Navigating the volatile world of cryptocurrency trading can be challenging, even for experienced investors. The Average True Range (ATR) is a powerful tool that can help traders understand and manage market volatility. This technical indicator provides a clear measure of average price fluctuations in a cryptocurrency over a specific time period. Understanding and applying ATR in crypto trading can help traders navigate the wild swings that are characteristic of the crypto market.

Unraveling the Mystery of ATR

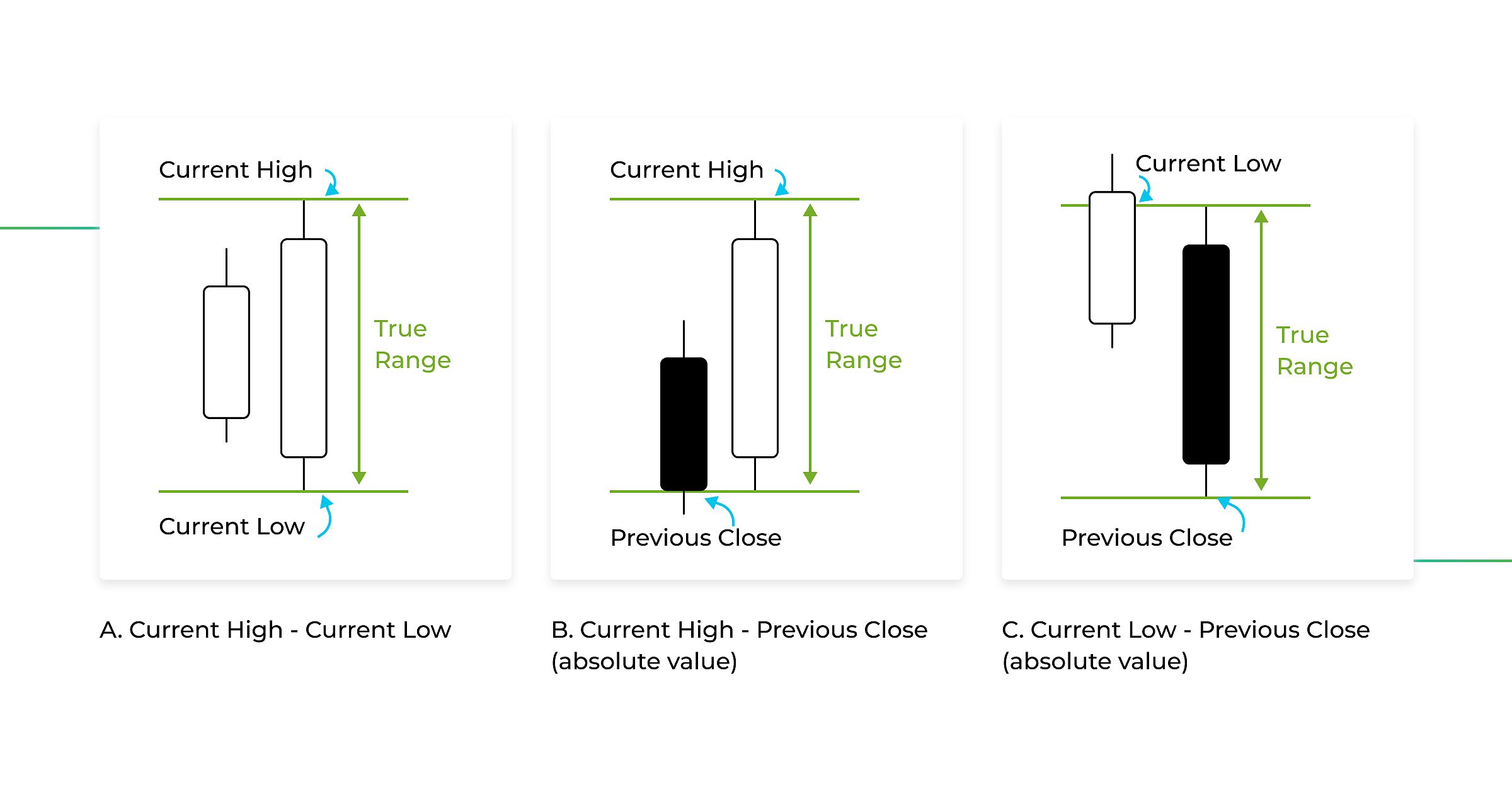

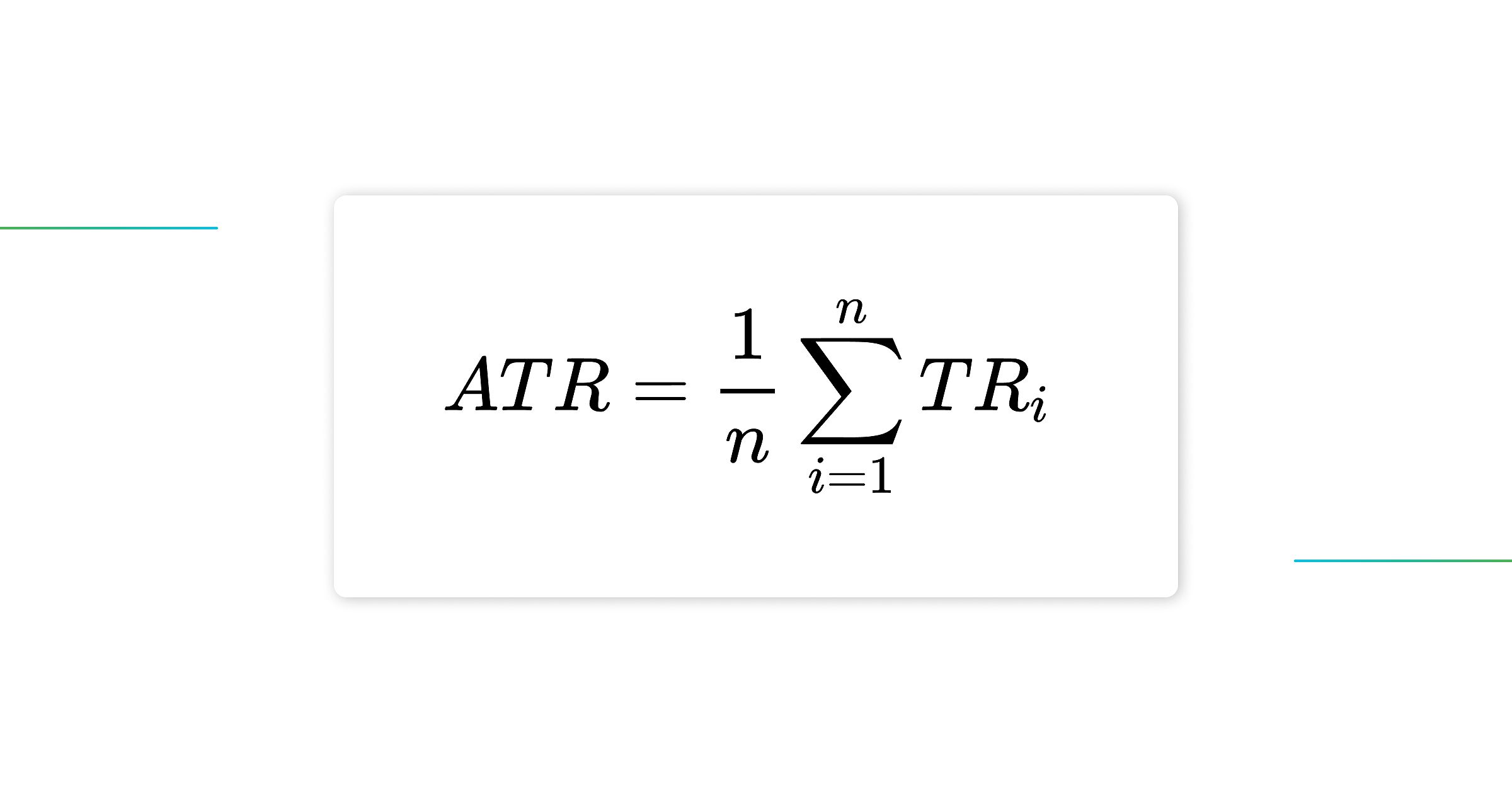

ATR calculation

ATR calculation

At its core, ATR is a deceptively simple yet remarkably insightful metric that was developed by technical analyst J. Welles Wilder Jr. in the 1970s. It measures the average range of price movements over a given timeframe, typically 14 days, providing traders with a tangible gauge of market volatility.

The mechanics behind ATR’s calculation are straightforward: it takes the greatest of three values — the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close — and then averages them out over the specified period. The resulting ATR value offers a clear and quantifiable representation of the degree of price fluctuation in a particular cryptocurrency.

But the true power of ATR lies in its ability to inform crucial trading decisions. By understanding the relationship between ATR values and market volatility, traders can make more informed choices when it comes to setting stop-loss orders, adjusting position sizes, and identifying potential trend reversals. This knowledge can be the difference between weathering the storm or getting swept away in the whirlwind of crypto market movements.

Understanding ATR in Crypto Trading

How to Read ATR Indicator?

How to Read ATR Indicator?

As with any technical indicator, the key to unlocking the full potential of ATR lies in the ability to correctly interpret its fluctuations. In the realm of cryptocurrency trading, this skill is particularly crucial, given the inherent volatility that characterizes the market.

When the ATR value is high, it signals a period of increased market volatility, where prices are likely to experience significant swings in either direction. In such scenarios, traders would be wise to consider employing wider stop-loss orders and potentially reducing their position sizes to manage the heightened risk. Conversely, when the ATR value is low, it suggests a more calm and consolidating market, where prices are less prone to dramatic fluctuations. This may present an opportunity for traders to tighten their stop-loss orders and potentially increase their position sizes to capitalize on the more stable market conditions.

By closely monitoring the ebb and flow of ATR values, traders can gain valuable insights into the current state of the crypto market and make more informed decisions about their trading strategies. It’s a powerful tool that can help navigate the treacherous waters of cryptocurrency trading, providing a crucial anchor in the face of the relentless waves of volatility.

Unleashing the Potential of ATR in Your Trading Arsenal

Leveraging ATR for Stop-Loss Placement

Leveraging ATR for Stop-Loss Placement

Now that we’ve explored the fundamentals of ATR and its role in interpreting market volatility, let’s dive into the practical applications of this versatile indicator in the world of crypto trading.

Leveraging ATR for Stop-Loss Placement

One of the primary uses of ATR is in the strategic placement of stop-loss orders. By aligning your stop-loss levels with the current ATR value, you can ensure that your positions are protected against unexpected price movements without being prematurely stopped out due to random fluctuations. For instance, in a highly volatile market with a high ATR, you might consider setting your stop-loss order 2-3 ATR points away from your entry price, whereas in a calmer market with a low ATR, you could tighten your stop-loss to just 1 ATR point away.

Setting ATR indicator in GoodCrypto app

Setting ATR indicator in GoodCrypto app

Optimizing Position Sizing with ATR

Effective risk management is a cornerstone of successful trading, and ATR can be a powerful tool in this regard. By using ATR to determine your position size, you can tailor your exposure to the current market conditions, reducing risk in volatile periods and capitalizing on more stable markets. This can be as simple as adjusting your position size by a fixed percentage for every 1 ATR point above or below a certain threshold.

Identifying Trend Strength with ATR

In addition to its applications in risk management, ATR can also shed light on the strength and momentum of prevailing trends in the crypto market. A rising ATR often signals that a trend is gaining strength and may be poised to continue, while a falling ATR can suggest that a trend is losing momentum and may be due for a reversal. By combining ATR with other technical indicators like moving averages and the Relative Strength Index (RSI), traders can gain a more comprehensive understanding of the market dynamics and time their entries and exits with greater precision.

Mastering the Crypto Wilderness with ATR

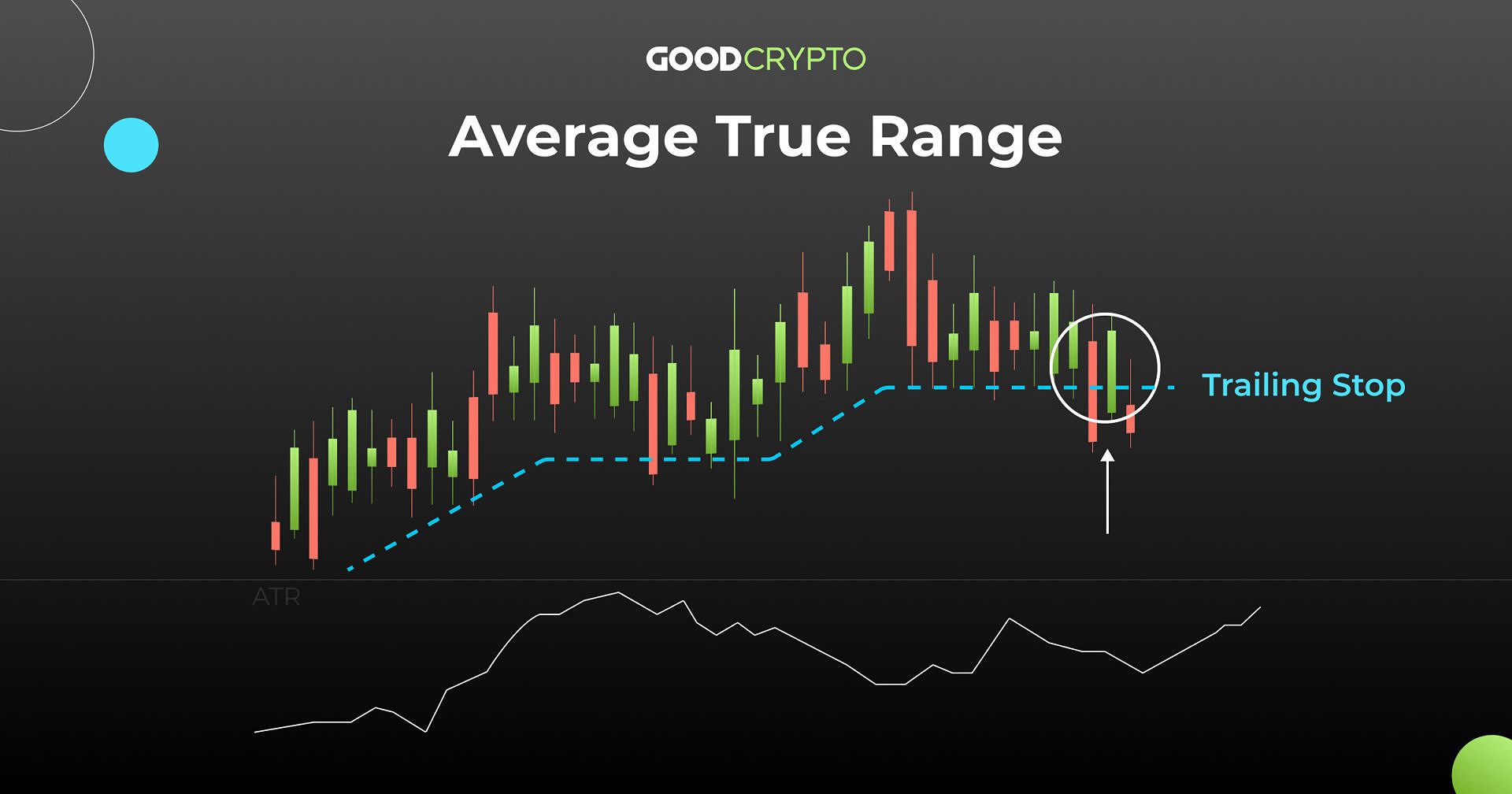

ATR chart

ATR chart

As the crypto landscape continues to evolve, with its dizzying price swings and unpredictable currents, the need for a reliable tool to navigate the volatility has never been more pressing. The Average True Range (ATR) stands as a beacon of clarity, offering traders a quantifiable measure of market volatility that can inform crucial decisions and help them weather the storm.

By understanding the nuances of ATR and how to interpret its fluctuations, traders — especially those new to the crypto game — can gain a significant advantage in the ever-changing market. Whether it’s setting stop-loss orders, optimizing position sizes, or identifying trend strength, ATR provides a powerful framework for making informed and strategic trading decisions.

As you embark on your journey through the crypto wilderness, remember that mastering the art of ATR can be a game-changer. By incorporating this versatile indicator into your trading arsenal, you’ll be better equipped to navigate the volatile currents, protect your profits, and position yourself for long-term success in the dynamic world of cryptocurrency trading.

FAQ

Q: How do I choose the right ATR period?

A: The most common ATR period is 14 days, but as with any technical indicator, experimenting with different timeframes can be beneficial. Depending on your trading style and the specific cryptocurrencies you’re monitoring, you may find that a shorter or longer ATR period better suits your needs. It’s a matter of trial and error to determine the optimal setting for your trading strategy.

Q: Can ATR predict future price movements?

A: No, ATR is a volatility indicator, not a directional one. It doesn’t provide a forecast of whether the price will go up or down, but rather gives you a sense of how much the price is likely to fluctuate. While ATR can be a valuable tool in identifying potential trend changes and momentum shifts, it’s important to remember that it’s just one piece of the puzzle when it comes to making informed trading decisions.

Q: Is ATR suitable for all cryptocurrencies?

A: ATR can be applied to any cryptocurrency, but its usefulness may vary depending on the inherent volatility of the asset. Highly volatile cryptocurrencies, such as Bitcoin or Ethereum, are particularly well-suited for ATR analysis, as understanding price fluctuations is crucial for managing risk and capitalizing on market movements. However, ATR can still provide valuable insights for less volatile digital assets, as it can help traders identify periods of consolidation and potential breakouts.

Conclusion: Navigating the Crypto Wilderness with ATR

In the ever-changing and often tumultuous world of cryptocurrency trading, the ability to navigate the volatile currents is essential for success. The Average True Range (ATR) stands as a powerful tool that can help traders, both experienced and novice, weather the storm and make more informed decisions in the face of market uncertainty.

By mastering the art of interpreting ATR and incorporating it into their trading strategies, crypto investors can gain a significant edge in the constantly evolving digital asset landscape. From setting more effective stop-loss orders and optimizing position sizes to identifying trend strength and potential reversals, ATR offers a comprehensive framework for managing risk and capitalizing on market opportunities.

As the crypto market continues to evolve and present new challenges, the savvy trader who embraces the insights provided by ATR will be better equipped to navigate the treacherous wilderness and emerge victorious. So, whether you’re a seasoned crypto veteran or a newcomer to the game, take the time to explore the power of ATR and unlock the key to unlocking your full potential as a cryptocurrency trader.