In the ever-evolving world of cryptocurrency, I’ve witnessed the rise and fall of countless trading strategies, each promising the allure of effortless profits. However, as a seasoned trader, I’ve come to view the concept of automated crypto trading with a healthy dose of skepticism. While the promise of 24/7 trading, reduced emotional bias, and potential for higher returns is certainly enticing, I’ve also seen the pitfalls that can arise from over-reliance on technology.

In this article, I’ll take a contrarian approach, challenging the conventional wisdom surrounding automated crypto trading strategies. I’ll shed light on the nuances and complexities that often get overlooked, empowering you to make informed decisions that align with your unique trading goals and risk tolerance.

Confronting the Myths of Automated Crypto Trading

The crypto trading landscape is rife with grand claims and oversimplified narratives. As an experienced trader, I’ve learned to approach these narratives with a critical eye, separating fact from fiction.

One of the most pervasive myths is the idea that automated trading bots can consistently outperform human traders. While algorithms undoubtedly possess the ability to execute trades with lightning speed and precision, they are not infallible. These systems are susceptible to bugs, coding errors, and unforeseen market conditions that can lead to disastrous consequences.

Automated Trading Bots

Automated Trading Bots

Moreover, the notion that automated trading eliminates emotional bias is a half-truth. The emotions and biases of the individuals who design and implement these algorithms are often baked into the very strategies they employ. Truly impartial and unemotional trading remains an elusive goal, even in the realm of automation.

Navigating the Landscape of Automated Crypto Trading Strategies

As you venture into the world of automated crypto trading, it’s crucial to approach the process with a clear understanding of the various strategies and their suitability for your trading profile.

Scalping: The High-Stakes Game

Scalping, a high-frequency trading strategy that focuses on capitalizing on small price fluctuations, is often touted as a reliable path to consistent profits. While it’s true that scalping bots can execute trades at lightning speed, the inherent risks of this approach cannot be overstated.

Scalping Trading Bot

Scalping Trading Bot

The need for highly liquid markets, the threat of slippage, and the potential for high transaction fees can quickly erode any gains you might achieve. As an experienced trader, I’ve witnessed many scalping enthusiasts get burned by the volatility and unpredictability of the crypto markets.

Trend Following: Riding the Waves or Drowning in Reversals

Trend Following strategies, which aim to identify and capitalize on established market trends, can be a more tempting proposition. However, the success of these strategies is heavily reliant on your ability to accurately identify and interpret market trends.

In the fast-paced world of cryptocurrency, trends can often be short-lived and susceptible to sudden reversals. While trend-following bots may offer a more passive approach, they are not immune to the whims of the market, and a single missed trend can lead to significant losses.

Trend Following Strategy

Trend Following Strategy

Arbitrage: The Elusive Pursuit of Riskless Profits

Arbitrage trading, the process of exploiting price discrepancies between different exchanges, has long been touted as a low-risk path to profits. However, the reality is far more complex.

To succeed in arbitrage trading, you require lightning-fast execution speeds, the ability to navigate a myriad of exchange fees and regulations, and the willingness to manage the ever-present risk of slippage. As an experienced trader, I’ve seen many well-intentioned arbitrage strategies fail due to the sheer complexity of the task at hand.

Market Making: Providing Liquidity or Courting Disaster?

Market-making strategies, which involve providing liquidity to the market by placing buy and sell orders, can be a lucrative proposition. However, the risks associated with this approach are often underestimated.

In the volatile world of cryptocurrency, the bid-ask spread can quickly evaporate, leaving market-making bots exposed to significant losses. Additionally, the need for substantial capital and the high-risk nature of the strategy make it a poor fit for many traders, regardless of their level of experience.

News Trading: Chasing the Elusive Jackpot

The allure of news trading, which focuses on capitalizing on market-moving events and news releases, is undeniable. The potential for high returns is tempting, but the risks involved are often overlooked.

Accurately interpreting news and sentiment is a complex task that even the most seasoned traders struggle with. Automated bots, no matter how sophisticated, can be susceptible to emotional biases and erroneous interpretations, leading to significant losses.

Choosing the Right Automated Crypto Trading Strategy: A Cautionary Tale

As you navigate the automated crypto trading landscape, it’s crucial to approach the decision-making process with a keen understanding of your own trading goals, risk tolerance, and experience level.

While the prospect of hands-off trading and the promise of higher profits may be enticing, I caution you against rushing into any automated strategy without a thorough evaluation of its suitability for your unique trading profile.

Careful backtesting, paper trading, and a willingness to adapt and evolve your approach are essential. The crypto markets are inherently unpredictable, and any automated strategy that fails to account for this unpredictability is doomed to failure.

The Perils of DIY Automated Crypto Trading

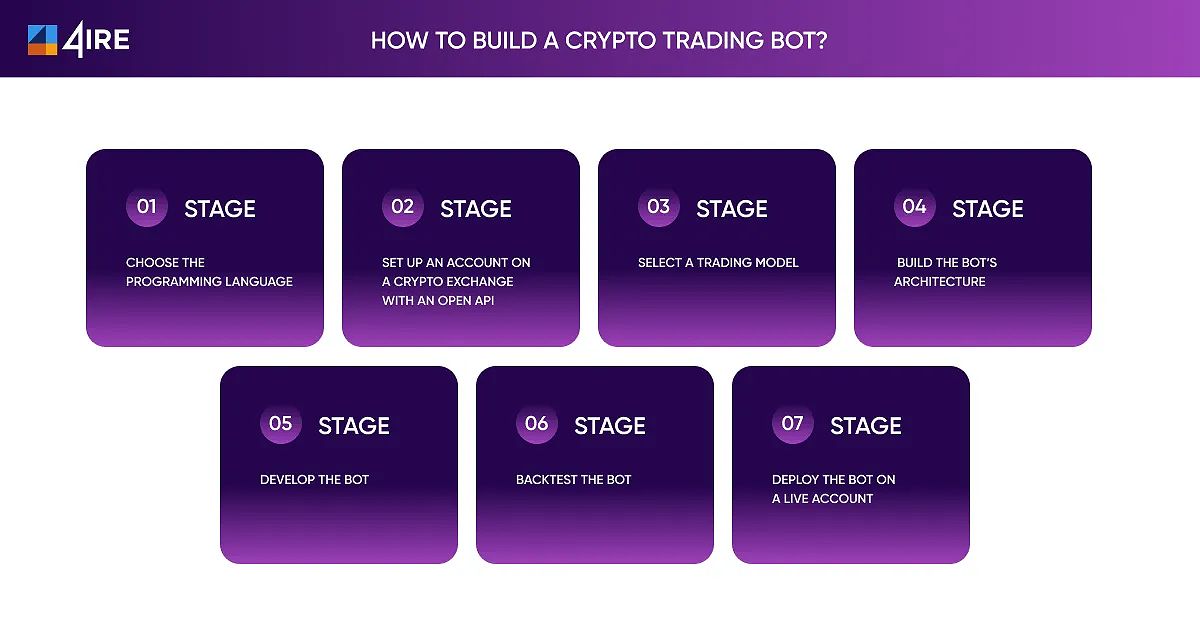

For the more technically inclined, the allure of building your own custom automated trading bot can be irresistible. However, I urge you to approach this endeavor with a keen awareness of the pitfalls that await.

Developing a robust and reliable automated trading system requires a deep understanding of programming languages, market dynamics, and risk management strategies. Even the slightest oversight or coding error can have catastrophic consequences, leading to significant financial losses.

Moreover, the ongoing maintenance and optimization of your trading bot can be a never-ending task, requiring constant vigilance and a willingness to adapt to the ever-changing market conditions.

Building a Trading Bot

Building a Trading Bot

A Contrarians Perspective: The Path to Sustainable Crypto Trading

As a seasoned trader, I’ve come to believe that the most sustainable approach to crypto trading, automated or otherwise, lies in the delicate balance between technology and human intuition.

While the allure of automated trading is undeniable, I caution against becoming overly reliant on algorithms and bots. The markets are inherently unpredictable, and the ability to adapt, think critically, and make informed decisions in the face of uncertainty is a vital skill that no automated system can replicate.

My advice to you, my fellow traders, is to approach automated crypto trading strategies with a healthy dose of skepticism. Develop a deep understanding of the underlying mechanics, thoroughly test and refine your strategies, and maintain a constant vigilance over your trading activities.

Most importantly, remember that you are the master of your own trading destiny. Automated systems should be viewed as tools to enhance and complement your trading abilities, not as a replacement for your own judgment and decision-making.

FAQ

Q: What is the best crypto trading bot strategy? A: There is no single “best” crypto trading bot strategy. The most suitable strategy depends on your individual trading goals, risk tolerance, and experience level. It’s essential to thoroughly evaluate and test different approaches before committing your capital.

Q: Are automated crypto trading bots legal? A: Yes, automated crypto trading bots are generally legal, but it’s crucial to ensure compliance with the regulations and guidelines of your jurisdiction. Always consult with financial and legal professionals to ensure you’re operating within the bounds of the law.

Q: How can I learn more about building my own crypto trading bot? A: There are numerous online resources, courses, and communities dedicated to crypto trading bot development. However, I caution against diving into this endeavor without a deep understanding of programming, market dynamics, and risk management. The risks of building a flawed automated trading system can be severe.

Q: What are the risks associated with automated crypto trading? A: Automated trading involves a range of risks, including technical errors, market volatility, and the potential for significant financial losses. Reliance on technology, the risk of bugs or errors, and the need for constant monitoring and adjustments are all potential drawbacks to consider.

Conclusion: Embrace Skepticism, Cultivate Resilience

As I reflect on the ever-evolving world of automated crypto trading, I’m reminded of the importance of maintaining a critical and skeptical mindset. While the promise of effortless profits may be alluring, the reality is often far more complex and fraught with risks.

My hope is that this contrarian’s guide has provided you with a more nuanced understanding of the automated crypto trading landscape. Remember, the path to sustainable trading success lies in the delicate balance between technology and human intuition, a balance that requires constant vigilance, adaptation, and a willingness to challenge the conventional wisdom.

Embrace your skepticism, cultivate your resilience, and navigate the unpredictable waters of cryptocurrency with a clear-eyed, strategic approach. The rewards of mastering this dynamic market can be substantial, but only for those willing to confront the challenges head-on.