The cryptocurrency market has become increasingly complex and dynamic, posing challenges for both seasoned traders and newcomers. However, the emergence of AI-powered trading signals has ushered in a new era of data-driven decision-making, empowering traders to capitalize on the hidden patterns and trends that often elude the human eye.

Unleashing The Potential Of Ai Crypto Trading Signals

AI-powered cryptocurrency trading These cutting-edge signals, generated by advanced algorithms and machine learning models, are designed to identify potential trading opportunities based on a comprehensive analysis of market data. From historical prices and trading volumes to technical indicators, these AI-driven insights can provide traders with a significant advantage in the fast-paced world of cryptocurrency.

AI-powered cryptocurrency trading These cutting-edge signals, generated by advanced algorithms and machine learning models, are designed to identify potential trading opportunities based on a comprehensive analysis of market data. From historical prices and trading volumes to technical indicators, these AI-driven insights can provide traders with a significant advantage in the fast-paced world of cryptocurrency.

The power of AI crypto trading signals lies in their ability to detect patterns and trends that may be invisible to the human observer. By leveraging the processing power of artificial intelligence, these signals can rapidly sift through vast amounts of data, uncovering insights that can inform more informed and objective trading decisions.

Diversifying Your Crypto Trading Approach

Diversifying crypto trading strategies The different types of AI crypto trading signals available cater to a variety of trading strategies, allowing traders to diversify their approach and potentially improve their overall performance. From trend-following signals that capitalize on market trends to breakout signals that detect when a cryptocurrency is about to break out of a range, there is a wealth of data-driven insights at the fingertips of savvy investors.

Diversifying crypto trading strategies The different types of AI crypto trading signals available cater to a variety of trading strategies, allowing traders to diversify their approach and potentially improve their overall performance. From trend-following signals that capitalize on market trends to breakout signals that detect when a cryptocurrency is about to break out of a range, there is a wealth of data-driven insights at the fingertips of savvy investors.

The advent of arbitrage signals has also introduced new avenues for traders to explore. These signals identify opportunities to profit from price discrepancies across multiple exchanges, unlocking the potential for enhanced returns in the volatile crypto market.

Navigating The Crypto Landscape With Confidence

By relying on the analysis of advanced algorithms rather than emotional biases, traders can make more informed and disciplined trades, potentially leading to improved overall performance. As traders embrace the power of AI crypto trading signals, they are finding that these data-driven insights can provide a much-needed layer of objectivity and consistency to their decision-making process.

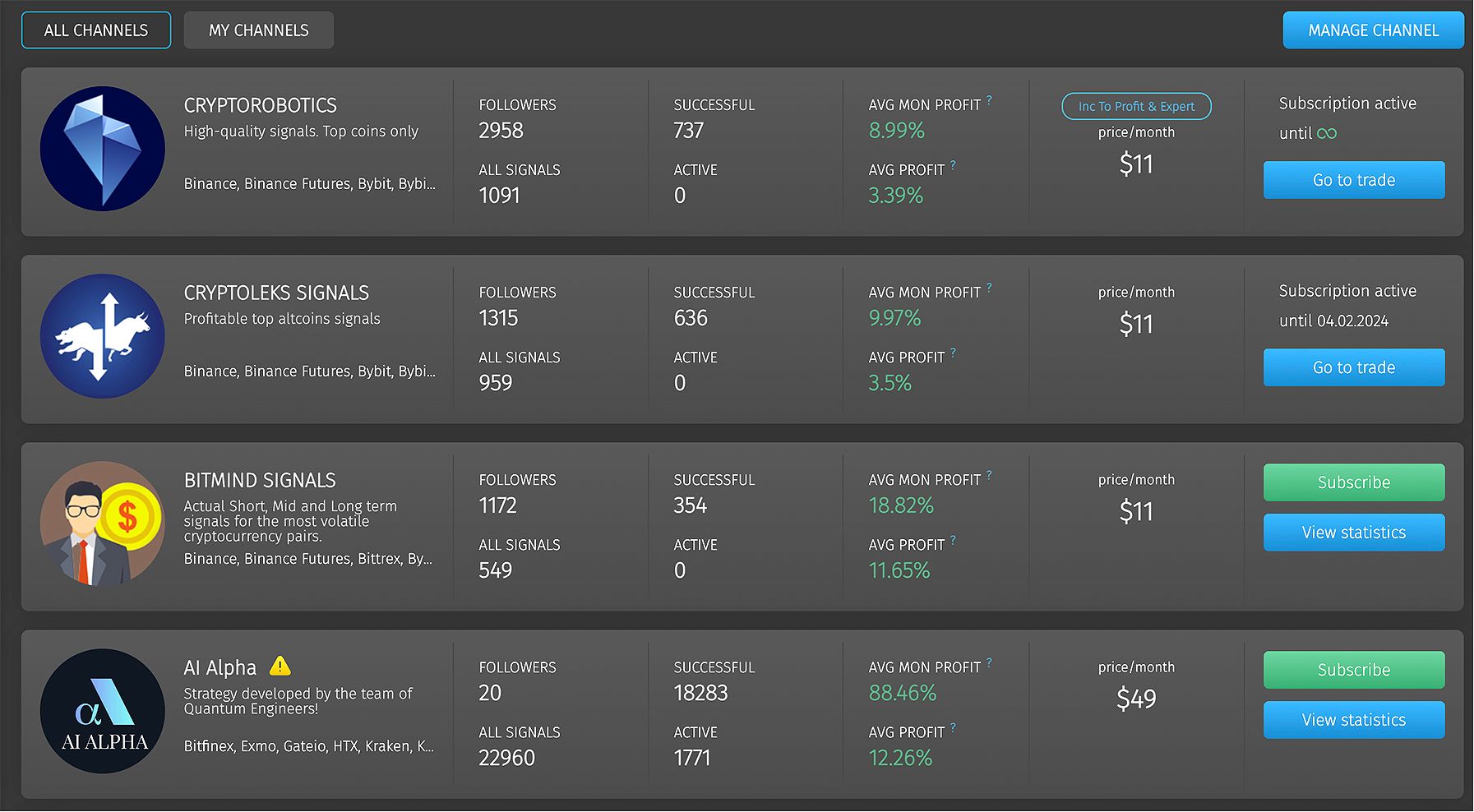

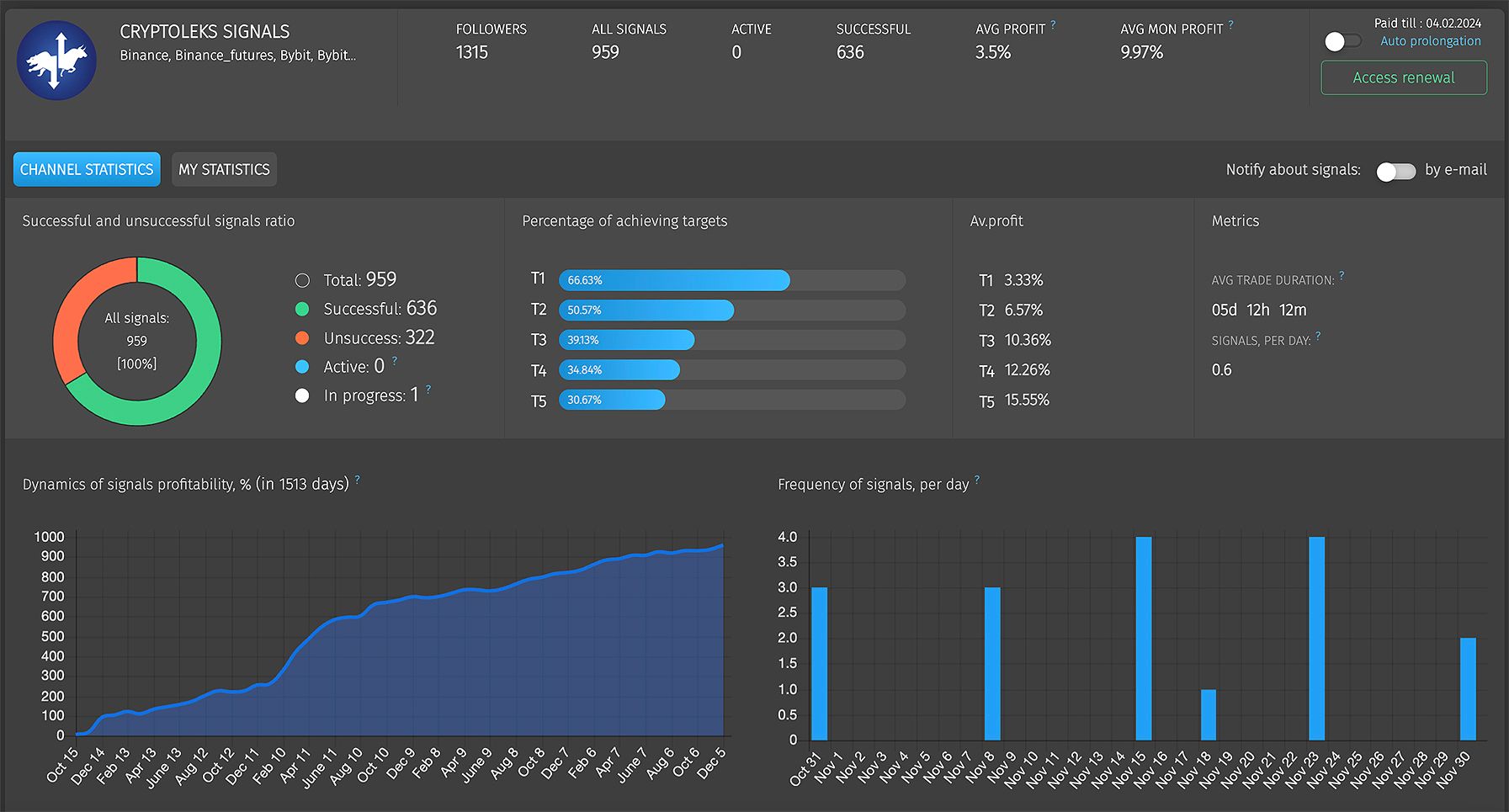

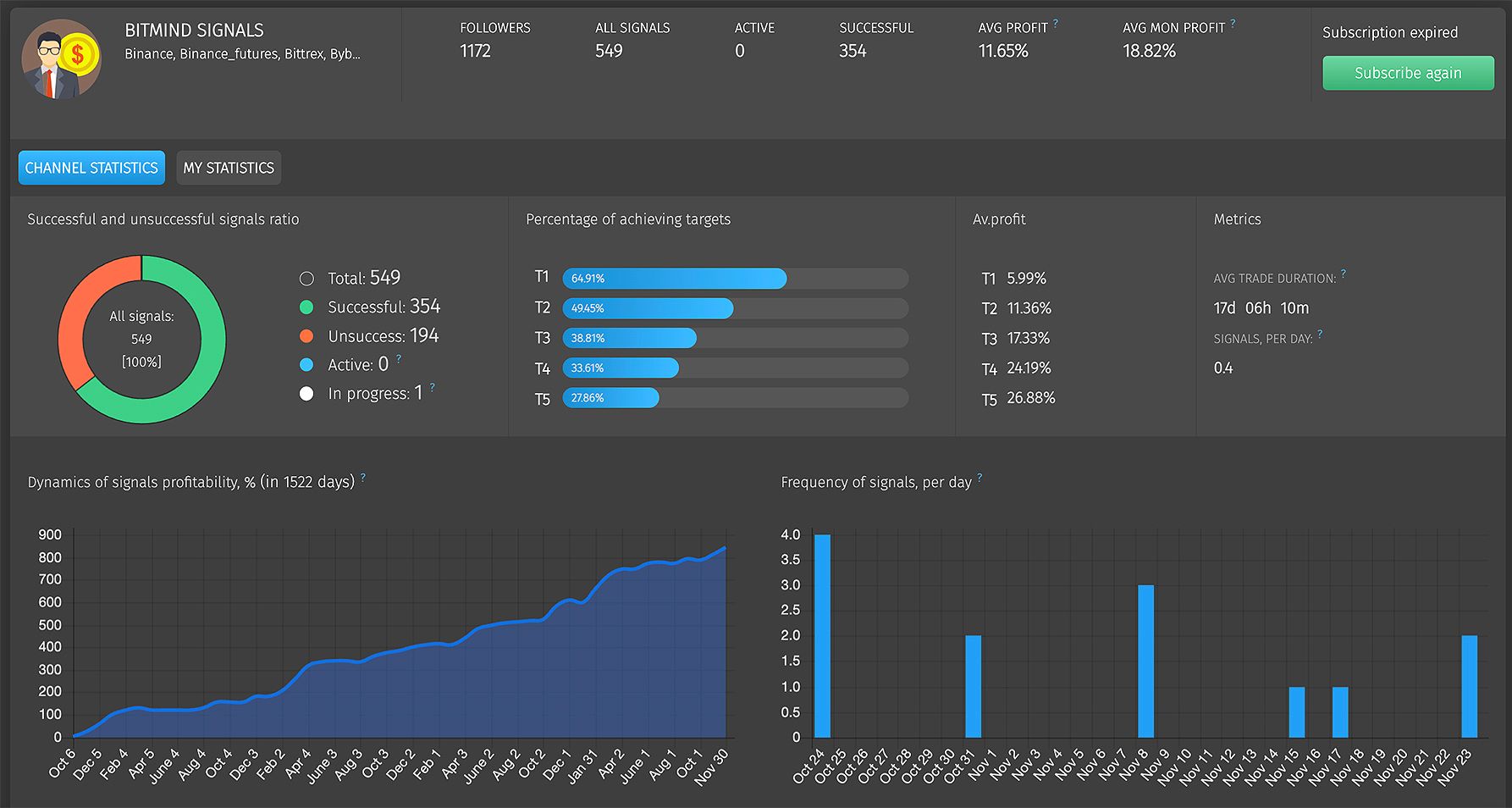

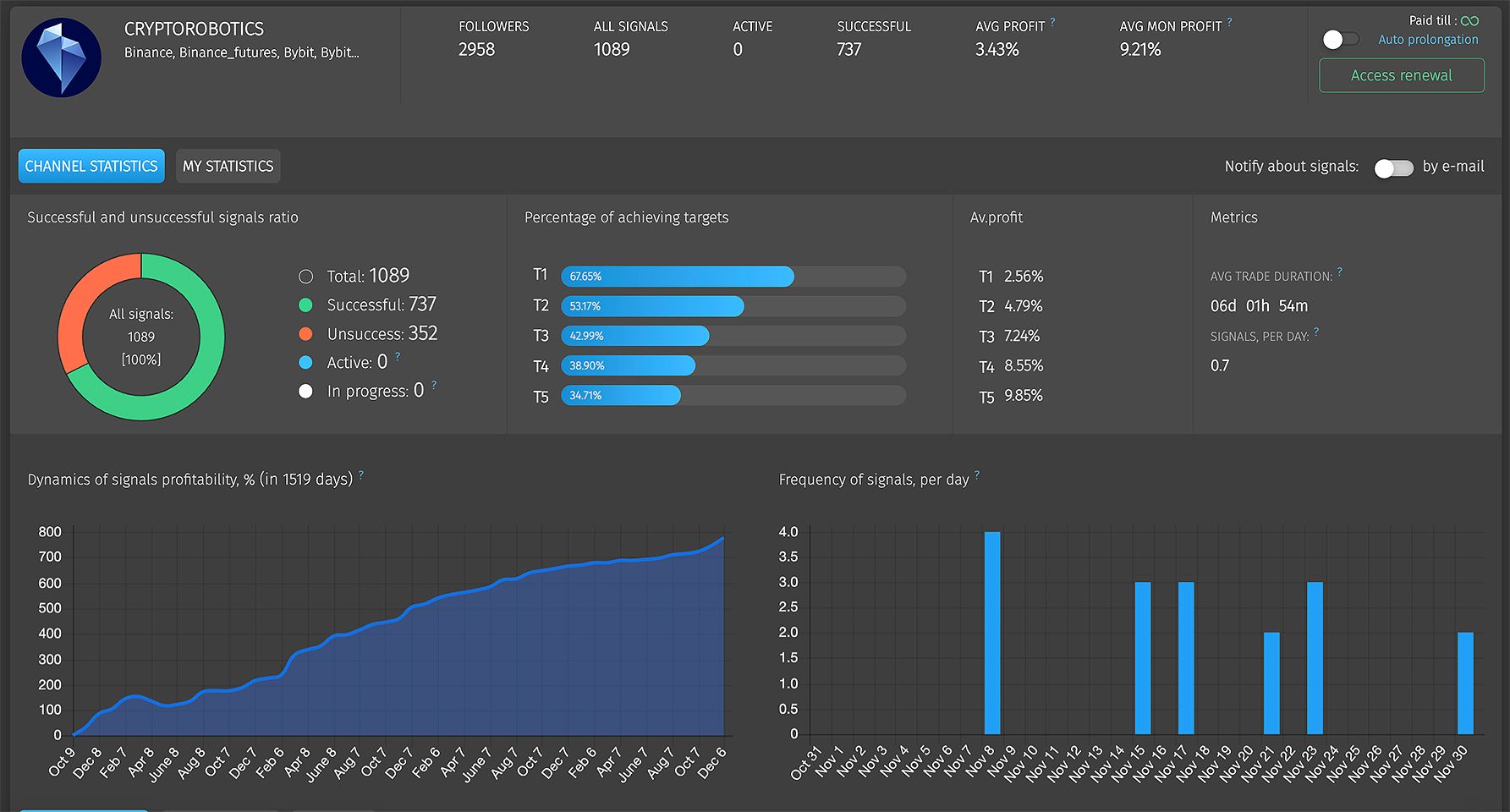

Choosing The Right Ai Crypto Trading Signal Provider

Selecting a reputable crypto signal provider When selecting a platform, it is crucial to do thorough research and due diligence. Look for providers with a proven track record of success, a strong reputation in the industry, and transparent reporting on their performance metrics. Some of the reputable AI crypto trading signal providers that have gained recognition in the market include Tickeron, Coinscreener, and ZIGDAO.

Selecting a reputable crypto signal provider When selecting a platform, it is crucial to do thorough research and due diligence. Look for providers with a proven track record of success, a strong reputation in the industry, and transparent reporting on their performance metrics. Some of the reputable AI crypto trading signal providers that have gained recognition in the market include Tickeron, Coinscreener, and ZIGDAO.

Empowering Beginners In The Crypto Realm

For those new to the world of cryptocurrency trading, the integration of AI crypto trading signals can be a game-changer. By leveraging these data-driven insights, beginners can potentially reduce the steep learning curve and make more informed decisions, ultimately increasing their chances of success.

However, it’s crucial for beginner traders to approach AI crypto trading signals with a balanced perspective. While these signals can provide valuable guidance, they should not be the sole basis for trading decisions. Instead, beginners should combine these insights with their own research, analysis, and risk management strategies to develop a well-rounded trading approach.

Maximizing The Potential Of Ai Crypto Trading Signals

Integrating AI crypto trading signals To effectively utilize AI crypto trading signals, traders must approach their implementation with diligence and discipline. This includes carefully reviewing each signal, understanding the entry points, take-profit levels, and stop-loss orders, and maintaining a consistent and methodical trading strategy.

Integrating AI crypto trading signals To effectively utilize AI crypto trading signals, traders must approach their implementation with diligence and discipline. This includes carefully reviewing each signal, understanding the entry points, take-profit levels, and stop-loss orders, and maintaining a consistent and methodical trading strategy.

Moreover, it is essential for traders to continuously monitor the performance of their trades and make adjustments as needed. By staying vigilant and adapting to the ever-changing market conditions, traders can optimize their use of AI crypto trading signals and potentially enhance their overall profitability.

Embracing The Future Of Crypto Trading

As the adoption of AI-driven solutions continues to accelerate, the landscape of cryptocurrency trading is poised for even more transformative changes. The integration of advanced technologies like machine learning and data analytics is set to redefine the way traders approach the digital asset market, ushering in a new era of informed and data-driven decision-making.

For those who are willing to embrace the power of AI crypto trading signals, the future holds immense potential. By leveraging these cutting-edge tools and combining them with a deep understanding of the cryptocurrency market, traders can position themselves for long-term success and capitalize on the ever-evolving opportunities in this dynamic and exciting landscape.

Faq

Are AI crypto trading signals suitable for complete beginners? Yes, AI crypto trading signals can be a valuable tool for complete beginners in the crypto trading space. These data-driven insights can help reduce the steep learning curve and provide a more structured approach to trading, potentially leading to improved performance. However, it’s crucial for beginners to also educate themselves on the fundamentals of cryptocurrency trading and to incorporate these signals as part of a well-rounded trading strategy.

How much money do I need to start using AI crypto trading signals? The amount of capital required to start using AI crypto trading signals can vary depending on the provider and your personal risk tolerance. Many reputable platforms offer low-minimum account sizes, allowing traders to get started with a relatively small investment. It’s important to remember that, regardless of the amount invested, diversification and risk management should be at the forefront of any trading strategy.

Can AI crypto trading signals guarantee profits? No, AI crypto trading signals cannot guarantee profits. While these data-driven insights can improve the likelihood of successful trades by identifying potentially lucrative opportunities, the cryptocurrency market remains inherently volatile, and there is always an element of risk involved. Traders should approach AI crypto trading signals with realistic expectations and a well-diversified portfolio to mitigate the potential for losses.

Conclusion

In the ever-evolving landscape of cryptocurrency, the integration of AI crypto trading signals has emerged as a transformative force, empowering traders of all experience levels to navigate the volatile and dynamic digital asset market with greater confidence and precision.

By leveraging the power of advanced algorithms and machine learning models, these data-driven insights can help traders identify profitable opportunities, reduce risk, and potentially enhance their overall trading performance. Whether you’re a seasoned investor or a newcomer to the crypto realm, the strategic incorporation of AI crypto trading signals can be a game-changer in your pursuit of financial success.

To improve the introduction, the article could start with a question or a surprising statistic about the volatility of the cryptocurrency market, such as: “Did you know that the cryptocurrency market can experience daily price swings of 10% or more?” This would immediately grab the reader’s attention and set the stage for the article’s focus on navigating the crypto frontier with the power of AI trading signals.

To enhance the readability, some of the longer sentences could be broken up into shorter ones, such as: “The power of AI crypto trading signals lies in their ability to detect patterns and trends that may be invisible to the human observer. By leveraging the processing power of artificial intelligence, these signals can rapidly sift through vast amounts of data, uncovering insights that can inform more informed and objective trading decisions.”

To provide more specific examples, the article could include a case study of a trader who has used AI crypto trading signals to achieve success. This would help illustrate the real-world applications and benefits of these data-driven insights.

Finally, to provide more information about the risks, the article could include a section on the potential drawbacks of using AI crypto trading signals, such as the reliance on the accuracy and reliability of the algorithms, the potential for unexpected market events, and the importance of maintaining a balanced and diversified trading strategy.

By implementing these improvements, the article will become more engaging, readable, and informative, providing readers with a comprehensive understanding of the power and potential of AI crypto trading signals in the ever-evolving world of cryptocurrency.