As an experienced crypto trader, I”ve come to appreciate the power of asset ratio, but I”ve also witnessed firsthand the dangers that come with wielding this double-edged sword. In the ever-evolving landscape of the crypto market, the ability to leverage your capital has become a crucial skill, one that can make or break your trading success.

Leveraging The Potential Of Asset Ratio

Astronaut trading in the metaverse

Astronaut trading in the metaverse

Asset ratio, also known as leverage trading, is the practice of using borrowed funds to amplify the size of your trades. This strategy can be employed through various methods, such as margin trading and futures trading. By leveraging your capital, you can potentially multiply your profits, but it’s essential to understand the inherent risks involved.

I’ve found that the primary advantage of using asset ratio in crypto trading is the ability to participate in larger trades, potentially magnifying your gains. This can be particularly beneficial in volatile markets, where small price movements can translate into significant returns. Additionally, asset ratio can be used as a risk management tool, allowing you to hedge your positions and mitigate the impact of market downturns on your overall portfolio.

The Perils Of Unchecked Leverage

Leverage trading risks

Leverage trading risks

While the potential rewards of asset ratio are undeniably enticing, I’ve also witnessed firsthand the devastating consequences of mismanaging this powerful tool. The leverage amplifies both your gains and your losses, meaning that even a small adverse market movement can lead to significant financial setbacks.

I’ve seen traders fall victim to margin calls, where their broker demands additional collateral to maintain their position, or even complete liquidation of their positions. The complexity of leverage trading can make it challenging for novice traders to manage their risk effectively, leading to devastating financial consequences.

Navigating The Risks: Strategies For Responsible Asset Ratio Trading

Stop-loss order

Stop-loss order

Effective risk management is the cornerstone of successful asset ratio trading in the crypto market. Drawing from my own experiences, here are some strategies I’ve found to be invaluable in mitigating the risks:

1- Set Strict Stop-loss Orders

Implement stop-loss orders to automatically close your positions when the market moves against you, limiting your potential losses.

2- Diversify Your Portfolio

Don’t concentrate all your leveraged trades on a single asset or market. Diversify your portfolio to reduce the impact of any individual trade going against you.

3- Limit Your Leverage

Start with a lower leverage ratio, such as 2:1 or 5:1, and gradually increase it as you gain experience and confidence in your trading abilities.

4- Practice Responsible Risk Management

Ensure that the amount you’re willing to risk on any given trade is a small percentage of your overall portfolio. Avoid overexposing yourself to the inherent volatility of the crypto market.

5- Stay Informed

Continuously educate yourself on the latest market trends, news, and regulations that may impact your leveraged trades. Knowledge is power when navigating the complex world of crypto asset ratio trading.

The Evolving Crypto Asset Ratio Landscape

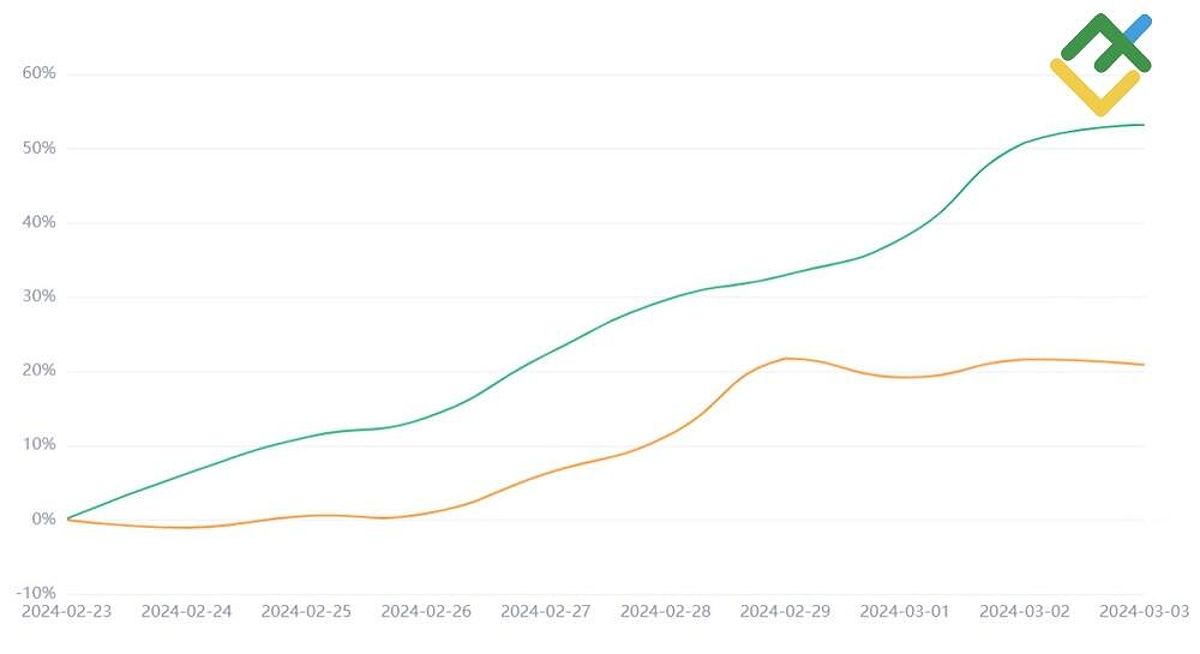

Importance of liquidity in the global market

Importance of liquidity in the global market

As we move into May 2024, the crypto market has continued to evolve, presenting both opportunities and challenges for traders looking to leverage their capital. One notable development has been the emergence of decentralized exchanges (DEXs) that facilitate leveraged trading.

These platforms, built on blockchain technology, provide traders with the ability to access asset ratio trading without the need for a centralized intermediary. This has sparked a growing interest among traders who value the transparency and self-custody aspect of decentralized finance (DeFi).

However, the decentralized nature of these platforms also brings increased responsibility for traders to manage their own risk effectively. Navigating the nuances of asset ratio trading on DEXs requires a deep understanding of the underlying protocols, smart contract risks, and the importance of prudent risk management strategies.

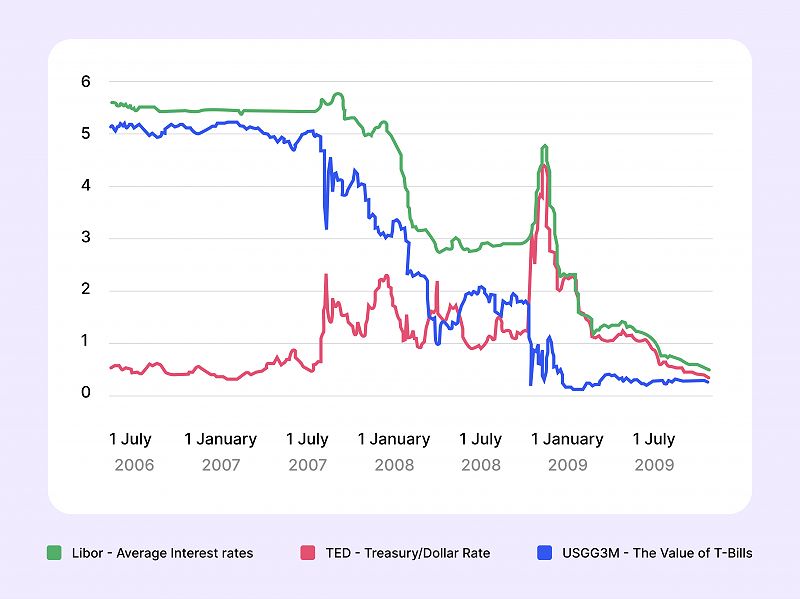

Challenging Conventional Wisdom: A Contrarian Perspective

2008 housing market crisis chart

2008 housing market crisis chart

In a world where the allure of easy money through leveraged trading is ever-present, I believe it’s essential to approach this topic with a critical and contrarian mindset. While the potential rewards of asset ratio are undeniable, the risks are often underestimated or downplayed by those with a vested interest in promoting these strategies.

As a trader who has weathered the ups and downs of the crypto market, I’m compelled to offer a different perspective. The path to consistent, long-term success in crypto trading is not paved with the seductive promises of leveraged gains, but rather with disciplined risk management, extensive research, and a deep understanding of the underlying market dynamics.

Conclusion: The Calculated Approach To Asset Ratio

Digital monitor with market analyses graph

Digital monitor with market analyses graph

In the end, asset ratio in crypto trading can be a powerful tool for experienced traders, but it requires a deep understanding of the risks involved and a disciplined approach to risk management. By following the strategies outlined in this article, you can navigate the world of leveraged crypto trading with more confidence and potentially achieve greater success.

Remember, the crypto market is inherently volatile, and the use of asset ratio can amplify both your gains and your losses. Always exercise caution, diversify your portfolio, and never risk more than you can afford to lose. With the right mindset and a well-considered trading plan, you can harness the benefits of asset ratio while minimizing the risks.

Faq

What is the difference between margin trading and futures trading?

Margin trading involves borrowing funds from a broker to increase the size of your trades. Futures trading, on the other hand, involves buying or selling contracts that represent the future price of a cryptocurrency, allowing you to speculate on price movements without owning the underlying asset.

What are the risks of using asset ratio?

The main risks of using asset ratio include the potential for significant losses, margin calls, and complete liquidation of your positions. The leverage amplifies both your gains and your losses, and even a small adverse market movement can lead to devastating financial consequences.

How can I manage my risk when using asset ratio?

To manage your risk when using asset ratio, you can implement strategies such as setting strict stop-loss orders, diversifying your portfolio, limiting your leverage, practicing responsible risk management, and staying informed about the latest market trends and regulations.