As the crypto landscape continues to evolve, savvy traders have discovered a unique advantage – the ability to capitalize on markets that operate 24/7, 365 days a year. However, this constant accessibility also presents a distinct challenge: identifying the optimal trading hours to maximize your profits. In this article, we”ll explore the intricacies of crypto trading hours, empowering you to fine-tune your strategy and stay ahead of the curve.

Rhythms Of The Crypto Realm

The crypto market operates in a truly global and dynamic landscape, where trading activity is influenced by an array of time zones and diverse market participants. Unlike traditional financial markets, which adhere to set operating hours, the crypto realm never sleeps. This continuous accessibility provides traders with unparalleled flexibility, but it also introduces unique challenges that require a keen understanding of the market’s ebbs and flows.

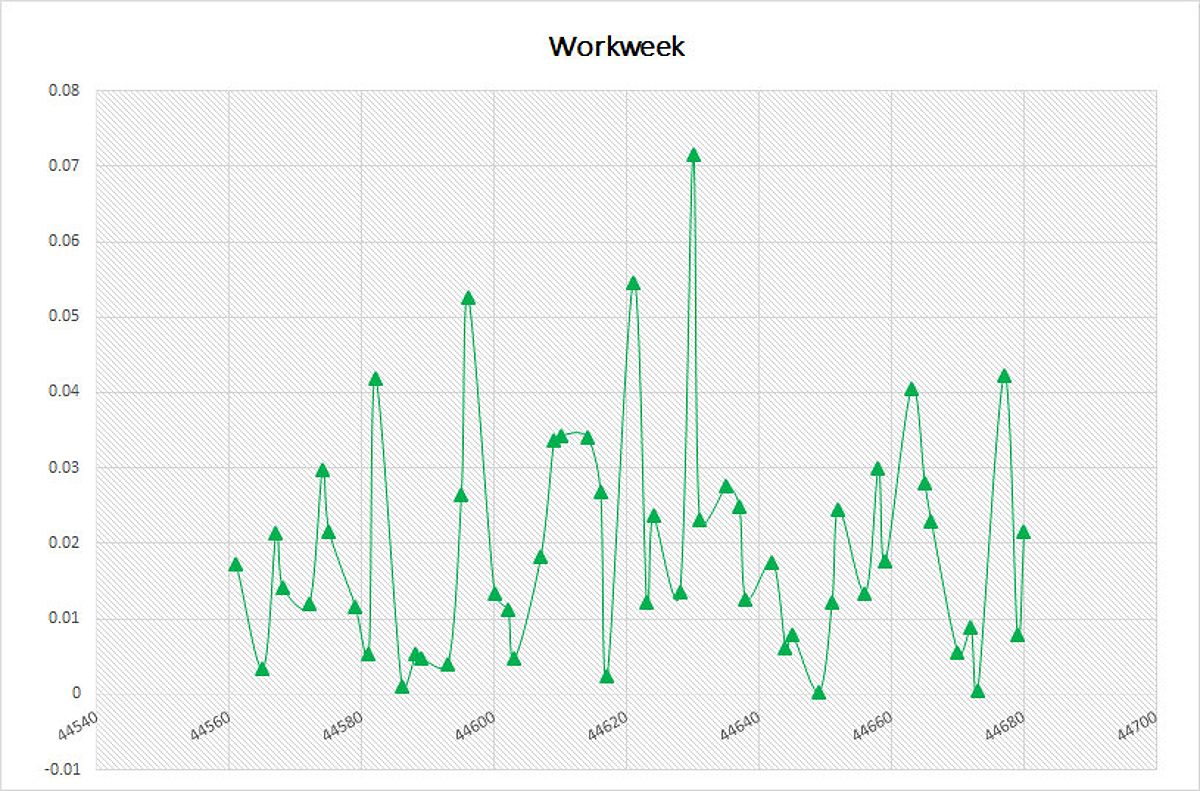

Cryptocurrency Trading Hours on Workweek

Cryptocurrency Trading Hours on Workweek

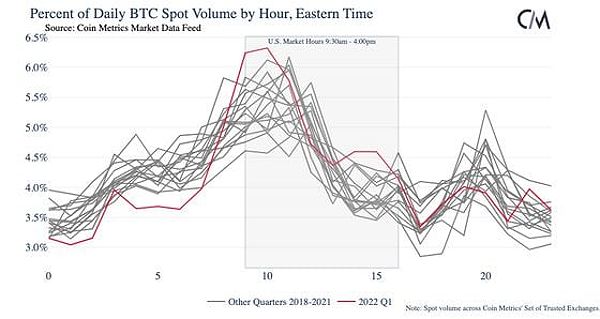

One of the pivotal factors shaping crypto trading patterns is the influence of major financial centers around the world. As the crypto market matures, the trading activity has shifted more towards Western markets, particularly during the regular business hours of the United States. This trend is evident in the data, which showcases Bitcoin’s spot volume tending to peak during U.S. stock market hours, especially around the market’s opening.

Bitcoin’s spot volume over three years

Bitcoin’s spot volume over three years

Identifying Optimal Crypto Trading Hours

Analyzing the trading activity patterns across different cryptocurrencies reveals that certain hours and days of the week tend to be more active and volatile. According to the data, the most active trading period is typically during the early morning hours, when the U.S. markets are just opening their doors.

During this period, the crypto market experiences a surge in liquidity and trading volume, creating favorable conditions for executing trades. The table below outlines the most active trading hours for some of the most popular cryptocurrencies:

| Cryptocurrency | Most Active Trading Hours |

|---|---|

| Bitcoin (BTC) | Sunday (08:00 – 24:00), Monday – Thursday (00:00 – 23:00, 23:15 – 24:00), Friday (00:00 – 22:00) |

| Ethereum (ETH) | Sunday (08:00 – 24:00), Monday – Thursday (00:00 – 23:00, 23:15 – 24:00), Friday (00:00 – 22:00) |

| Ripple (XRP) | Sunday (08:00 – 24:00), Monday – Thursday (00:00 – 23:00, 23:15 – 24:00), Friday (00:00 – 22:00) |

| Litecoin (LTC) | Sunday (08:00 – 24:00), Monday – Thursday (00:00 – 23:00, 23:15 – 24:00), Friday (00:00 – 22:00) |

It’s important to note that these patterns are subject to change over time, as the crypto market continues to evolve. Staying up-to-date with the latest market trends and monitoring real-time data can help you adapt your trading strategy accordingly.

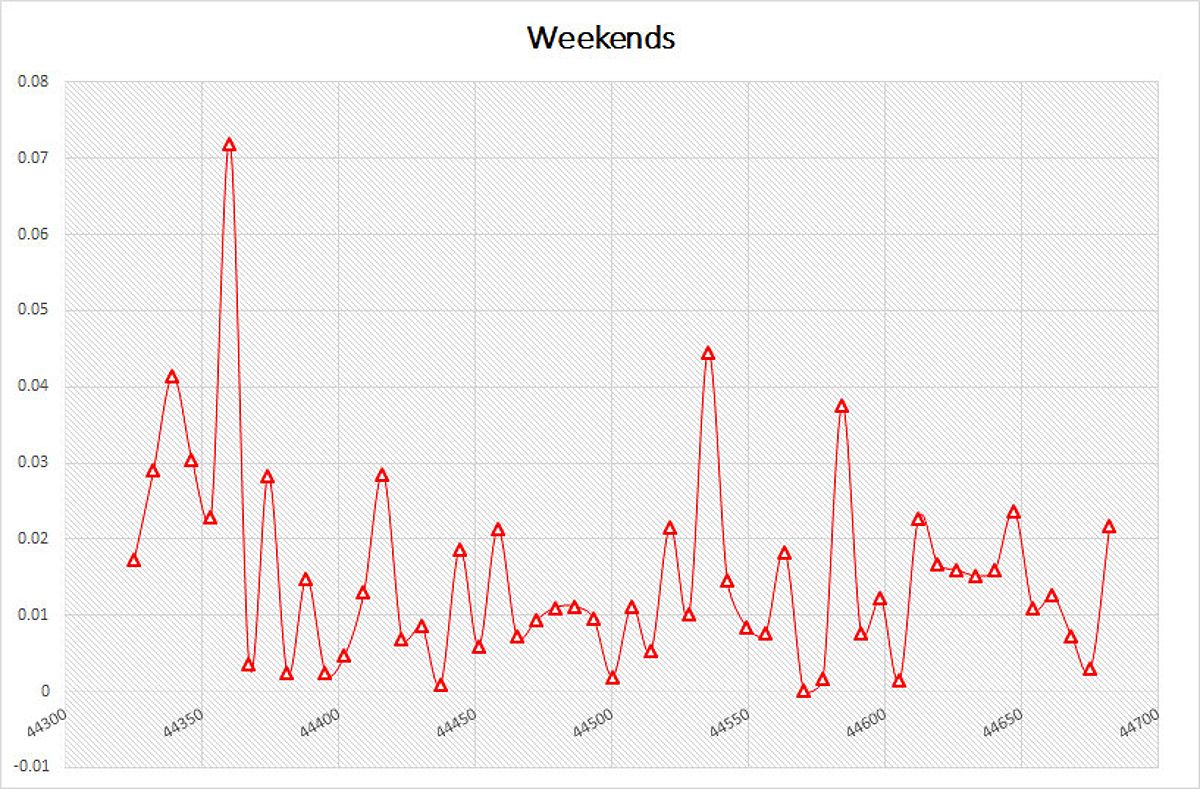

The Weekend Dip Phenomenon

Crypto trading is not immune to the influence of market trends, and understanding these patterns can provide valuable insights for your trading strategy. One notable trend is the “weekend dip” phenomenon, where trading activity and prices tend to decline on weekends.

Cryptocurrency Trading Hours on Weekends

Cryptocurrency Trading Hours on Weekends

The rationale behind this trend is that during the weekends, when traditional financial markets are closed, the crypto market experiences a drop in participation from institutional and professional traders. This reduced activity can lead to increased volatility and price swings, which savvy traders can leverage to their advantage.

By being aware of these market trends, you can time your trades to capitalize on the price fluctuations. For example, you might consider buying crypto assets on weekends when prices are generally lower, and then selling them during the more active weekdays when the market is more bullish.

Importance Of Liquidity

Liquidity is a crucial factor in crypto trading, as it affects the ease and speed with which you can execute trades. High-liquidity markets tend to have tighter bid-ask spreads, lower slippage, and better execution prices, all of which can contribute to improved trading outcomes.

When it comes to the crypto market, liquidity is often unevenly distributed across different trading hours and days of the week. The data suggests that the most liquid periods coincide with the active trading hours of major financial centers, particularly during the U.S. market hours.

By focusing your trading activities on the most liquid periods, you can minimize the impact of market friction and maximize your potential profits. This may involve prioritizing trades during the early morning hours or avoiding less active periods, such as weekends, when liquidity tends to be lower.

Optimizing Your Crypto Trading Strategy

To effectively leverage the insights gained from understanding crypto trading hours, it’s crucial to align your trading strategy with the identified optimal periods. This may involve adjusting your entry and exit points, setting price alerts, or even employing automated trading tools to execute trades during the most favorable times.

Successful crypto traders have often found that by tailoring their strategies to the market’s rhythms, they can achieve better risk-adjusted returns over the long term. By capitalizing on the increased volatility and liquidity during the peak trading hours, you can maximize your chances of executing profitable trades and minimizing potential losses.

Q: Are There Any Specific Days Of The Week That Are Better For Crypto Trading?

A: According to the data, Mondays tend to have higher trading volume and volatility, while weekends typically experience lower activity. This suggests that Monday may be the best day of the week to consider entering new crypto positions.

Q: How Can I Stay Updated On The Latest Market Trends And Trading Hours?

A: To stay informed, subscribe to industry news sources, follow respected crypto analysts on social media, and utilize technical analysis tools to monitor market movements in real-time. Staying on top of the latest developments can help you adapt your trading strategy and capitalize on emerging trends.

Conclusion

The crypto market’s unique characteristics, including its 24/7 accessibility and global reach, present both opportunities and challenges for traders. By understanding the ebb and flow of trading activity, you can strategically time your investments to maximize your profits and stay ahead of the curve.

Remember, the crypto market is highly dynamic, and the patterns and trends discussed in this guide are subject to change over time. Staying vigilant, adapting your strategy, and continuously refining your approach will be crucial to your success as a crypto trader. Embrace the flexibility and potential that the crypto market offers, and embark on your journey to crypto trading mastery.