As an investor navigating the ever-evolving financial landscape, I’ve come to appreciate the importance of diversification. In today’s world, where market volatility can be unpredictable, finding new avenues to spread my risk and potentially enhance my portfolio’s performance has become a top priority. That’s why I’ve been closely examining the benefits of crypto trading — a fascinating asset class that has the power to transform the way I approach investing.

Beyond the Conventional: Cryptocurrencies and Diversification

Diversification is the bedrock of sound investment strategies, and for good reason. By allocating my funds across different asset classes, I can mitigate the impact of market fluctuations and capitalize on the unique characteristics of each investment. Cryptocurrencies, with their distinct features and market dynamics, have emerged as a compelling option to complement my traditional portfolio.

One of the most intriguing aspects of the crypto ecosystem is its low correlation with traditional assets like stocks and bonds. This means that the price movements of cryptocurrencies often diverge from those of other investment vehicles, providing me with the opportunity to potentially offset losses in one asset class with gains in another. During the market turmoil of 2020 and 2022, I witnessed firsthand how cryptocurrencies like Bitcoin and Ethereum showcased their resilience, outperforming many conventional investments and offering a potential hedge against broader market volatility.

Moreover, the crypto world extends far beyond the flagship cryptocurrencies, with a diverse array of altcoins, stablecoins, and decentralized finance (DeFi) tokens catering to a wide range of investment strategies and risk appetites. By diversifying across this rich tapestry of digital assets, I can further mitigate my exposure to the inherent volatility of the crypto markets.

The Benefits of Crypto Trading for Diversification

Accessing a New Frontier of Investments

Cryptocurrencies represent a novel asset class that has the potential to generate significant returns for investors like myself. While the crypto market has experienced its fair share of ups and downs, the long-term growth potential of this emerging sector remains compelling. By incorporating cryptocurrencies into my portfolio, I can gain exposure to a market that has historically outperformed traditional assets, offering the opportunity for substantial capital appreciation.

Lowering Correlation with Conventional Markets

One of the most compelling benefits of crypto trading for diversification is the low correlation between cryptocurrencies and traditional financial markets. This lack of correlation means that the performance of my crypto investments is often not directly tied to the movements of stocks, bonds, or other conventional investment vehicles. During times of market turbulence, I can rely on my crypto holdings to potentially offset losses in other asset classes, contributing to more stable overall portfolio returns.

Embracing Flexibility and Accessibility

The crypto trading landscape offers me greater accessibility and flexibility compared to traditional investment avenues. The lower barriers to entry allow me to participate in the crypto markets with even limited capital, enabling me to achieve diversification without significant upfront investments. Additionally, the 24/7 availability of crypto markets provides me with greater control and the ability to capitalize on market opportunities as they arise, regardless of traditional trading hours.

Navigating the Risks and Rewards of Crypto Trading

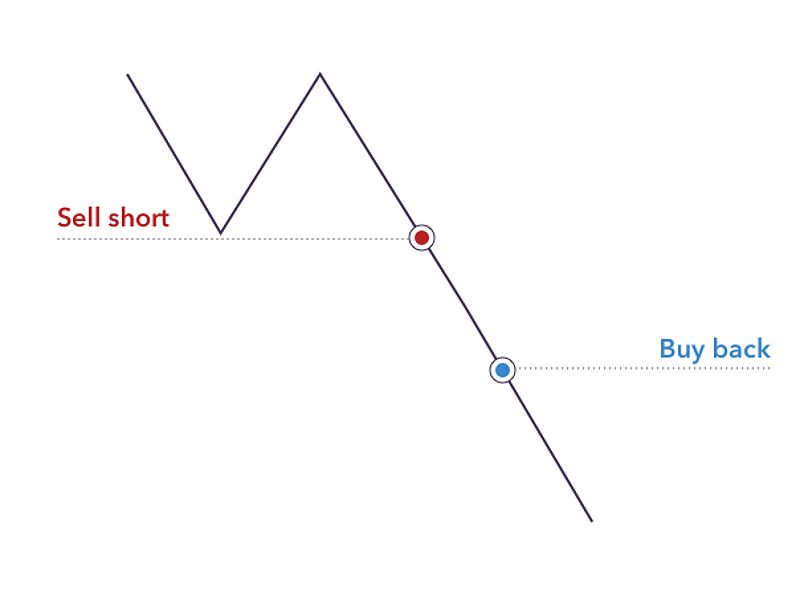

While the potential benefits of crypto trading for diversification are undeniable, it’s essential to acknowledge the inherent risks associated with this asset class. The crypto market is renowned for its volatility, with significant price fluctuations driven by a range of factors, including regulatory uncertainty, technological advancements, and the influence of large institutional investors.

As an investor, I understand the importance of implementing robust risk management strategies. This includes diversifying my crypto portfolio across multiple digital assets, setting appropriate stop-loss orders, and maintaining a long-term investment horizon. Additionally, the security of my crypto assets is a crucial consideration, emphasizing the need to use reputable exchanges and secure digital wallets.

Another critical aspect of navigating the crypto landscape is understanding the different types of cryptocurrencies and their respective use cases. While Bitcoin and Ethereum may be the most well-known, the crypto ecosystem encompasses a diverse range of digital assets, each with its own unique characteristics and risk-reward profiles. By conducting thorough research and due diligence, I can make informed decisions that align with my investment goals and risk tolerance.

Integrating Crypto Trading into My Portfolio

Assessing My Risk Tolerance

When it comes to incorporating crypto trading into my investment portfolio, I’ve learned that it’s essential to carefully assess my risk tolerance and align it with my overall financial objectives. As an investor, I know that the crypto markets are known for their volatility, and I must determine the appropriate allocation to this asset class based on my personal risk appetite and long-term goals.

Implementing a Diversification Strategy

Constructing a diversified crypto portfolio has been a crucial part of my investment strategy. By spreading my investments across different cryptocurrencies, including large-cap, mid-cap, and emerging altcoins, as well as stablecoins and DeFi protocols, I can gain exposure to a broader range of opportunities while limiting my exposure to any single asset.

Leveraging Tools and Resources

Staying informed about the latest developments in the crypto space is a constant endeavor for me. I regularly consult reputable resources, such as financial news websites, analytical platforms, and industry forums, to ensure I’m up-to-date on market trends, regulatory updates, and technological advancements. This knowledge helps me make informed decisions and adapt my investment strategy accordingly.

Navigating the Evolving Crypto Landscape

As the crypto industry continues to evolve, I’ve recognized the importance of being adaptable and open to new opportunities. The emergence of decentralized finance (DeFi), for instance, has piqued my interest, as these platforms offer a range of financial services and products built on blockchain technology. By exploring the DeFi ecosystem, I can potentially diversify my crypto holdings and capitalize on the yield-generating potential of these decentralized protocols.

Additionally, the rise of non-fungible tokens (NFTs) has captivated my attention. While the NFT market has experienced its own cycles of volatility, I see the potential for long-term value creation in this emerging sector, and I’m continuously exploring ways to incorporate it into my diversification strategy.

As I navigate the ever-changing crypto landscape, I remain committed to staying informed and adaptable. By positioning myself to capitalize on the benefits of this dynamic asset class, I believe I can enhance the overall risk-adjusted returns of my investment portfolio and unlock new avenues for growth and financial security.

FAQ

Q: What is the best way to get started with crypto trading?

A: To get started with crypto trading, the first step is to set up an account with a reputable cryptocurrency exchange. This typically involves providing personal information, verifying your identity, and funding your account. Once your account is established, you can begin exploring the various cryptocurrencies and trading strategies that align with your investment goals and risk tolerance.

Q: How much should I allocate to crypto in my portfolio?

A: The ideal allocation to crypto in your portfolio will depend on your individual risk profile and investment objectives. As a general guideline, it’s recommended to start with a relatively small percentage, such as 5-10% of your total portfolio, and gradually increase your exposure as you become more comfortable with the crypto market. It’s essential to diversify your investments and not overexpose yourself to the inherent volatility of the crypto asset class.

Q: Are there any tax implications for crypto trading?

A: Yes, there are potential tax implications for crypto trading. Cryptocurrency transactions are generally considered capital assets, and any gains or losses from the sale or exchange of cryptocurrencies may be subject to capital gains or losses taxation. It’s crucial to consult with a tax professional to understand the specific tax considerations in your jurisdiction and ensure you are complying with all applicable regulations.

Conclusion

As an investor seeking to diversify my portfolio, I’ve come to appreciate the transformative power of crypto trading. By gaining exposure to this new asset class, I’ve been able to enhance my portfolio’s risk-adjusted returns, leverage the low correlation with traditional markets, and capitalize on the growth potential of the evolving crypto ecosystem.

However, navigating the crypto landscape requires a well-informed and risk-managed approach. I’ve learned the importance of conducting thorough research, understanding the different types of cryptocurrencies, and integrating this asset class into a diversified investment strategy.

As the crypto industry continues to mature and adoption grows, I’m excited to see the new opportunities for diversification that will emerge. By embracing the benefits of crypto trading, I believe I’m positioned to navigate the ever-changing investment landscape and achieve my long-term financial goals with greater confidence and resilience.