In the ever-evolving landscape of cryptocurrency trading, success is often determined by the ability to navigate the market’s unpredictable currents. But what if you could harness the power of the past to shape your future trading victories? Welcome to the realm of backtesting, where the secrets of profitable crypto strategies are waiting to be uncovered.

As we step into the year 2024, the crypto market continues to captivate investors and traders alike, with its unparalleled potential for growth and the thrill of uncovering new opportunities. However, the path to consistent profitability is not without its challenges. Volatility, market shifts, and the constant need to adapt can make navigating the crypto waters a daunting task. That’s where the art of backtesting comes into play, providing a visionary’s approach to refining your trading strategies and unlocking the full potential of the digital asset ecosystem.

Mastering the Art of Backtesting: Your Pathway to Crypto Trading Success

Imagine a world where you can test your trading ideas without risking a single penny of your hard-earned capital. That’s the power of backtesting — a transformative tool that allows you to simulate trades using historical market data, empowering you to identify profitable strategies and minimize potential pitfalls before taking the plunge into the live market.

By embracing the power of backtesting, you’ll gain a competitive edge in the dynamic crypto trading landscape. Through meticulous analysis of past market movements, you’ll uncover the strengths and weaknesses of your trading approach, refine your strategies, and enhance your decision-making abilities. This holistic understanding of your trading capabilities will instill the confidence you need to navigate the market’s ever-changing tides with poise and precision.

Backtest Crypto Trading Strategy: Key Steps to Effective Crypto Backtesting

Backtesting is not merely a technical exercise; it’s a strategic journey that requires careful planning and execution. Let’s delve into the essential steps that will guide you towards backtesting mastery and unlock the full potential of your crypto trading strategies.

1- Define Your Crypto Trading Roadmap

Before you can embark on your backtesting adventure, it’s crucial to have a well-defined trading strategy. This involves specifying your entry and exit points, risk management parameters, and the technical indicators or signals you intend to use. By clearly outlining your approach, you’ll ensure that your backtesting process aligns seamlessly with your investment goals and risk tolerance.

Take the time to carefully consider the trading style that resonates most with you — whether it’s trend-following, mean-reversion, or momentum-based strategies. This deliberate selection will lay the foundation for a robust and adaptable trading plan, ready to navigate the ever-changing crypto landscape.

2- Gather the Necessary Data

The quality and breadth of your historical data are paramount to the success of your backtesting endeavors. Seek out reliable sources of cryptocurrency price data that span a diverse time frame, capturing a wide range of market conditions and cycles. This comprehensive dataset will allow you to thoroughly test your strategy’s performance across a variety of scenarios, providing invaluable insights into its viability.

When selecting your data, be mindful of factors such as liquidity, volatility, and trading volume, as these can significantly impact the performance of your strategy. Aim to gather data that aligns seamlessly with the cryptocurrency pairs and timeframes you intend to trade in the live market, ensuring a seamless transition from your backtesting to real-world trading.

3- Choose Your Backtesting Platform

In the dynamic world of crypto trading, the selection of a suitable backtesting platform can make all the difference. Research and evaluate a variety of options, focusing on the one that best suits your trading strategy and technical requirements. Some of the most popular choices in 2024 include TradingView, Cryptohopper, and Vestinda, each offering a unique set of features and capabilities.

When evaluating your backtesting platform, consider factors such as the available cryptocurrency pairs, the depth of historical data, the customizability of strategy parameters, and the platform’s overall user-friendliness. Additionally, look for advanced features like optimization tools, performance analytics, and the ability to simulate real-world trading conditions, as these can significantly enhance the effectiveness of your backtesting process.

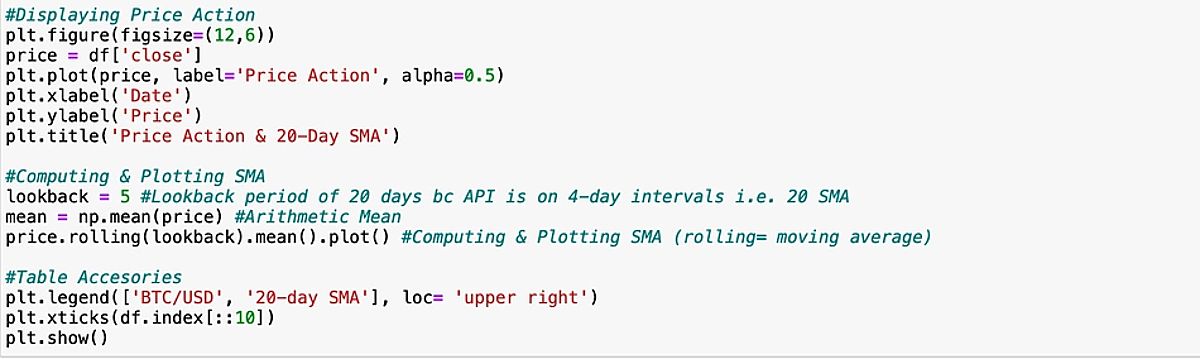

4- Optimize Your Strategy Parameters

With your backtesting platform in place, it’s time to dive into the heart of the matter — fine-tuning your trading strategy parameters. This includes defining your precise entry and exit criteria, stop-loss orders, take-profit targets, and any other relevant settings. Ensuring that these parameters accurately reflect your intended trading approach and risk management protocols is crucial for the accuracy and reliability of your backtesting results.

Embrace an iterative approach to parameter optimization, experimenting with different variations to identify the ideal configuration for your strategy. This meticulous process will not only enhance the performance of your trading plan but also instill a deeper understanding of the underlying market dynamics, empowering you to make more informed decisions in the live market.

5- Run the Backtest and Analyze the Results

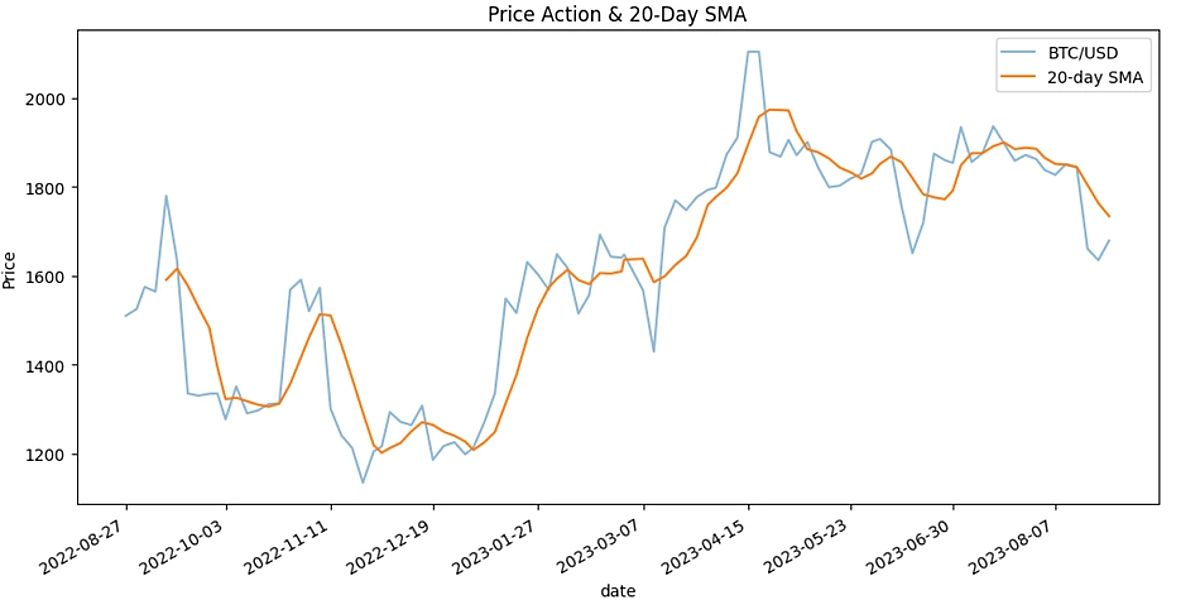

Armed with your carefully crafted trading strategy and optimized parameters, it’s time to put your backtesting skills to the test. Simulate trades over a substantial historical period, ensuring that you cover a wide range of market conditions, including both bullish and bearish phases. This comprehensive approach will provide you with a more holistic understanding of how your strategy would have performed under various scenarios.

As the backtest unfolds, closely monitor the simulation, observing the outcomes of your trades and the overall performance of your strategy. Pay close attention to key metrics such as profitability, win rate, maximum drawdown, and risk-adjusted returns. These insights will be instrumental in evaluating the effectiveness and robustness of your trading approach, guiding you towards the path of continuous improvement.

6- Refine and Optimize Your Crypto Trading Strategy

Based on the valuable insights gained from your backtesting analysis, it’s time to embark on the journey of refinement and optimization. Experiment with adjustments to your parameters, including indicator settings, entry and exit rules, and risk management protocols. Run additional backtests to assess the impact of these changes and identify the optimal configuration for your approach.

This iterative process is the hallmark of a visionary crypto trader. By continuously testing and refining your strategy, you’ll be able to adapt to the ever-evolving market conditions and position yourself for long-term success in the dynamic cryptocurrency landscape. Remember, backtesting is not a one-time exercise; it’s an ongoing exploration of the market’s complexities, empowering you to stay ahead of the curve and capitalize on emerging opportunities.

Unleashing the Power of Crypto Trading Bots for Backtesting

As the crypto market continues to mature, the rise of sophisticated trading bots has revolutionized the way traders approach backtesting. These advanced algorithms have the ability to rapidly simulate trades, analyze results, and provide detailed performance metrics, significantly streamlining the backtesting process and freeing up valuable time for strategy development and optimization.

When leveraging crypto trading bots for backtesting, it’s essential to choose a platform that offers robust backtesting capabilities. Look for features such as customizable strategy parameters, the ability to incorporate real-world factors like fees and slippage, and comprehensive performance reporting. By harnessing the power of these automated tools, you can gain deeper insights into your trading strategies and uncover new opportunities for optimization.

Embracing Best Practices for Effective Crypto Backtesting

To ensure the accuracy and reliability of your backtesting results, it’s crucial to adhere to the following best practices:

- Use Sufficient Historical Data: Ensure that the historical data you use for backtesting covers a diverse range of market conditions, including both bullish and bearish phases. This will provide a more comprehensive assessment of your strategy’s performance.

- Factor in Real-World Costs: When backtesting, be sure to account for trading fees, slippage, and other transaction costs. This will give you a more realistic evaluation of your strategy’s profitability in the live market.

- Test Under Various Market Conditions: Evaluate your strategy’s performance not only during stable market periods but also during volatile and uncertain times. This will help you identify its strengths, weaknesses, and resilience.

- Avoid Overoptimization: Be cautious of over-fitting your strategy to past data, as this can lead to poor performance in live trading. Strive for a balanced and robust approach that can adapt to changing market dynamics.

- Validate Your Results: Consider testing your strategy on a separate dataset or during a holdout period to validate the accuracy and consistency of your backtesting results.

- Continuously Monitor and Refine: Regularly review and update your backtesting process to ensure it remains aligned with the evolving cryptocurrency market and your trading goals.

By embracing these best practices, you’ll elevate your backtesting efforts, enhancing the reliability and effectiveness of your crypto trading strategies. As the market continues to evolve, this commitment to continuous improvement will be the hallmark of your success as a visionary crypto trader.

FAQ

Q: What is the best backtesting platform for crypto trading in 2024? A: There are numerous excellent backtesting platforms available, each with its own unique features and capabilities. Some of the top options in 2024 include TradingView, Cryptohopper, and Vestinda. The best platform for you will depend on your specific needs, trading style, and technical requirements.

Q: How can I access high-quality historical data for backtesting in the crypto market? A: Accessing reliable and comprehensive historical data is crucial for effective backtesting. You can obtain data from various sources, including cryptocurrency exchanges, data providers, and websites like CoinGecko. Ensure that the data you choose is accurate, up-to-date, and covers a sufficient time frame to capture the nuances of the crypto market.

Q: Can I use backtesting to predict future market movements in the crypto space? A: Backtesting can provide valuable insights into the performance of your trading strategies based on historical data, but it cannot be used to predict future market movements with certainty. The crypto market is inherently dynamic and unpredictable, and past performance is not always indicative of future results. Backtesting should be leveraged as a tool to refine your strategies and enhance your decision-making, not as a crystal ball for future market behavior.

Q: How often should I backtest my crypto trading strategy in 2024? A: Regularly backtesting your crypto trading strategy is essential, especially as the market evolves and your trading approach undergoes refinements. It’s recommended to backtest your strategy on a periodic basis, such as monthly or quarterly, to ensure that it remains aligned with the current market conditions and your investment objectives. Additionally, any significant changes to your trading rules or market shifts should prompt a thorough backtesting review to validate the effectiveness of your strategy.

Unlocking the Future of Crypto Trading with Backtesting

As we step into the future of cryptocurrency trading in 2024, the power of backtesting stands as a beacon, guiding visionary traders towards consistent profitability and sustainable success. By embracing this transformative tool, you’ll gain the confidence to refine your strategies, identify potential pitfalls, and position yourself as a true master of the crypto landscape.

Remember, the crypto market is a dynamic and ever-changing arena, and the ability to adapt and evolve is key to long-term prosperity. By continuously testing and optimizing your trading approaches through the rigorous process of backtesting, you’ll unlock the full potential of the digital asset ecosystem and chart a course towards financial freedom.

So, embark on your backtesting journey today, and witness the transformation of your crypto trading prowess. The future is yours to shape, and with the power of this visionary tool at your fingertips, the path to trading mastery lies ahead, waiting to be conquered.