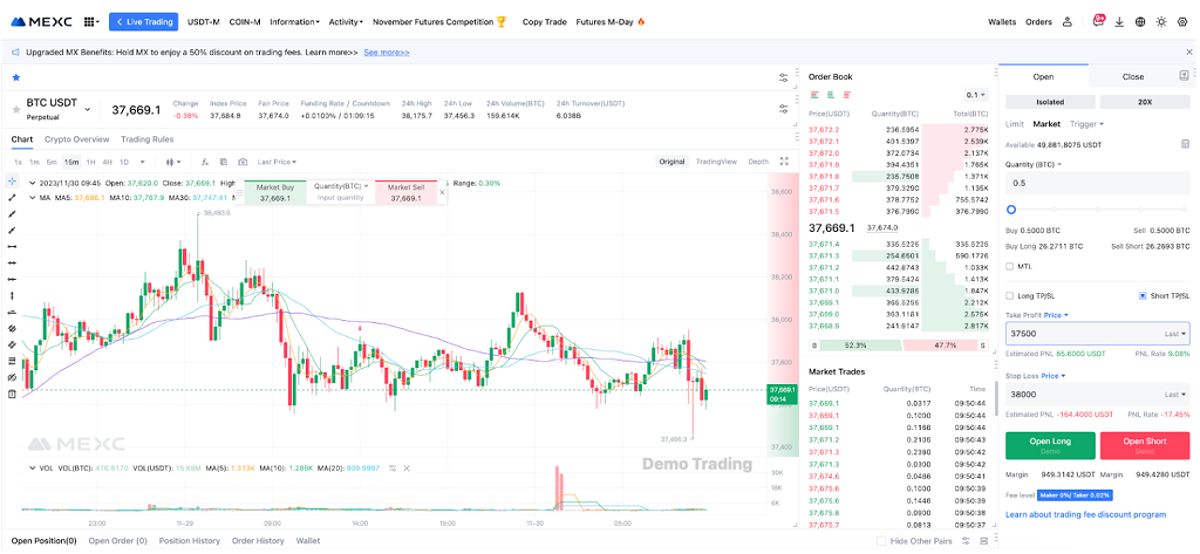

MEXC Margin Trade BTC Futures

MEXC Margin Trade BTC Futures

-

Kraken: Known for its robust security measures and regulatory compliance, Kraken provides margin trading with up to 50x leverage on a wide range of cryptocurrencies, including BTC, ETH, and altcoins, catering to traders who value safety and trustworthiness.

Kraken Crypto Exchange

Kraken Crypto Exchange

-

Coinbase: As the world’s largest publicly traded crypto exchange, Coinbase now offers margin trading, with up to 5x leverage on BTC and ETH trades for eligible users in select regions, making it an attractive option for traders seeking a familiar and reputable platform.

Coinbase Crypto Exchange

Coinbase Crypto Exchange

-

OKX: Boasting a feature-rich platform and a demo account for risk-free practice, OKX allows margin trading with up to 100x leverage on a diverse range of cryptocurrencies, empowering traders to fine-tune their strategies and manage their risk effectively.

OKX Crypto Exchange

OKX Crypto Exchange

-

Binance: As the largest crypto exchange globally, Binance offers margin trading with up to 125x leverage, alongside a vast selection of over 300 trading pairs for futures contracts, making it a go-to destination for traders seeking unparalleled liquidity and trading opportunities.

Binance Crypto Exchange

Binance Crypto Exchange

- PrimeXBT: This multi-faceted exchange enables traders to access up to 100x leverage on Bitcoin futures, alongside innovative features like copy trading and trading competitions, catering to those seeking a comprehensive trading ecosystem.

- Bybit: Renowned for its user-friendly interface and advanced trading tools, Bybit provides margin trading with up to 100x leverage on BTC and ETH, as well as leveraged tokens for easy exposure, appealing to both novice and experienced traders.

- Kucoin: With a massive selection of over 800 cryptocurrencies and nearly 250 futures contracts, Kucoin offers margin trading with up to 125x leverage for seasoned traders seeking a diverse range of trading opportunities.

- Phemex: Featuring a clean and intuitive platform, Phemex allows traders to access up to 100x leverage on perpetual contracts across a diverse range of over 200 cryptocurrency pairs, empowering them to capitalize on market fluctuations with precision and agility.

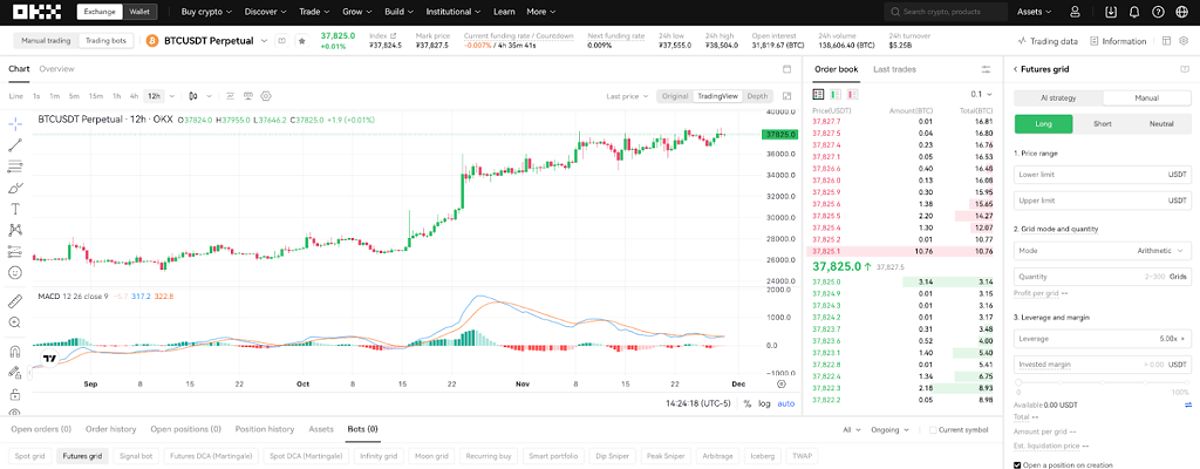

OKX Margin Trade BTC

OKX Margin Trade BTC

By understanding the allure and risks of crypto margin trading and carefully selecting the right exchange, you can position yourself to take advantage of the exciting opportunities in the crypto market while minimizing potential losses. Happy trading!

Navigating The Risks: Tips For Successful Crypto Margin Trading

As the adage goes, “with great power comes great responsibility,” and this sentiment rings especially true in the world of crypto margin trading. While the potential rewards are enticing, the risks can be equally daunting, making it crucial for traders to approach leveraged trading with a well-informed and disciplined mindset.

- Understand the Risks: Before delving into margin trading, it’s essential to have a firm grasp of the inherent risks involved. Leverage can amplify both profits and losses, so it’s crucial to thoroughly understand the mechanics and potential consequences of your trades.

- Start with Lower Leverage: As a beginner, it’s wise to start with lower leverage ratios, such as 2x or 3x, to get a feel for the market and to minimize your potential losses. This allows you to gain experience and refine your trading strategies before gradually increasing your leverage.

- Set Strict Stop-Loss Orders: Protect your trading capital by setting stop-loss orders at levels that align with your risk tolerance. This can help you limit your downside and prevent catastrophic losses in the event of unexpected market movements.

- Diversify Your Portfolio: Don’t concentrate all your margin trades on a single cryptocurrency. Spread your risk across multiple assets to mitigate the impact of unexpected price swings in any one particular market.

- Stay Informed: Continuously stay up-to-date with market news, economic indicators, and technical analysis to make informed trading decisions and avoid getting caught off guard by sudden price movements.

- Practice Diligently: Consider using a demo account to hone your trading skills and test your strategies in a risk-free environment before committing real funds. This can help you develop a deeper understanding of the nuances of margin trading.

By embracing these best practices and remaining vigilant, crypto traders can navigate the world of margin trading with a heightened awareness of the risks and a steadfast commitment to preserving their trading capital.

Frequently Asked Questions

What is the minimum amount of money I need to start margin trading? The minimum deposit required to start margin trading can vary across different exchanges. Some platforms may have a minimum of $100 or $200, while others may have higher requirements. It’s best to check the specific requirements of the exchange you’re interested in before opening an account.

What are the risks of margin trading? Margin trading amplifies both profits and losses. If the market moves against your position, your losses can quickly exceed your initial investment. It’s crucial to understand your risk tolerance and to practice proper risk management techniques, such as setting stop-loss orders and diversifying your portfolio.

How do I choose the right margin trading exchange? When selecting a crypto margin trading platform, consider factors such as the available leverage ratios, the range of tradable assets, trading fees, security measures, user-friendliness, and additional features like copy trading and trading bots. Research and compare several exchanges to find the one that best suits your trading needs and risk profile.

Conclusion

The world of crypto margin trading offers a wealth of opportunities for traders seeking to amplify their profits in the ever-evolving cryptocurrency market. By carefully selecting the right exchange and implementing sound risk management strategies, you can navigate the potential rewards and risks of leveraged trading with confidence.

As the crypto landscape continues to evolve, the landscape of margin trading platforms is likely to change as well. By staying informed, doing your research, and making decisions that align with your trading goals and risk tolerance, you can unlock new possibilities to maximize your gains in the dynamic world of cryptocurrencies.

Whether you’re a seasoned trader or new to the world of crypto, margin trading can be a valuable tool in your investment arsenal. By understanding the mechanics of leveraged trading and selecting the right exchange, you can embark on a journey to unlock your full potential in the thrilling realm of cryptocurrency markets.