As a seasoned crypto enthusiast, I’ve always been fascinated by the potential of the digital asset market. The thrill of chasing the next big opportunity, the rollercoaster of market volatility — it’s all part of the excitement. But as I delved deeper into the world of cryptocurrency trading, I quickly realized that manual trading could be a daunting and time-consuming task, often plagued by emotional biases and missed opportunities.

That’s when I discovered the power of automated crypto trading coinbase — a game-changing approach that has transformed the way I approach the crypto markets. By leveraging the best crypto trading bots for Coinbase, I’ve been able to unlock new levels of profitability and efficiency in my trading journey.

The Rise of Automated Crypto Trading on Coinbase

Crypto trading bots are essentially computer programs designed to execute trades on your behalf, based on pre-programmed strategies. On Coinbase, these bots can automate your entire trading process, executing multiple transactions 24/7 without the emotional baggage and cognitive limitations that can often hinder manual traders.

I was initially skeptical about handing over the reins to a bot, but as I explored the benefits of automated crypto trading on Coinbase, I quickly realized the immense potential it held. By leveraging proven algorithms and strategies, these bots can help you increase your profits, reduce the time and effort required for trading, and mitigate the impact of emotional decision-making.

Navigating the Best Crypto Trading Bots for Automated Crypto Trading on Coinbase

With the rapid growth of the cryptocurrency market, a plethora of trading bot providers have emerged to cater to the needs of Coinbase users. As I delved into the options, I carefully evaluated each platform, considering factors such as features, user-friendliness, security, and overall performance.

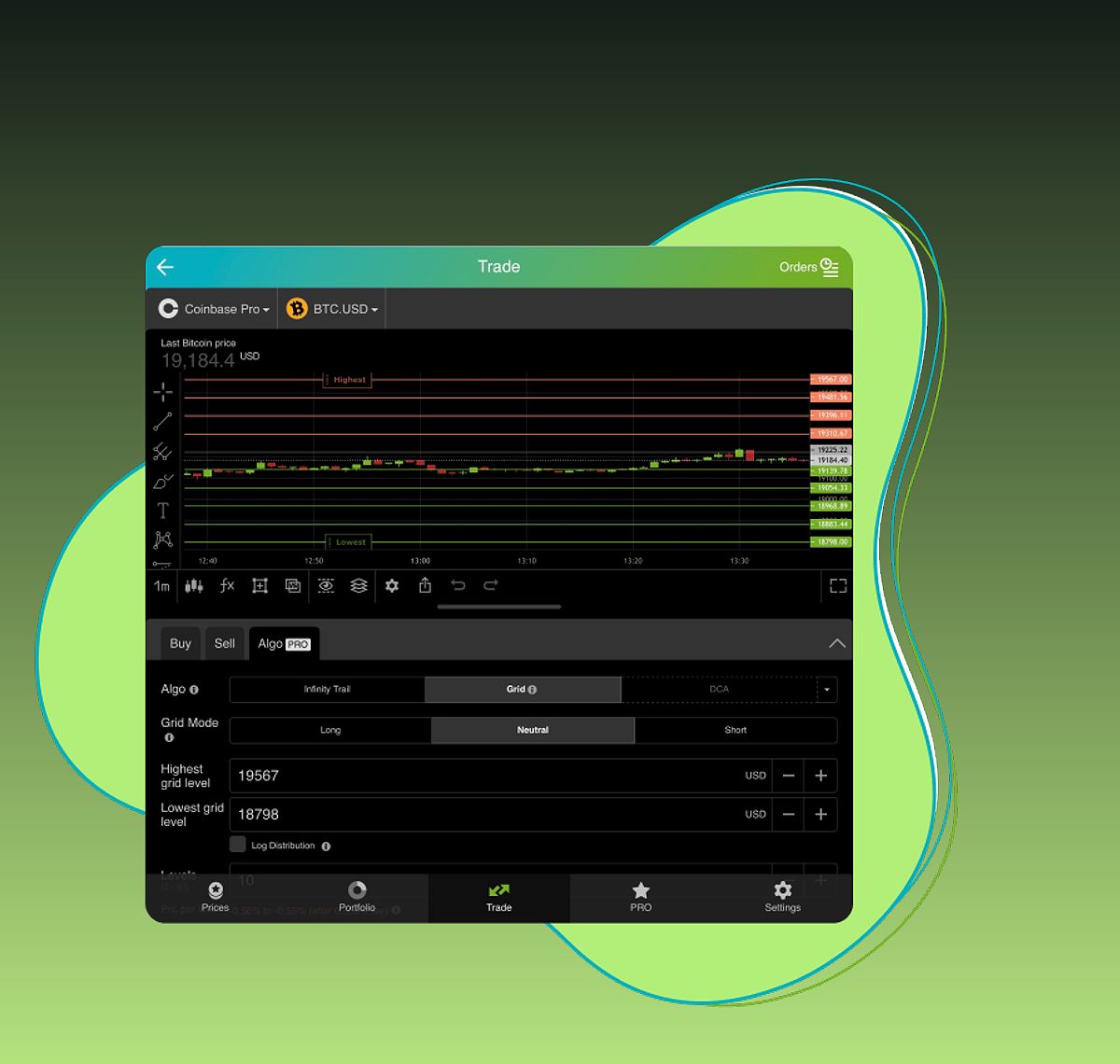

Bitsgap: The All-in-One Solution

Bitsgap Image: Bitsgap

Bitsgap Image: Bitsgap

Bitsgap quickly became one of my top choices for automated crypto trading on Coinbase. Its integrated trading solutions allow me to manage all my trading accounts in one place, with support for over 25 exchanges, including Coinbase. The platform’s user-friendly interface and the availability of a demo account made it an accessible option for both my beginner and more experienced trading endeavors.

One of the standout features of Bitsgap is its seamless integration with Coinbase, allowing me to effortlessly connect my account and start automating my trades. The platform’s advanced charting tools and arbitrage opportunities have been invaluable in identifying and capitalizing on market inefficiencies.

3Commas: Beginner-Friendly Automation

3Commas Image: 3Commas

3Commas Image: 3Commas

As a relative newcomer to the world of automated trading, I was drawn to the beginner-friendly approach of 3Commas. The platform’s extensive library of proven trading strategies and its focus on security features have been instrumental in building my confidence and optimizing my Coinbase trading journey.

What I appreciate most about 3Commas is its affordable subscription plans, which have made automated trading accessible to traders of all skill levels. With its user-friendly interface and comprehensive video tutorials, I’ve been able to quickly get up to speed and start implementing my own custom trading strategies on Coinbase.

Quadency: The Powerhouse of Automated Trading

Quadency Image: Quadency

Quadency Image: Quadency

For those seeking a more advanced and feature-rich platform for automated crypto trading on Coinbase, Quadency has quickly become a standout option. As a seasoned trader, I’ve been particularly impressed by Quadency’s professional-grade charting tools, comprehensive strategy library, and support for over 35 exchanges, including Coinbase.

One of the key advantages of Quadency is its free Pro version, which has allowed me to explore the platform’s capabilities without any upfront investment. The platform’s emphasis on portfolio management and its user-friendly interface have been instrumental in optimizing my Coinbase trading activities.

TradeSanta: Simple and Affordable Automation

TradeSanta Image: TradeSanta

TradeSanta Image: TradeSanta

In my quest for the best crypto trading bot for Coinbase, TradeSanta emerged as a compelling option, particularly for those just starting their automated trading journey. The platform’s cloud-based architecture and extensive video tutorials have made it easy for me to get up and running, with both long and short trading bots at my disposal.

What I appreciate most about TradeSanta is its affordable pricing, which has allowed me to experiment with automated trading without breaking the bank. While the platform may not offer the same level of advanced features as some of its competitors, its user-friendly interface and comprehensive educational resources have been invaluable in helping me navigate the world of automated crypto trading on Coinbase.

Altrady: Tailored for Experienced Traders

Altrady Image: Altrady

Altrady Image: Altrady

As my expertise in automated trading grew, I found myself drawn to Altrady, a platform that caters to the needs of experienced cryptocurrency traders. With its comprehensive toolset, including GRID and SIGNAL bots, Altrady has enabled me to implement more sophisticated trading strategies on Coinbase.

One of the standout features of Altrady is its focus on multi-exchange trading and portfolio management. This has been particularly useful in diversifying my Coinbase trading activities and optimizing my overall investment strategy. While the platform may not be as beginner-friendly as some of the others, its advanced features and robust functionality have made it an invaluable asset in my automated trading arsenal.

Exploring Automated Trading Strategies on Coinbase

As I dove deeper into the world of “automated crypto trading coinbase,” I discovered a range of powerful strategies that have helped me capitalize on market opportunities and streamline my trading activities.

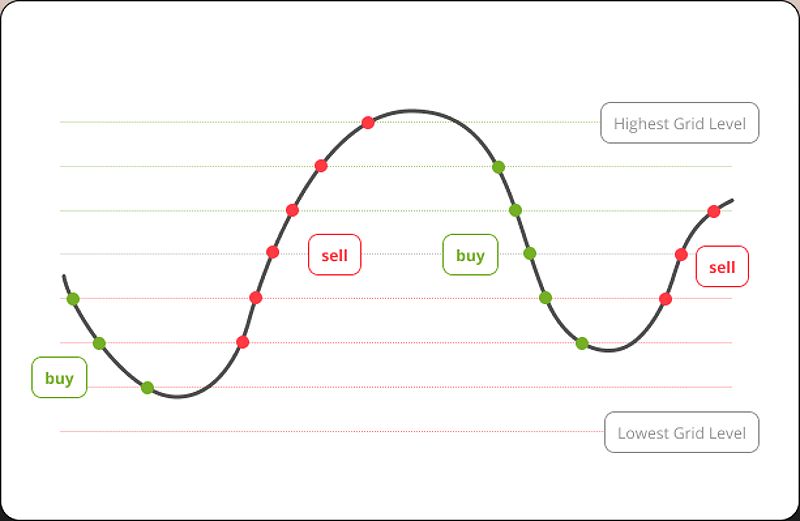

Grid Trading: Profiting from Price Fluctuations

One of the strategies that has proven particularly effective for me on Coinbase is grid trading. By employing a bot that places a series of buy and sell orders within a specified price range, I’ve been able to generate consistent profits, even in sideways markets.

For example, my grid bot on Coinbase might place buy orders at the lower end of a price range and sell orders at the upper end. As the price moves up and down, the bot automatically executes counter-orders, capturing small profits along the way. This strategy has allowed me to maintain a steady stream of income, regardless of the market’s overall direction.

Dollar Cost Averaging (DCA): Reducing Risk and Stabilizing Prices

Another strategy that has become an integral part of my “automated crypto trading coinbase” approach is dollar cost averaging (DCA). By programming a bot to automatically purchase cryptocurrency at regular intervals, I’ve been able to reduce the risk of investing a lump sum at the wrong time and lower my average entry price over time.

Imagine a DCA bot on Coinbase that buys a fixed amount of Bitcoin every week. Even as the price fluctuates, the bot will continue to accumulate the asset, potentially resulting in a lower average entry price compared to my manual trading efforts. This strategy has been particularly valuable during volatile market conditions, helping me weather the storms and consistently build my crypto portfolio.

Trailing Stop: Protecting Profits and Minimizing Losses

As the crypto market can be notoriously volatile, I’ve also found the trailing stop strategy to be an invaluable tool in my “automated crypto trading coinbase” arsenal. By programming a bot to automatically adjust stop-loss orders based on the price movements of the asset, I’ve been able to protect my gains while still allowing my portfolio to ride the upward trends.

For example, my trailing stop bot on Coinbase might start with a stop-loss order at a certain percentage below the current price and then move it up as the asset price increases. This has allowed me to lock in profits during bullish market conditions and limit my losses during bearish periods, ultimately enhancing the stability and long-term growth of my Coinbase trading activities.

Securing and Managing My Automated Trading Journey

As I’ve embraced the power of “automated crypto trading coinbase,” I’ve also remained vigilant about the importance of security and risk management. Choosing a reputable and trustworthy bot provider has been a top priority, as I’ve recognized the potential risks associated with API key compromise and other security vulnerabilities.

To mitigate these risks, I’ve always ensured that my Coinbase account is equipped with robust security measures, including two-factor authentication (2FA). Additionally, I’ve carefully diversified my trading portfolio and set appropriate stop-loss orders to manage my exposure and protect my hard-earned gains.

FAQ

Q: Is it safe to use automated crypto trading bots? A: While automated trading can be tremendously beneficial, it’s crucial to choose a reputable bot provider with a strong track record of security and user privacy. I’ve always prioritized security and risk management practices to ensure the safety of my funds and the effectiveness of my trading strategies.

Q: How much can I potentially earn with a crypto trading bot? A: The potential returns from “automated crypto trading coinbase” can be significant, but they depend on a variety of factors, including the chosen strategy, market conditions, and your risk tolerance. It’s important to manage your expectations and understand that losses are always a possibility, even with the most sophisticated trading bots.

Q: Do I need any coding experience to use a crypto trading bot? A: One of the great advantages of the top crypto trading bots for Coinbase is their user-friendly interfaces and pre-configured strategies. As a non-technical trader, I’ve been able to leverage these platforms without any prior coding experience, making the transition to automated trading seamless and accessible.

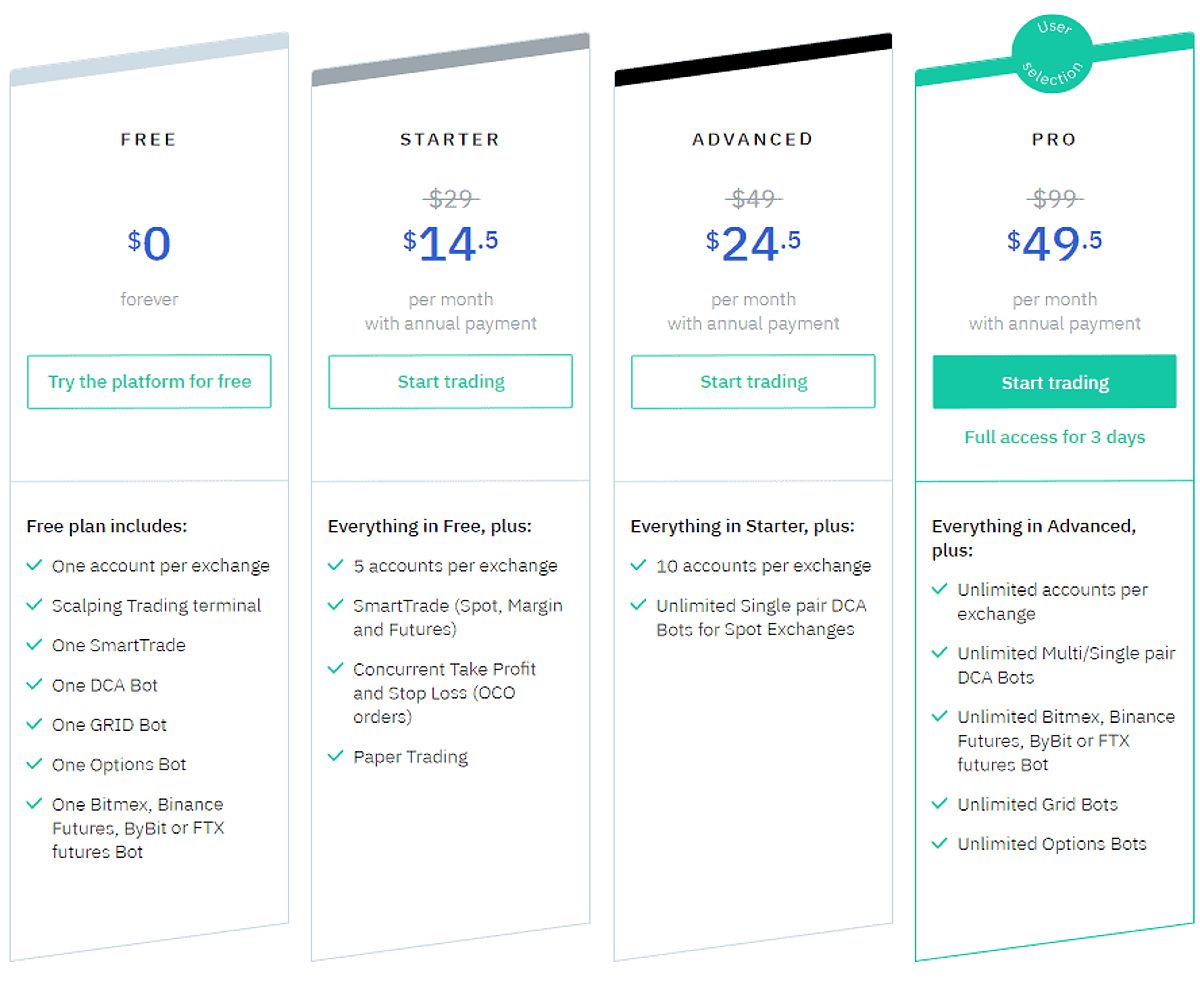

Q: What are the fees associated with using a crypto trading bot? A: The fees for “automated crypto trading coinbase” can vary widely depending on the bot provider and their pricing plans. Some platforms offer free plans with limited features, while others charge subscription fees for more advanced functionality. It’s essential to research and compare the pricing structures of different providers to find the one that best aligns with your trading needs and budget.

Conclusion: Unlocking the Future of Crypto Profits

As I reflect on my journey with “automated crypto trading coinbase,” I’m truly amazed at the transformative power of these trading bots. By leveraging the best crypto trading bots for Coinbase, I’ve been able to unlock new levels of profitability, efficiency, and control over my crypto trading activities.

Whether it’s grid trading, dollar cost averaging, or trailing stops, the strategies enabled by these bots have allowed me to capitalize on market opportunities, minimize emotional biases, and streamline my trading workflow. And as the cryptocurrency market continues to evolve, I’m confident that “automated crypto trading coinbase” will play an increasingly vital role in my investment strategy.

As you embark on your own automated trading journey, I encourage you to explore the platforms and strategies I’ve discussed, and to always prioritize security and risk management. With the right approach, “automated crypto trading coinbase” can be a powerful tool in your arsenal, helping you navigate the dynamic crypto landscape and unlock the full potential of your trading endeavors.