As a seasoned cryptocurrency trader, I”ve always been on the lookout for ways to amplify my trading potential and maximize my returns. Margin trading has emerged as a game-changer in the crypto space, offering traders like myself the ability to leverage our capital and potentially generate higher profits. In this guide, I”ll share my insights on the best crypto margin trading exchanges, their features, and the key considerations to keep in mind when choosing the right platform for your trading needs.

The Allure Of Crypto Margin Trading

Cryptocurrency trading can be a thrilling and rewarding endeavor, but it’s not without its challenges. That’s where margin trading comes into play. By borrowing funds from an exchange, I can effectively increase my buying power and potentially capitalize on short-term price movements. This leverage can be a powerful tool, but it’s also one that requires a deep understanding of the associated risks.

A man trading

A man trading

Over the years, I’ve learned that effective risk management is the key to success in crypto margin trading. It’s not just about the potential for higher returns; it’s about navigating the market’s volatility with precision and confidence. That’s why I’ve spent countless hours researching and testing different crypto margin trading exchanges, determined to find the ones that offer the best combination of features, security, and risk management capabilities.

How To Choose The Best Crypto Margin Trading Exchanges For Your Needs

When it comes to choosing the right crypto margin trading exchange, there are several crucial factors I consider. First and foremost, security is of the utmost importance. I want to entrust my funds to an exchange that has a proven track record of protecting user assets, with robust security measures like multi-factor authentication and cold storage.

Liquidity is another essential element. High trading volume and order book depth ensure efficient trade execution and minimize the impact of slippage. I carefully analyze each exchange’s liquidity metrics to ensure I can enter and exit positions seamlessly.

Fees are another critical consideration. I compare the trading fees, interest rates, and any other costs associated with margin trading on different platforms to find the most competitive options. After all, every penny saved is a penny earned in the world of crypto trading.

Leverage options are also a key factor in my decision-making process. Different exchanges offer varying leverage ratios, from 2x all the way up to 100x or more. I assess these options carefully, choosing the ones that align with my risk tolerance and trading strategy.

But it’s not just about the numbers — the trading tools and features available on the platform are also crucial. I look for exchanges that offer advanced charting tools, a wide range of order types, and robust risk management features like stop-loss and take-profit orders. These capabilities can significantly enhance my decision-making and trading experience.

Lastly, I consider the regulatory compliance and reputation of the exchanges I’m evaluating. Operating in a well-regulated environment and adhering to industry standards can provide an additional layer of trust and security, which is essential in the dynamic world of crypto.

My Top Picks For Crypto Margin Trading

After meticulous research and personal experience, I’ve identified the following crypto margin trading exchanges as my top picks:

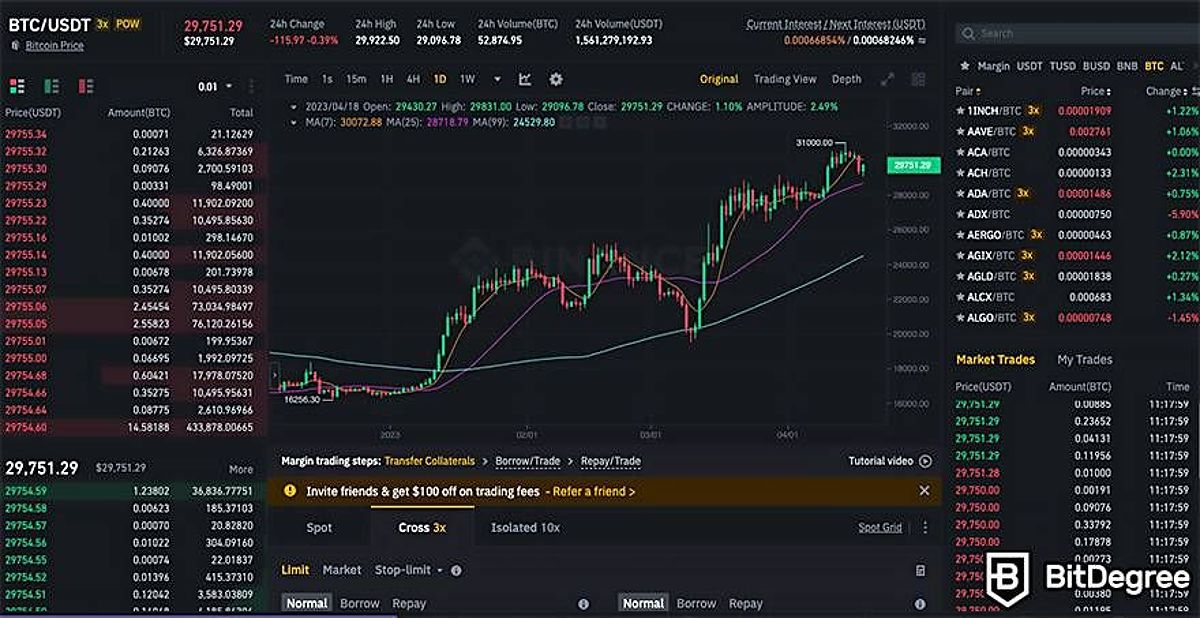

- Binance: As one of the largest and most renowned cryptocurrency exchanges, Binance offers a comprehensive margin trading platform. It supports up to 10x leverage for isolated margin and up to 3x leverage for cross-margin trading. Binance’s extensive range of trading pairs, competitive fees, and advanced trading tools make it a standout choice for crypto traders like myself.

Binance margin trading

Binance margin trading

- Bybit: Bybit is a dedicated crypto derivatives exchange that specializes in perpetual swaps and futures trading. It offers up to 100x leverage, a user-friendly interface, and a range of risk management features that I’ve found invaluable in my trading journey. Bybit’s focus on providing a seamless margin trading experience has made it a go-to platform for seasoned traders.

Bybit margin trading

Bybit margin trading

- Kraken: Kraken is a well-established cryptocurrency exchange that also provides margin trading services. It offers up to 5x leverage, and I’ve been impressed by its strong security measures, regulatory compliance, and reliable trading infrastructure. Kraken’s reputation for trustworthiness and transparency has made it a reliable choice in my trading arsenal.

Kraken

Kraken

- Huobi: Huobi is another leading crypto exchange that offers margin trading capabilities. It supports up to 5x leverage for isolated margin and up to 3x leverage for cross-margin trading. Huobi’s user-friendly platform, diverse trading options, and 24/7 customer support have made it a valuable resource in my trading endeavors.

- KuCoin: KuCoin is a versatile exchange that provides margin trading with up to 5x leverage for cross-margin and up to 10x leverage for isolated margin. Its wide range of cryptocurrencies and advanced trading features have made it a platform I often turn to when exploring new margin trading strategies.

Bitcoin

Bitcoin

Mastering The Art Of Risk Management

One of the most important lessons I’ve learned in my crypto trading journey is the importance of effective risk management. Margin trading, with its ability to amplify both profits and losses, requires a meticulous approach to managing risk.

I’ve found that employing strategies like stop-loss and take-profit orders can be invaluable in mitigating potential losses and protecting my hard-earned gains. Additionally, carefully managing my position size, leverage, and margin levels has been instrumental in reducing the risk of liquidation.

Understanding the concept of maintenance margin — the minimum level of collateral required to keep a position open — has also been a game-changer for me. By staying vigilant about my margin levels and responding promptly to margin calls, I’ve been able to navigate the crypto margin trading landscape with greater confidence and control.

Conclusion

Crypto margin trading has been a game-changer in my trading journey, offering me the opportunity to amplify my potential returns and navigate the dynamic cryptocurrency market with greater agility. However, it’s a strategy that requires a deep understanding of the associated risks and a commitment to disciplined risk management.

By carefully evaluating the top crypto margin trading exchanges, implementing robust risk mitigation techniques, and staying informed about the latest advancements in this space, I’ve been able to unlock new avenues for growth and success in my trading endeavors. As I continue to refine my approach, I’m excited to see what the future holds for the world of crypto margin trading.

Whether you’re a seasoned trader or just starting your journey, I encourage you to approach this space with a sense of curiosity, a thirst for knowledge, and a steadfast commitment to your own personal growth and development. With the right mindset and the right tools, the world of crypto margin trading can be a truly transformative and rewarding experience.

Faq

Q: What are the risks of crypto margin trading? A: Crypto margin trading carries significant risks, including the possibility of liquidation if your position falls below the required margin level. Additionally, the high volatility in the cryptocurrency market can lead to rapid price movements, potentially resulting in substantial losses. It’s crucial to understand and manage these risks through effective risk management strategies.

Q: How do I choose the right leverage for my trading strategy? A: The appropriate leverage level depends on your risk tolerance and trading strategy. I generally recommend starting with lower leverage (e.g., 2x or 5x) and gradually increasing it as you gain more experience and confidence in managing the risks. Avoid over-leveraging, as this can lead to significant losses.

Q: What are some tips for successful margin trading? A: Some key tips for successful margin trading include:

- Conducting thorough market research and analysis to identify trading opportunities

- Implementing strict risk management strategies, such as using stop-loss orders

- Diversifying your portfolio to mitigate the impact of losses

- Continuously monitoring your positions and adjusting your strategy as needed

- Educating yourself on the nuances of margin trading to make informed decisions.