As someone who has been fascinated by the world of cryptocurrency for years, I’ve always been intrigued by the prospect of automated trading. The idea of a money printing machine that could generate profits without constant monitoring was endlessly captivating. However, as I delved deeper into the crypto landscape, I quickly realized that it was rife with scams and dubious claims, leaving me wondering, Are there any legit crypto trading bots worth considering?

In this article, I’ll share my personal journey of navigating the world of crypto trading bots, exploring the different types, evaluating reputable platforms, and providing practical tips to help you make informed decisions about incorporating automated trading strategies into your cryptocurrency portfolio. Whether you’re a beginner or an experienced trader, I hope to equip you with the knowledge and tools to unlock the potential of legitimate crypto trading bots.

Understanding the Basics of Crypto Trading Bots

Crypto trading bots are essentially software programs designed to automate the buying and selling of cryptocurrencies based on pre-defined algorithms and strategies. These bots can execute trades 24/7, take advantage of market opportunities, and potentially reduce the impact of emotional biases that often plague human traders.

As I delved into the different types of crypto trading bots, I discovered three main categories that piqued my interest:

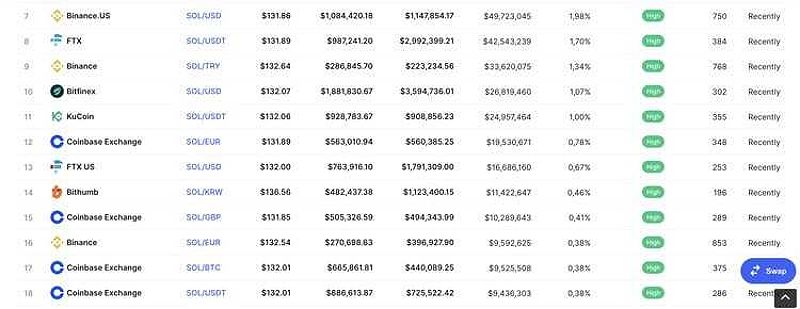

- Arbitrage Bots: These bots capitalize on price discrepancies between exchanges, buying on one platform and selling on another to capture the difference. I was particularly intrigued by the potential of these bots to generate consistently profitable trades.

Arbitrage Bots

Arbitrage Bots

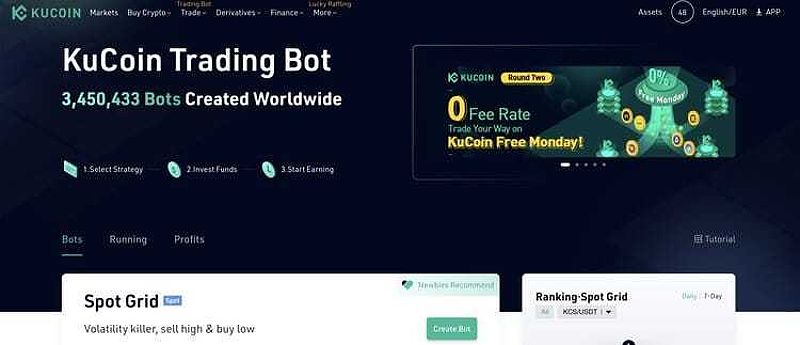

- Grid Bots: Grid bots establish a trading range and automatically place buy and sell orders within that range, aiming to profit from the cryptocurrency’s price fluctuations. I found this strategy appealing as it could potentially generate returns even in sideways or volatile markets.

Grid Bots

Grid Bots

- Dollar-Cost Averaging (DCA) Bots: DCA bots automate the process of investing a fixed amount at regular intervals, regardless of the asset’s price, to smooth out market volatility. This strategy resonated with me as a way to build a diversified cryptocurrency portfolio while mitigating the impact of market swings.

Dollar-Cost Averaging (DCA) Bots

Dollar-Cost Averaging (DCA) Bots

While the promise of these automated trading tools was undeniable, I also recognized the inherent risks involved. Algorithms can be flawed, exchanges can be hacked, and bots can make irrational decisions if not properly configured. As I embarked on my journey, I made sure to approach the use of these tools with a balanced perspective, understanding both the potential benefits and the associated risks.

Choosing the Right Crypto Trading Bot Platform

Selecting a reputable and trustworthy crypto trading bot platform was crucial to ensuring the safety and effectiveness of my automated trading strategies. As I evaluated potential platforms, I focused on several key factors:

Security

Robust security measures, such as two-factor authentication, API key restrictions, and the ability to limit the bot’s access to my exchange account, were non-negotiable. I wanted to ensure that my funds remained secure, with no risk of unauthorized withdrawals.

Features

I explored the platform’s offerings, including backtesting capabilities, paper trading options, customizable strategies, and support for multiple exchanges. The more advanced the features, the better equipped I’d be to fine-tune my trading approach and adapt to changing market conditions.

User Interface

An intuitive and user-friendly interface was essential, especially as a newcomer to the world of automated trading. I wanted a platform that would make the learning curve more manageable and help me monitor my bots’ performance effectively.

Pricing

I carefully evaluated the platform’s pricing structure, considering factors like free trials, tiered subscription plans, and any potential hidden fees. Ensuring the costs aligned with my trading goals and budget was a top priority.

Customer Support

Reliable and responsive customer support could be invaluable when navigating any issues or seeking guidance. I looked for platforms that offered multiple support channels, such as email, live chat, or a comprehensive knowledge base.

After thoroughly researching and evaluating various options, I ultimately settled on a few top-tier crypto trading bot platforms that I believe offer the best combination of features, security, and user-friendliness.

Top Crypto Trading Bot Platforms: A Detailed Comparison

Pionex: Best for Beginners and Advanced Users

Pionex stood out to me as an excellent choice for both novice and experienced traders. Its comprehensive suite of 16 free trading bots, including grid trading, arbitrage, and dollar-cost averaging strategies, made it an accessible and appealing option. The platform’s seamless integration with major exchanges like Binance and Huobi Global, coupled with its low trading fees and user-friendly interface, made it an attractive starting point for my automated trading journey.

Pionex

Pionex

Cryptohopper: Best for Copy Trading and Advanced Strategies

For those seeking a more comprehensive trading experience, Cryptohopper caught my attention. Its diverse selection of bots, including arbitrage, AI-powered, and mirror trading capabilities, catered to a wide range of traders. The platform’s integration with leading exchanges like Binance, Coinbase Pro, and Kraken, combined with advanced features like backtesting and customizable strategies, made it a compelling choice for traders looking to take their automated trading to the next level.

Cryptohopper

Cryptohopper

Coinrule: Best for Customizable Strategies and Pre-Built Templates

Coinrule’s extensive library of over 200 pre-built trading strategies, as well as the ability to create and backtest custom rules, empowered me to take full control of my automated trading. The platform’s security and user-friendly interface, coupled with its support for major exchanges like Binance, Kraken, and Coinbase Pro, made it an appealing option for traders seeking a balance of customization and ease of use.

Coinrule

Coinrule

Bitsgap: Best for Arbitrage and Advanced Order Functionality

As I delved deeper into the world of crypto trading bots, Bitsgap caught my eye with its more sophisticated set of tools. The platform’s grid bots, futures bots, and advanced order functionality, including trailing stop-loss and take-profit, catered to traders seeking a more advanced trading experience. Bitsgap’s integration across a wide range of exchanges, including Binance, Kraken, and Bitfinex, positioned it as a robust platform for those looking to unlock the full potential of automated trading.

Bitsgap

Bitsgap

Tips for Using Crypto Trading Bots Effectively

Throughout my journey with crypto trading bots, I’ve learned several valuable lessons that I believe can benefit both novice and seasoned traders:

- Start Small and Gradually Increase Your Investment: I began with a small portion of my portfolio and gradually scaled up as I gained confidence and experience. This approach allowed me to mitigate the risks and better understand the nuances of automated trading.

- Backtest Your Strategies Thoroughly: Utilizing the platform’s backtesting capabilities was crucial in validating my trading strategies and ensuring they were profitable in historical market conditions. This step helped me avoid costly mistakes and build a solid foundation for my automated trading approach.

- Monitor Your Bots Regularly: Maintaining a close eye on my bots’ performance and being prepared to make adjustments as needed has been essential. Adapting my strategies to changing market dynamics has been a constant learning process.

- Diversify Your Portfolio and Manage Risk: I’ve found that over-reliance on a single bot or strategy can be risky. By diversifying my automated trading portfolio, I’ve been able to mitigate potential losses and achieve more consistent returns.

- Integrate with Crypto Tax Software: To simplify the process of reporting my earnings, I’ve found it beneficial to integrate my trading activities with a reliable crypto tax software. This step has helped me stay compliant and organized, allowing me to focus more on refining my trading strategies.

The Future of Crypto Trading Bots

As I look towards the future of crypto trading bots, I’m excited about the growing role of artificial intelligence and machine learning in this space. The potential for more sophisticated and personalized trading strategies, with bots that can adapt to market conditions and learn from their own experiences, holds tremendous promise.

Staying informed about the latest developments in the crypto trading bot landscape will be crucial for traders like myself who are looking to stay ahead of the curve. By continuously exploring new advancements and fine-tuning our strategies, we can unlock the full potential of these automated tools and enhance our performance in the ever-dynamic world of cryptocurrencies.

FAQ

Q: Are crypto trading bots legal? A: Yes, crypto trading bots are generally legal, but it’s essential to ensure you are using reputable platforms and complying with all relevant regulations.

Q: Do crypto trading bots really work? A: The effectiveness of crypto trading bots depends on various factors, including the chosen strategy, market conditions, and platform reliability. There is no guarantee of profitability, but bots can help improve efficiency and reduce emotional biases.

Q: Are crypto trading bots safe? A: Security is a crucial concern when using crypto trading bots. Choose platforms with strong security measures, such as two-factor authentication and API key restrictions. Always limit the bot’s access to your exchange account and monitor its activity regularly.

Q: Are crypto trading bots suitable for beginners? A: Some platforms are more beginner-friendly than others. Look for platforms with user-friendly interfaces, educational resources, and pre-built strategies. However, it’s important to understand the risks involved and start with a small investment.

Are There Any Legit Crypto Trading Bots? Conclusion

In my journey through the dynamic world of cryptocurrencies, the promise of automated trading through legitimate crypto trading bots has been a constant source of fascination. By understanding the fundamentals, evaluating reputable platforms, and following best practices, I’ve been able to explore the potential of these tools and potentially unlock new revenue streams.

However, as with any investment strategy, there are inherent risks associated with crypto trading bots. I’ve approached this space with a balanced mindset, prioritizing security, and continuously monitoring and refining my trading approaches. With the right knowledge and a prudent approach, I believe traders like myself can navigate the world of crypto trading bots and potentially achieve our financial objectives.

If you’re intrigued by the prospect of incorporating automated trading strategies into your cryptocurrency portfolio, I encourage you to explore the platforms and strategies discussed in this article. By staying informed, taking a measured approach, and leveraging the power of legitimate crypto trading bots, you can embark on an exciting new chapter in your crypto investing journey.