As an avid crypto enthusiast, I’ve always been fascinated by the idea of automating my trading activities. The thrill of the markets, the potential for life-changing gains, and the endless possibilities of this new digital frontier have captivated me for years. But with the dizzying pace of the crypto world, manually tracking the markets and executing trades can be a daunting and time-consuming task. That’s why I decided to take matters into my own hands and build my very own crypto trading bot using Python.

In this guide, I’ll share with you the step-by-step process I went through to create an automated trading system that has the potential to revolutionize the way I approach the crypto markets. Whether you’re a seasoned trader or a complete newcomer to the world of algorithmic trading, I’m confident that by the end of this article, you’ll have the knowledge and confidence to start building your own crypto trading bot.

Understanding the Fundamentals of Automated Crypto Trading

What is Algorithmic Trading?

Algorithmic trading, often referred to as “algo-trading,” is the use of pre-programmed rules and algorithms to execute trades automatically. By leveraging the speed and efficiency of computers, algo-trading removes the emotional biases that can often hinder manual trading decisions. This approach can potentially lead to more consistent and profitable trading strategies, especially in the volatile cryptocurrency market.

You see, these algorithmic trading systems analyze market data, identify trading opportunities, and execute trades without any human intervention. They can react to market conditions instantaneously, taking advantage of fleeting market inefficiencies that may be missed by even the most experienced manual traders. Additionally, these algo-trading strategies can be backtested and optimized over time, allowing you to continuously refine and improve your trading performance.

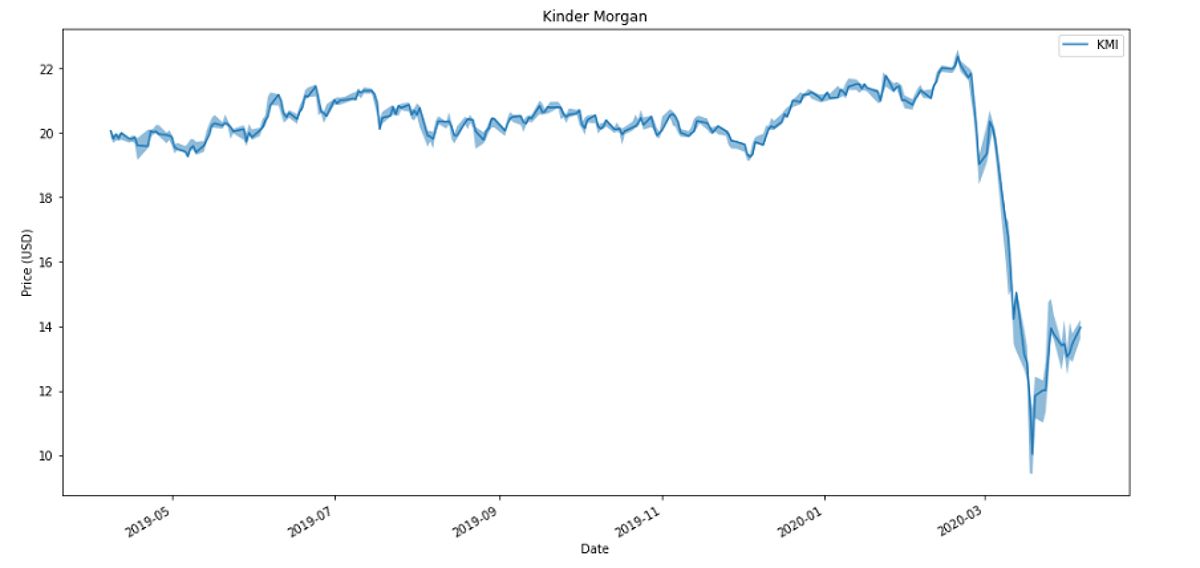

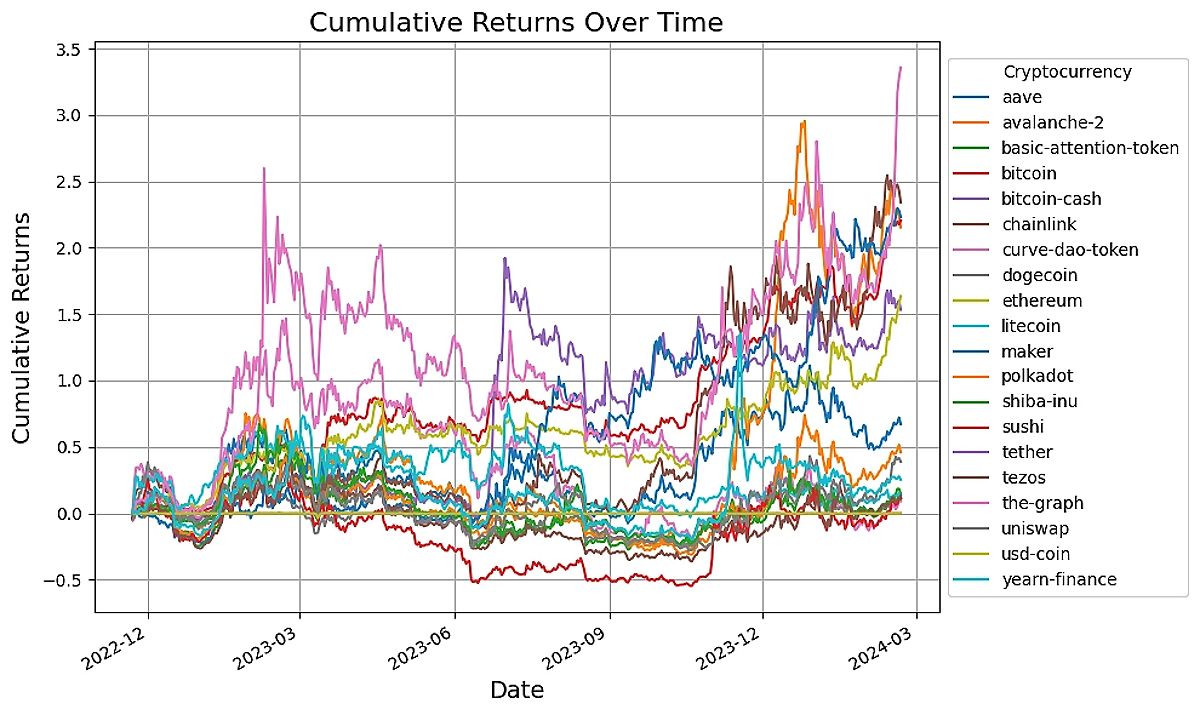

Algorithmic Trading Chart

Algorithmic Trading Chart

Why Python for Crypto Trading?

As I delved into the world of automated crypto trading, I quickly discovered that Python has emerged as the language of choice for many traders and developers. Its versatility, extensive libraries, and ease of use make it an excellent choice for building trading bots.

Python’s powerful libraries like pandas, NumPy, and Matplotlib provide the tools I needed to fetch and analyze market data, develop my trading strategies, and visualize my portfolio’s performance. These features have been instrumental in automating and optimizing my crypto trading workflows.

Moreover, Python’s readability and simplicity make it accessible to both experienced programmers and newcomers to the world of algorithmic trading. And with the vast Python ecosystem offering a wealth of community-driven resources, tutorials, and pre-built solutions, I was able to jumpstart my crypto trading bot development and hit the ground running.

Python for Crypto Trading

Python for Crypto Trading

Setting Up Your Trading Environment

Choosing a Crypto Exchange

When building my crypto trading bot, one of the first and most important decisions I had to make was selecting the right crypto exchange to work with. I knew that the exchange I chose would have a significant impact on my trading bot’s performance and the opportunities it could access.

After thorough research and comparison, I settled on Binance as my exchange of choice. Binance’s robust API, security, fee structure, and the vast range of trading pairs it supports make it an attractive option for automated crypto trading. I also explored other popular exchanges like Coinbase Pro and Kraken, but ultimately, Binance’s feature set and liquidity best aligned with my trading strategy and risk profile.

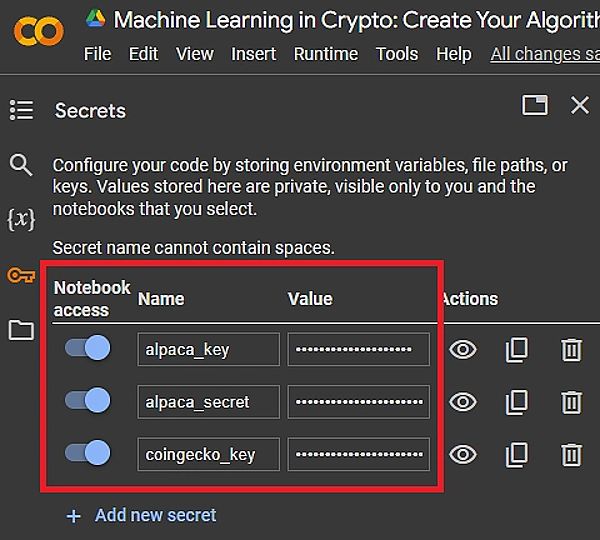

Obtaining API Keys

To connect my trading bot to the Binance exchange, I needed to obtain a set of API keys. These keys provide secure access to the exchange’s services, allowing my bot to retrieve real-time market data and execute trades programmatically.

I followed Binance’s comprehensive documentation to generate my API keys, ensuring that I treated them with the utmost care. These API keys are the gateway to my trading accounts, so I stored them in a secure password manager and never shared them with anyone.

Installing Python Libraries

With my exchange selection and API keys in place, the next step was to install the necessary Python libraries to build my crypto trading bot. I started by installing ccxt, a unified interface to dozens of cryptocurrency exchanges, as well as the python-binance library, which provides a user-friendly API wrapper for interacting with the Binance platform.

Additionally, I added the requests library to my setup, which would allow me to make the HTTP requests needed to fetch market data and execute trades. Familiarizing myself with the documentation and usage examples for these libraries has been crucial in establishing the foundation of my trading bot’s functionality.

Building Your First Crypto Trading Bot

Creating a Simple Trading Strategy

At the heart of any successful trading bot is a well-crafted trading strategy. While there are numerous advanced strategies to explore, such as trend following, mean reversion, and arbitrage, I decided to start with a more basic approach that I could easily implement and test.

My initial strategy focused on a simple moving average crossover. The premise is straightforward: When the short-term moving average crosses above the long-term moving average, my bot would generate a buy signal; conversely, when the short-term average crosses below the long-term average, it would trigger a sell signal. This strategy allows me to capitalize on emerging trends while maintaining a relatively simple set of rules.

As I gain more experience and confidence, I plan to explore more complex strategies that incorporate additional technical indicators, market sentiment analysis, or even machine learning techniques. But for now, starting with a basic strategy has allowed me to focus on the fundamentals of building and testing my crypto trading bot.

Simple Moving Average Crossover

Simple Moving Average Crossover

Connecting to the Exchange API

Using the python-binance library, I was able to establish a seamless connection between my trading bot and the Binance exchange. This allowed me to fetch real-time market data, including current prices, order book information, and historical trade data — all of which are essential for powering my trading algorithms.

The Binance API documentation has been an invaluable resource, as it has helped me navigate the various methods and data structures I need to interact with the exchange programmatically. By familiarizing myself with the API’s rate limits and usage restrictions, I’ve been able to ensure that my trading bot operates within the exchange’s guidelines, avoiding any potential issues.

Executing Trades

With my trading strategy in place and my connection to the Binance API established, the next step was to start placing orders through my trading bot. The python-binance library provides a range of order execution methods, including market orders, limit orders, and stop-loss orders, allowing me to manage my trades with precision and control.

As I’ve implemented my trading bot, I’ve been mindful of incorporating robust risk management techniques. This includes setting appropriate stop-loss levels and position sizing based on my risk tolerance. These measures help protect my trading account from significant drawdowns and ensure the long-term sustainability of my bot’s performance.

Executing Trades

Executing Trades

Backtesting Your Trading Bot

The Importance of Backtesting

Before deploying my crypto trading bot in live markets, I knew that thorough backtesting was a crucial step. By simulating my bot’s trades using historical data, I could identify potential flaws in my strategy, optimize key parameters, and gain confidence in my bot’s ability to generate consistent profits.

Backtesting has allowed me to explore how my trading bot would have performed under various market conditions, helping me assess its robustness and identify areas for improvement. This process has been invaluable in uncovering hidden biases, inefficiencies, or edge cases that may not have been apparent during the initial development phase.

Using Backtesting Libraries

To streamline my backtesting process, I turned to Python’s robust backtesting libraries, such as backtrader and zipline. These tools have provided me with a comprehensive framework for loading historical data, executing trades, and analyzing the results — all within the comfort of my Python environment.

The advanced features offered by these backtesting libraries, including portfolio optimization, risk management, and visualization tools, have been instrumental in helping me gain deeper insights into my trading strategy’s behavior and performance. By leveraging these powerful tools, I’ve been able to refine my bot’s parameters and ensure that it’s well-equipped to navigate the volatile crypto markets.

Analyzing Backtest Results

As I’ve reviewed the results of my backtesting, I’ve focused on key metrics such as total return, annualized return, maximum drawdown, and Sharpe ratio. These metrics have provided me with a clear understanding of the risk-reward profile of my trading strategy, and have informed my decisions on how to further optimize and refine my bot’s performance.

Moreover, I’ve evaluated the consistency of my bot’s performance, its sensitivity to market conditions, and its ability to adapt to changing market dynamics. This comprehensive analysis has been invaluable in helping me identify areas for improvement and ensuring that my trading bot is well-positioned for long-term success.

Deploying Your Trading Bot

Choosing a Deployment Method

With my crypto trading bot now developed and thoroughly tested, the next step was to decide on the best deployment method. I considered several options, including running the bot locally, deploying it on a cloud server, or utilizing a dedicated trading platform.

After careful consideration, I opted to deploy my bot on a cloud-based server. While running it locally would have been the simplest solution, I wanted to ensure that my trading activities could continue uninterrupted, even in the event of a network or hardware issue. By hosting my bot on a cloud server, I’ve been able to benefit from better uptime, scalability, and the peace of mind that comes with a managed infrastructure.

Ensuring Security

As I’ve deployed my crypto trading bot, the importance of security has been at the forefront of my mind. Unauthorized access or data breaches could lead to catastrophic financial losses, so I’ve implemented a range of best practices to protect my bot and my trading assets.

I’ve used strong passwords, enabled two-factor authentication, and stored my API keys in a secure password manager. Additionally, I’ve set up monitoring and alerting systems to detect and respond to any suspicious activity or potential security threats. Regularly reviewing my bot’s code and staying up-to-date with the latest security updates has been a crucial part of my deployment strategy.

Monitoring and Maintenance

Deploying my crypto trading bot was just the beginning. Ongoing monitoring and maintenance have been essential to ensuring its long-term success. I’ve set up robust monitoring systems and alerts to track key performance metrics, identify potential issues, and make timely interventions to maintain my bot’s profitability.

Maintaining my trading bot is an ongoing process that requires continuous review and refinement of my trading strategy, as well as close attention to market conditions. As the crypto markets evolve, I’m prepared to adapt my bot’s parameters to ensure it remains responsive and effective in the face of changing market dynamics.

FAQ

What are the risks associated with automated crypto trading?

Automated crypto trading, while potentially lucrative, does come with its fair share of risks. Market volatility, exchange outages, and the potential for bugs in your trading bot are all factors that need to be carefully considered. It’s essential to implement robust risk management strategies, continuously monitor your bot’s performance, and be prepared to intervene if necessary to mitigate these risks.

How do I choose the right trading strategy for my bot?

Selecting the right trading strategy for your crypto trading bot requires careful consideration of factors such as your risk tolerance, trading style, and market conditions. Start with a basic strategy that you understand and can effectively backtest, then gradually build up complexity as you gain more experience and confidence. Continuously evaluate your bot’s performance and be willing to adapt your strategy as the market landscape changes.

How can I learn more about advanced crypto trading strategies?

If you’re interested in exploring more advanced crypto trading strategies, there are numerous resources available to help you expand your knowledge. Online courses, trading communities, and specialized books on algorithmic trading and technical analysis can all provide valuable insights and guidance. Additionally, staying up-to-date with the latest industry trends and developments can help you identify new opportunities and refine your trading approach.

Conclusion

In this guide, I’ve shared my personal journey of building a crypto trading bot using Python. By understanding the fundamentals of algorithmic trading, setting up a robust trading environment, and implementing a tailored trading strategy, I’ve been able to unlock the power of automated crypto trading.

The process of creating my own trading bot has been both challenging and rewarding. It’s allowed me to take control of my crypto trading activities, potentially improve my trading performance, and explore the exciting world of algorithmic trading. As I continue to refine and optimize my bot, I’m excited to see the long-term benefits it can bring to my crypto portfolio.

If you’re an aspiring crypto trader looking to automate your trading activities, I encourage you to embrace the opportunity and start building your own trading bot. With the right approach, the right tools, and the right mindset, you too can harness the power of Python to revolutionize your crypto trading journey. So, let’s dive in and unlock the full potential of automated crypto trading together!