In the ever-evolving world of finance, few realms captivate the public”s imagination quite like the realm of cryptocurrency. As a seasoned trader, I”ve witnessed the crypto market”s dizzying heights and cavernous depths, and I can attest that navigating this landscape is no easy feat. Yet, for those willing to embrace the challenge, the rewards of day trading cryptocurrencies can be truly remarkable.

Unmasking The Realities Of Crypto Day Trading

Contrary to the popular narrative, day trading crypto is not a surefire path to riches. In fact, it’s a high-stakes game that requires a level of discipline, technical expertise, and risk management that few possess. The crypto market is a veritable minefield, with volatility that can make even the most experienced traders tremble.

But for those undaunted by the risks, the potential rewards are tantalizing. The key, as I’ve learned, is to approach crypto day trading with a contrarian mindset — one that challenges the conventional wisdom and seeks to uncover the hidden truths that others may have overlooked.

The Art Of Crypto Day Trading Strategies

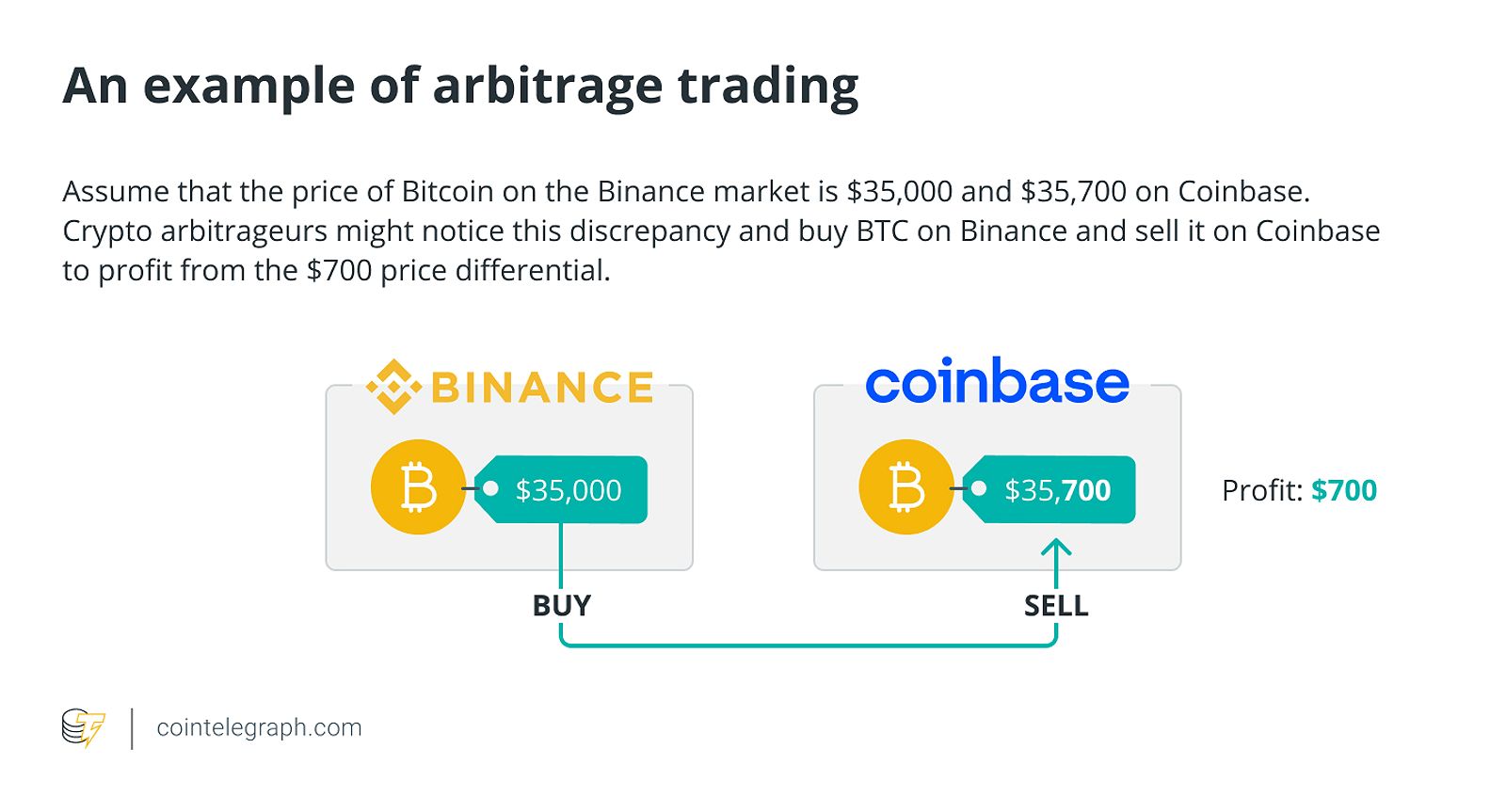

An example of arbitrage trading An example of arbitrage trading

An example of arbitrage trading An example of arbitrage trading

When it comes to day trading cryptocurrencies, there is no one-size-fits-all approach. Instead, traders must be well-versed in a variety of strategies, each with its own unique strengths and weaknesses.

Scalping, for instance, is a high-frequency trading technique that capitalizes on the market’s micro-movements, while range trading thrives in periods of relative market stability. Momentum trading, on the other hand, seeks to ride the wave of sudden price surges, but the risk of being caught on the wrong side of a reversal is ever-present.

As a contrarian, I’ve found that the most successful crypto day traders are those who are willing to think outside the box, experiment with unconventional approaches, and adapt their strategies to the ever-changing market conditions.

Navigating The Crypto Day Trading Landscape

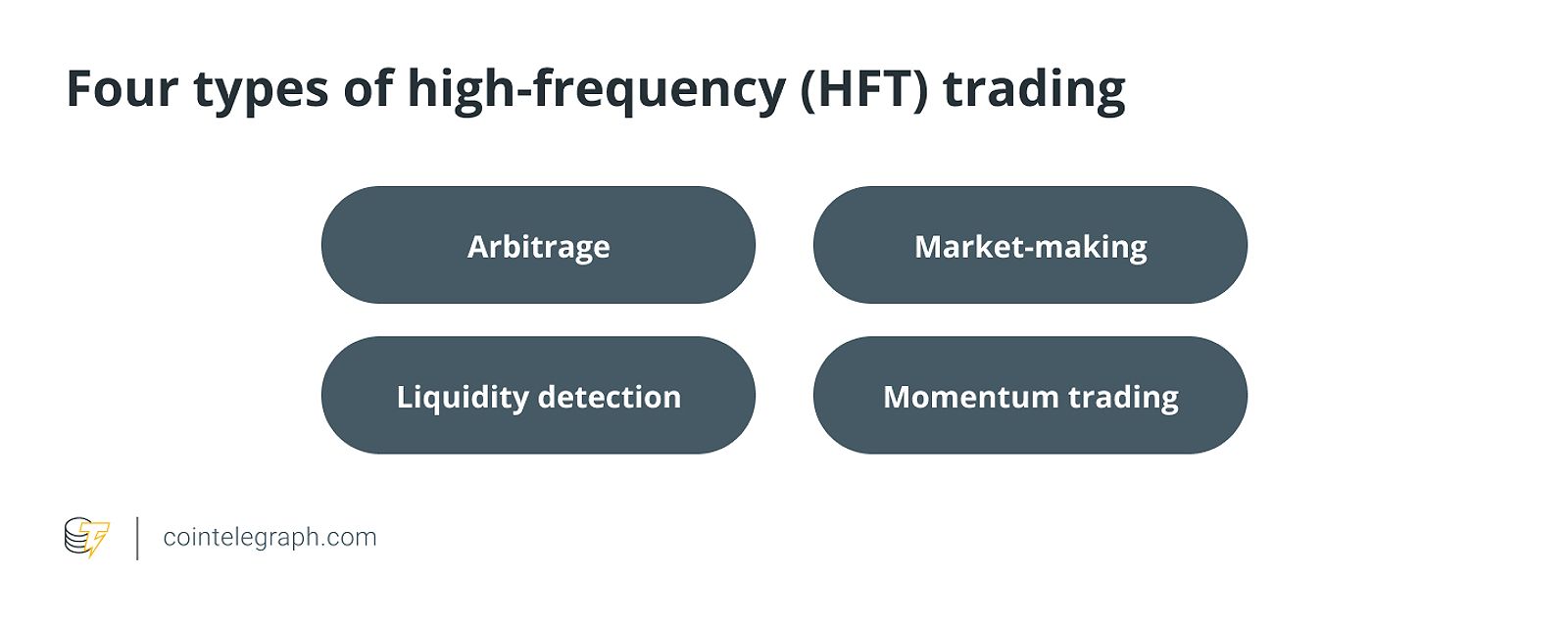

Four types of high-frequency (HFT) trading Four types of high-frequency (HFT) trading

Four types of high-frequency (HFT) trading Four types of high-frequency (HFT) trading

When it comes to choosing the best cryptocurrencies for day trading, the options can seem overwhelming. From the well-established Bitcoin and Ethereum to the more speculative altcoins, the crypto market is a veritable cornucopia of possibilities.

In my experience, the key is to focus on a select few assets that offer the optimal balance of liquidity, volatility, and predictability. Coins like Solana, Polkadot, and Chainlink, for instance, have consistently demonstrated strong technical patterns and market sentiment, making them prime candidates for day trading success.

Of course, the selection of the right crypto day trading platform is equally crucial. Exchanges like Binance, FTX, and Kraken have emerged as industry leaders, offering a suite of advanced trading tools, robust security features, and competitive fee structures.

Mastering The Art Of Risk Management

In the volatile world of crypto day trading, risk management is not merely an afterthought — it’s the very foundation upon which successful strategies are built. As a contrarian, I’ve seen countless traders succumb to the siren call of greed, only to be dashed against the jagged rocks of market turmoil.

To mitigate these risks, crypto day traders must exercise unwavering discipline, meticulously crafting their trading plans and adhering to stringent risk-control measures. This may include the use of stop-loss orders, position sizing, and diversification across multiple assets — strategies that can help insulate traders from the market’s unpredictable fluctuations.

The Importance Of Continuous Learning And Adaptation

Crypto day trading: strategies, risks, and rewards Crypto day trading: strategies, risks, and rewards

Crypto day trading: strategies, risks, and rewards Crypto day trading: strategies, risks, and rewards

The crypto day trading landscape is ever-evolving, with new technologies, regulations, and market trends constantly reshaping the playing field. As a contrarian, I’ve learned that the most successful traders are those who continuously expand their knowledge, adapt their strategies, and remain vigilant in the face of change.

Whether it’s mastering the intricacies of technical analysis, staying abreast of industry news and regulatory updates, or honing their emotional intelligence, the most accomplished crypto day traders are those who are committed to a lifelong journey of learning and self-improvement.

Q: What Is The Minimum Amount Of Capital Required To Start Day Trading Crypto?

A: There is no universally applicable minimum, as the appropriate starting capital can vary greatly depending on your trading strategy, risk tolerance, and the specific crypto assets you intend to trade. However, I would generally recommend beginning with a relatively small amount, perhaps in the range of $1,000 to $5,000, to allow for a gradual learning curve and minimize the potential for significant losses as you develop your skills.

Q: What Are The Key Factors To Consider When Choosing A Crypto Day Trading Platform?

A: When selecting a crypto day trading platform, some of the most critical factors to consider include the diversity of tradable assets, the quality and reliability of the trading tools and user interface, the platform’s liquidity and order execution speeds, and the overall security measures in place to protect your funds. Platforms like Binance, FTX, and Kraken have established themselves as industry leaders in this regard, but it’s essential to conduct thorough research to find the one that best aligns with your specific needs and trading approach.

Q: How Can I Effectively Manage The Risks Associated With Crypto Day Trading?

A: Effective risk management is the cornerstone of successful crypto day trading. Some of the key strategies I employ include diversifying your portfolio across multiple assets, implementing robust stop-loss orders, and maintaining strict position sizing discipline. Additionally, developing a well-defined trading plan, continuously educating yourself on market trends and emerging risks, and cultivating the emotional intelligence to avoid impulsive decision-making are all crucial elements of a comprehensive risk management approach.

Conclusion: Embracing The Contrarian Mindset In Crypto Day Trading

As a contrarian, I’ve come to view the world of crypto day trading not as a realm of easy riches, but as a challenge to be conquered through a combination of technical mastery, disciplined risk management, and a willingness to think beyond the mainstream narratives.

The crypto market is a landscape of dizzying heights and cavernous depths, where the unwary can be quickly swept away by the tides of volatility. But for those who are willing to embrace the contrarian mindset, to challenge the conventional wisdom and uncover the hidden truths, the rewards can be truly life-changing.

So, if you’re ready to embark on this thrilling journey, I encourage you to approach crypto day trading with a spirit of intellectual curiosity, a commitment to continuous learning, and an unwavering dedication to the principles of sound risk management. The path may not be an easy one, but the potential for greatness has never been more within reach.