In the dynamic and rapidly evolving world of finance, cryptocurrency trading has emerged as a captivating frontier for those seeking to navigate the ever-changing markets. This digital realm, where the buying and selling of virtual assets like tokens, coins, and NFTs take center stage, offers traders the opportunity to capitalize on the inherent volatility and potential of the cryptocurrency landscape.

At its core, what is crypto trading involves speculating on the price movements of various digital currencies. Unlike traditional investing, which focuses on long-term portfolio growth, crypto traders are driven by the pursuit of short-term profits. By carefully analyzing market trends, leveraging the power of leverage, and executing strategic buy and sell orders, traders seek to generate returns from the fluctuations in the value of cryptocurrencies.

To engage in this crypto trading journey, individuals typically begin by establishing an account on a reputable cryptocurrency exchange platform. These platforms serve as gateways, providing traders with the ability to deposit funds, access a diverse array of digital assets, and execute their trading strategies. Leveraging the power of leverage, crypto traders can amplify their potential returns, though it”s crucial to understand the inherent risks associated with this approach.

The cryptocurrency market is a vast and dynamic ecosystem, home to a myriad of digital currencies, each with its own unique characteristics and use cases. From the pioneering Bitcoin to the innovative Ethereum and the ever-growing number of altcoins, traders have a veritable playground to explore and potentially capitalize on. Understanding the nuances of these different cryptocurrencies, their market capitalization, and their price volatility is essential for informed trading decisions.

However, it”s important to recognize that the world of crypto trading is not without its risks. Cryptocurrencies are known for their high volatility, making them susceptible to sudden and dramatic price swings. Liquidity challenges, security concerns, and the potential for market manipulation are factors that traders must consider when navigating this dynamic landscape.

Selecting A Reliable And Reputable Cryptocurrency Trading Platform For What Is Crypto Trading

Selecting a reliable and reputable cryptocurrency trading platform is a crucial step in the crypto trading journey. Factors such as security, fees, customer support, and the range of cryptocurrencies offered should be thoroughly evaluated. Conducting thorough research and reading reviews can help ensure that traders choose a platform that aligns with their trading goals and risk tolerance.

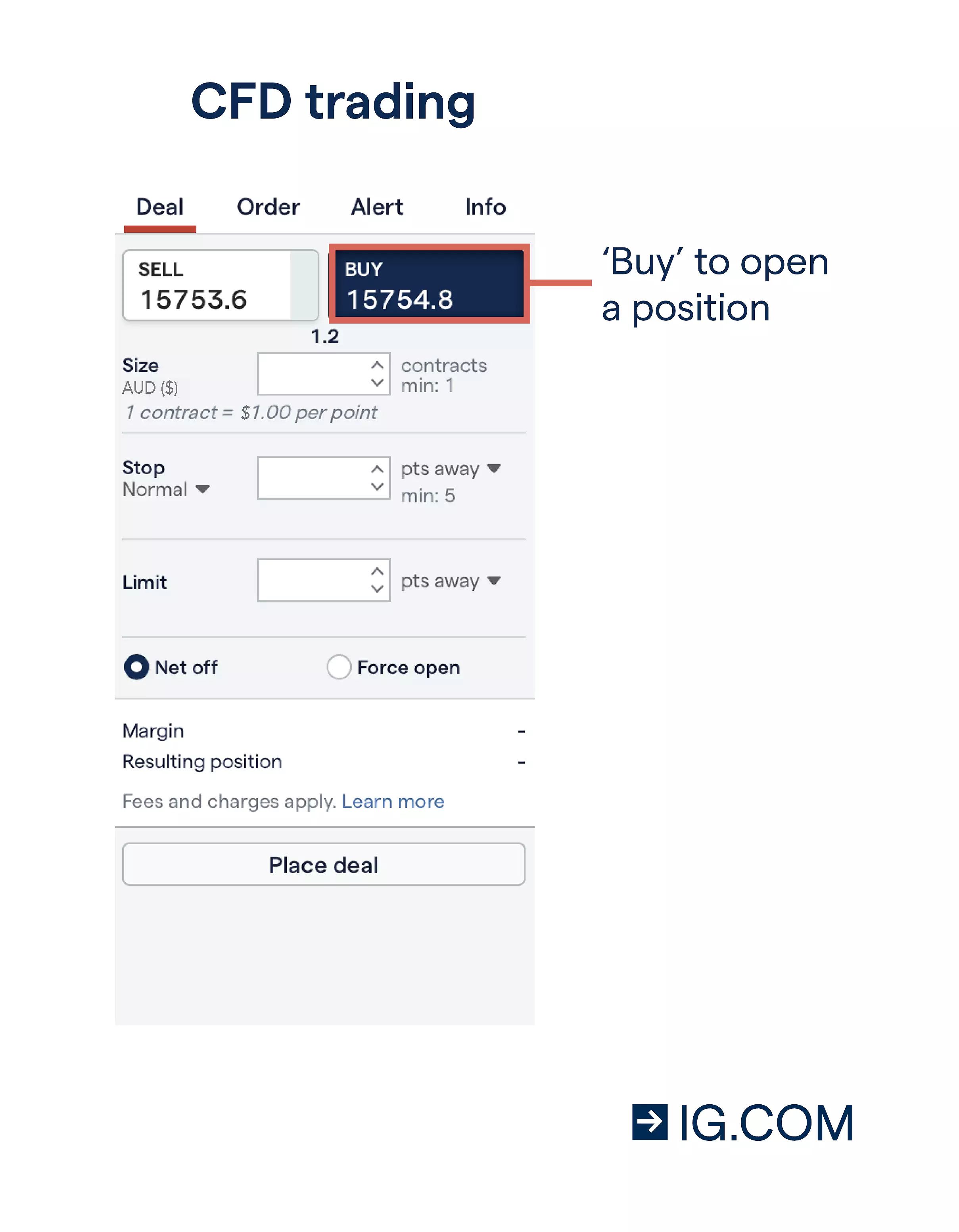

CFD trading deal ticket – going long

CFD trading deal ticket – going long

Developing A Crypto Trading Strategy

Effective crypto trading requires a well-crafted strategy that combines technical analysis, fundamental analysis, and disciplined risk management. Familiarizing oneself with technical indicators, chart patterns, and market sentiment can provide valuable insights to inform trading decisions. Additionally, diversifying one’s portfolio and implementing risk-mitigating techniques, such as stop-loss orders, can help navigate the volatility of the crypto markets.

Cryptocurrency Trading Guide

Cryptocurrency Trading Guide

Conclusion

Crypto trading presents both opportunities and challenges for those seeking to navigate the dynamic world of digital assets. By understanding the fundamentals of crypto trading, familiarizing oneself with the various cryptocurrencies, and developing a comprehensive trading strategy, traders can position themselves to capitalize on the potential of this rapidly evolving market. However, it’s crucial to approach crypto trading with a clear understanding of the risks involved and a commitment to responsible and disciplined trading practices.

Faq

What is the difference between cryptocurrency trading and investing?

The primary distinction between cryptocurrency trading and investing lies in the time horizon and the approach. Cryptocurrency trading focuses on short-term price movements, with the goal of generating profits from the fluctuations in the market. Cryptocurrency investing, on the other hand, is a long-term approach, where the aim is to build wealth by holding onto digital assets over an extended period.

What are the most popular cryptocurrencies traded?

Some of the most widely traded cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and Binance Coin (BNB). These digital assets are often the focus of traders due to their high liquidity and significant market capitalization.

How can I minimize the risks of cryptocurrency trading?

To minimize the risks associated with cryptocurrency trading, it’s essential to diversify one’s portfolio, set stop-loss orders, and practice sound risk management strategies. Additionally, staying informed about the latest developments in the crypto market, conducting thorough research, and maintaining a disciplined trading approach can help mitigate the inherent volatility and risks.

What are the benefits of using a cryptocurrency trading platform?

Cryptocurrency trading platforms offer several advantages, including access to a wide range of digital assets, user-friendly trading interfaces, real-time market data, and the ability to execute trades quickly. These platforms also often provide advanced tools and features, such as technical analysis indicators and order execution options, which can enhance the trading experience.