As a cryptocurrency investor, I know firsthand the complexities of navigating the tax landscape. One question that often comes up is: are crypto trading fees tax deductible? In this comprehensive guide, I’ll share my insights and experiences to help you understand the tax implications of these fees and how to potentially reduce your tax burden.

Understanding Crypto Trading Fees

In the dynamic world of cryptocurrency, investors like ourselves encounter various types of fees. Exchange fees are charged by platforms like Coinbase, Binance, and Kraken when we buy, sell, or trade digital assets. These fees can range from 0.1% to 1% or more, depending on the exchange and the specific transaction.

Another type of fee we encounter is the network fee, also known as the gas fee. These are paid to the blockchain network, such as Ethereum, to facilitate transactions. On the Ethereum network, these fees are paid in GWEI, a denomination of Ether. Bitcoin and other blockchain networks also have their own network fee structures.

Finally, there are transfer fees incurred when we move our cryptocurrencies from one wallet to another, whether it’s an exchange wallet or a personal one.

As an investor, I’ve seen how these fees can significantly impact the profitability of our crypto portfolios. Let me give you an example: Imagine I purchased 1 BTC for $50,000 and paid a $500 exchange fee. My cost basis for the BTC would be $50,500. If I later sold the BTC for $60,000 and paid a $600 exchange fee, my capital gain would be $8,900 ($60,000 – $600 – $50,500). In this scenario, the trading fees have reduced my taxable gain by $1,100.

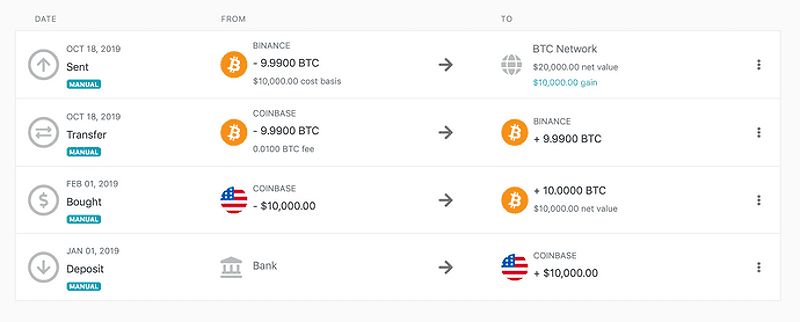

No realized gains example Example of no realized gains

No realized gains example Example of no realized gains

Are Crypto Trading Fees Tax Deductible?

The tax implications of crypto trading fees can be a bit complex, and I’ve had to navigate this myself. While businesses can often deduct trading fees as a necessary business expense, individual investors like you and I generally cannot claim them as itemized deductions on our tax returns.

Cost Basis Adjustment

However, there is a silver lining for individual investors like ourselves. Crypto trading fees can be used to adjust our cost basis, which can ultimately reduce our capital gains tax liability.

When I purchase cryptocurrency, the fees I pay to acquire it can be added to my cost basis. This means that my total investment in the asset includes the purchase price plus any fees I incurred. Similarly, when I sell or exchange cryptocurrency, the fees I pay as part of the transaction can be subtracted from my gross proceeds, effectively reducing my taxable capital gain.

Let me walk you through another example: I buy 1 ETH for $2,000 and pay a $20 exchange fee. My cost basis for the ETH would be $2,020 ($2,000 + $20). If I later sell the ETH for $3,000 and pay a $30 exchange fee, my capital gain would be $950 ($3,000 – $30 – $2,020).

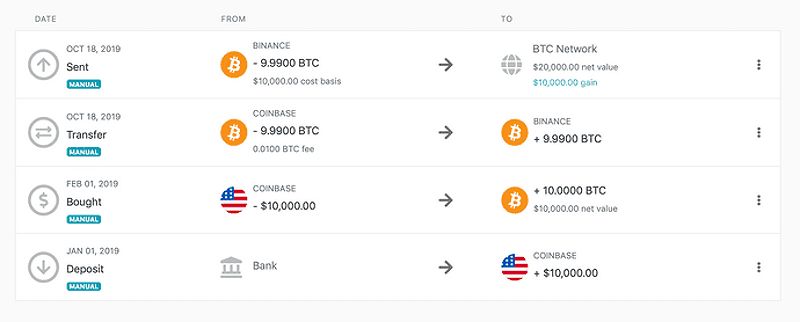

Koinly final gains calculation Example of Koinly final gains calculation

Koinly final gains calculation Example of Koinly final gains calculation

Transfer Fees and Tax Deductibility

The IRS hasn’t provided definitive guidance on the tax deductibility of cryptocurrency transfer fees. Some tax professionals believe that transfer fees, unlike trading fees, are not directly related to the acquisition or disposition of the asset and therefore cannot be used to adjust our cost basis or gross proceeds.

However, others argue that transfer fees should be treated similarly to trading fees, as they are necessary expenses incurred in the process of managing our crypto portfolios. The debate on this issue continues, and the treatment of transfer fees may vary depending on our specific circumstances and the advice of our tax professionals.

Reporting Crypto Trading Fees on Your Tax Return

Accurately reporting our crypto trading fees on our tax returns is crucial to minimizing our tax liability. When filing our taxes, we’ll need to track all of our crypto transactions, including the fees associated with each one.

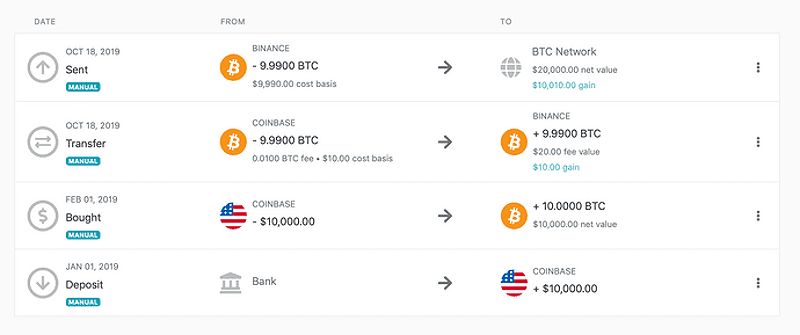

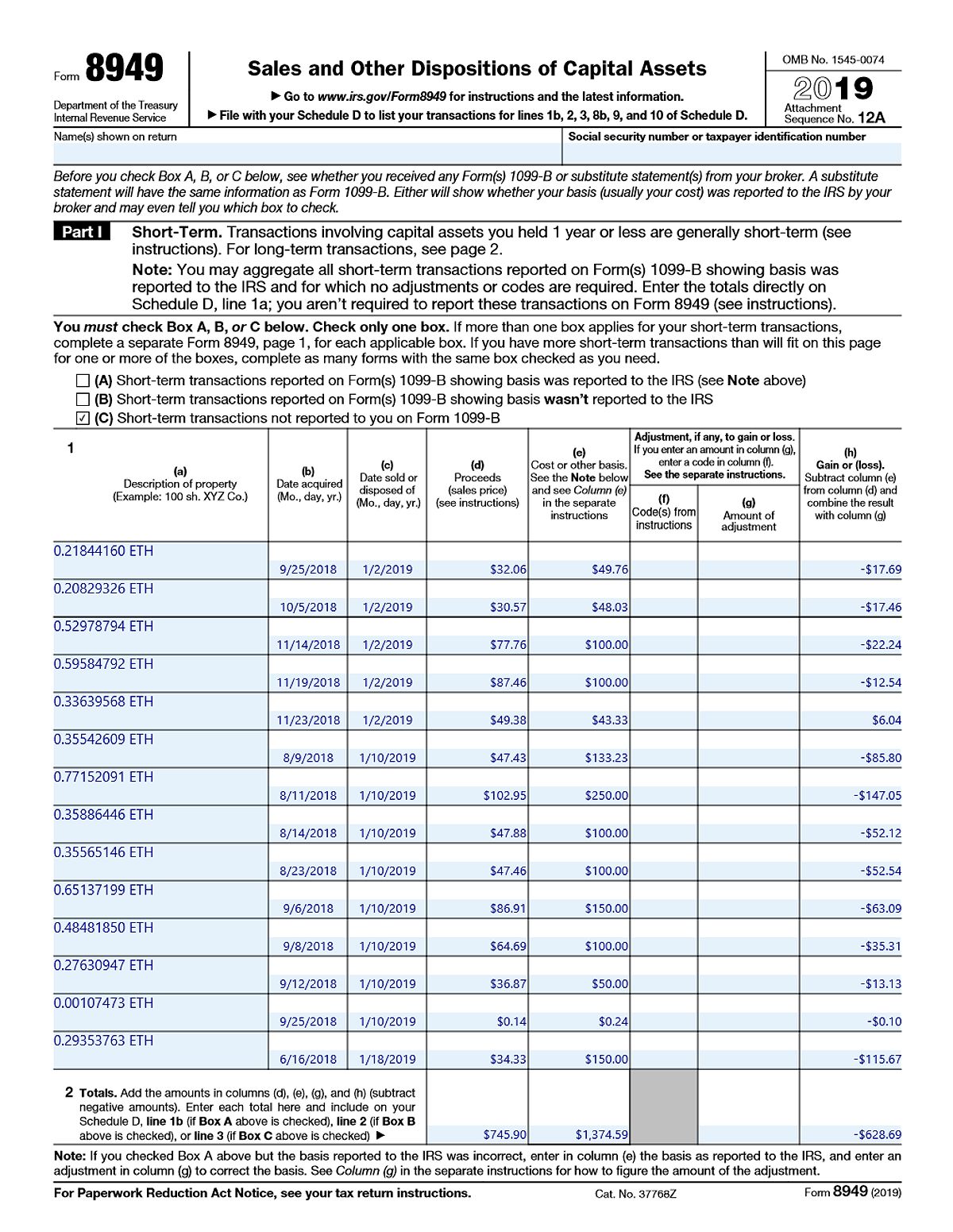

We’ll typically report our crypto capital gains and losses on Form 8949 and Schedule D of our tax return. On these forms, we can include the fees we paid as part of our cost basis and gross proceeds calculations.

IRS Form 8949 for Crypto Taxes Example of IRS Form 8949 for Crypto Taxes

IRS Form 8949 for Crypto Taxes Example of IRS Form 8949 for Crypto Taxes

Using Crypto Tax Software

As the cryptocurrency landscape continues to evolve, many investors like myself have turned to specialized crypto tax software to simplify the reporting process. Tools like CoinLedger, Koinly, and others can automatically import our transaction data from exchanges, calculate our capital gains and losses, and generate the necessary tax forms for us.

These platforms often have features that allow us to easily track and account for our crypto trading fees, ensuring that we don’t miss any deductions or adjustments that could potentially reduce our tax burden.

Staying Compliant with Crypto Taxes

Given the IRS’s increased focus on cryptocurrency taxation in recent years, it’s essential that we stay up-to-date with the latest tax regulations and ensure that we’re reporting all of our crypto-related income and gains correctly. Failing to do so can result in penalties and interest charges.

One important step I’ve taken is to keep detailed records of all my cryptocurrency transactions, including the date, the amount, the purpose (e.g., purchase, sale, transfer), and the associated fees. This information has been crucial when it comes to calculating my cost basis and capital gains or losses.

Additionally, I’m aware that the IRS may request information about my crypto holdings and transactions, either through a 1099-B form from my exchange or through a John Doe summons. It’s essential to be prepared to provide this information if requested.

Tax Planning for Crypto Investors

As I navigate the world of cryptocurrency taxes, I’ve explored various tax planning strategies that can help me maximize my investment returns. One such strategy is to hold my cryptocurrencies for more than a year, as long-term capital gains are typically taxed at a lower rate than short-term gains.

Another strategy I’ve considered is investing in cryptocurrencies through tax-advantaged accounts, such as a self-directed IRA or a Roth IRA. Transactions within these accounts are generally not taxable, although withdrawals may be subject to taxes depending on the account type.

I’ve also explored the potential for offsetting my crypto gains with losses from other investments, as well as taking advantage of tax-loss harvesting opportunities. By working with a tax professional who specializes in cryptocurrency, I’ve been able to develop a comprehensive tax strategy that aligns with my investment goals and risk tolerance.

The Evolving Landscape of Crypto Taxes

As the cryptocurrency industry continues to evolve, the tax landscape is also changing rapidly. In 2023, the IRS began requiring cryptocurrency exchanges to issue 1099-B forms to their customers, providing detailed information about their transactions. This new reporting requirement is expected to improve the accuracy of crypto tax reporting and make it easier for investors like myself to comply with our tax obligations.

Additionally, the IRS has been actively pursuing enforcement actions against taxpayers who have failed to report their crypto activities. This has led to increased scrutiny and the potential for penalties, making it crucial for investors to stay informed and proactive in their tax planning.

FAQ

Q: Do I need to report all my crypto transactions, even small ones? A: Yes, it’s important to report all crypto transactions, regardless of size, to avoid potential penalties from the IRS.

Q: What happens if I don’t report my crypto transactions? A: The IRS can impose penalties for failing to report crypto income or for filing inaccurate returns.

Q: What if I made a mistake on my crypto tax return? A: You can file an amended tax return (Form 1040-X) to correct any errors.

Q: Are there any other tax considerations for crypto investors? A: Yes, there are other tax considerations, such as the potential for wash sales and the tax implications of staking and mining.

Conclusion

As a cryptocurrency investor, I’ve learned that understanding the tax implications of trading fees is crucial to minimizing my tax burden. By staying informed about the latest crypto tax regulations and using the right tools, I’ve been able to navigate this complex landscape effectively.

While crypto trading fees may not be directly tax deductible, I’ve discovered that they can be used to adjust my cost basis and reduce my capital gains taxes. Additionally, exploring tax planning strategies and staying compliant with IRS reporting requirements have been key to maximizing my investment returns.

As the crypto industry continues to evolve, I’ll remain vigilant and adapt my tax planning strategies accordingly. By combining my knowledge, resources, and the guidance of tax professionals, I’m confident that I can continue to thrive in the ever-changing world of cryptocurrency investments.