As the cryptocurrency markets continue to evolve, traders are increasingly recognizing the power of quantitative analysis in navigating these volatile waters. Crypto quantitative trading offers the potential to make informed, data-driven decisions, minimize the impact of emotions, and uncover trading opportunities that may elude the average trader. In this guide, we”ll explore the ins and outs of crypto quantitative trading, equipping you with the knowledge and strategies to leverage this powerful tool for improved performance in the cryptocurrency markets.

Understanding Crypto Quantitative Trading

Quantitative trading, at its core, involves the use of mathematical models, statistical analysis, and advanced algorithms to identify and execute profitable trading opportunities. In the context of cryptocurrency markets, this approach leverages historical data, market patterns, and various technical indicators to generate trading signals and automate the decision-making process.

The benefits of crypto quantitative trading are manifold. By relying on objective data rather than subjective emotions, traders can minimize the impact of biases and make more informed decisions. Furthermore, the speed and efficiency of automated trading systems allow for rapid response to market movements, potentially capitalizing on opportunities that would be challenging for a human trader to identify and act upon.

However, it’s essential to acknowledge the limitations of quantitative trading. The accuracy and reliability of the approach are heavily dependent on the quality and breadth of historical data available. Additionally, the risk of overfitting models to past performance and the potential for sudden market shifts can pose challenges that require diligent risk management strategies.

Key Techniques In Crypto Quantitative Trading

Crypto quantitative trading encompasses a range of techniques, each with its unique strengths and applications. Let’s explore some of the key methods employed by successful traders:

Technical Analysis

Technical Analysis

Technical Analysis

Technical analysis, a cornerstone of quantitative trading, involves the use of statistical tools and chart patterns to identify trading opportunities. Indicators such as moving averages, relative strength index (RSI), and Bollinger Bands can be integrated into algorithmic models to detect trends, identify overbought or oversold conditions, and time entry and exit points.

Statistical Analysis

Statistical Analysis

Statistical Analysis

Statistical models, such as regression analysis and time series forecasting, can be employed to understand the relationships between various market variables and predict future price movements. By analyzing historical data, traders can develop models that capture the inherent patterns and dynamics of the cryptocurrency markets.

Machine Learning

Machine Learning

Machine Learning

The integration of machine learning algorithms has revolutionized the field of crypto quantitative trading. These advanced models can identify complex patterns, adapt to changing market conditions, and make highly accurate predictions based on vast amounts of data. From neural networks to decision trees, machine learning techniques can enhance the precision and adaptability of trading strategies.

Developing A Crypto Quantitative Trading Strategy

Crafting a successful crypto quantitative trading strategy requires a meticulous approach. Let’s explore the key steps involved:

Data Collection And Preparation

Data Collection and Preparation

Data Collection and Preparation

The foundation of any quantitative trading strategy lies in the quality and breadth of the data used. Traders must gather historical price data, trading volume, and other relevant market information, ensuring it is cleaned, normalized, and organized for effective analysis.

Strategy Formulation

Strategy Formulation

Strategy Formulation

Based on the insights gained from data analysis, traders can define a set of rules and conditions that will guide the trading decisions. This may involve the integration of technical indicators, statistical models, or machine learning algorithms to identify entry and exit points, manage risk, and optimize position sizing.

Backtesting And Optimization

Backtesting and Optimization

Backtesting and Optimization

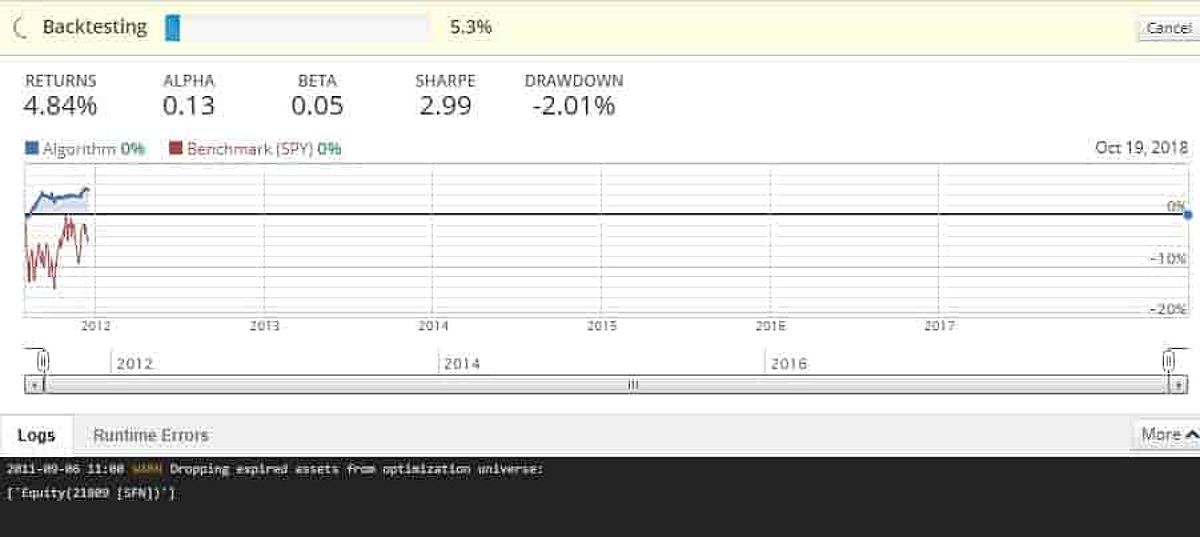

Rigorous backtesting is crucial to evaluating the potential performance of a quantitative trading strategy. By applying the strategy to historical data, traders can assess its profitability, identify areas for improvement, and fine-tune the parameters to enhance its effectiveness.

Risk Management In Crypto Quantitative Trading

Effective risk management is the cornerstone of successful crypto quantitative trading. Traders must employ robust strategies to assess and mitigate potential risks:

Risk Assessment

Quantitative analysis provides valuable tools for assessing the risk associated with a trading strategy. Metrics such as drawdown, value at risk (VaR), and risk-adjusted returns can help traders understand the potential downside and make informed decisions about position sizing and overall risk exposure.

Position Sizing

Position Sizing

Position Sizing

Proper position sizing is critical in managing risk. Quantitative models can be used to determine the optimal trade size based on factors like account balance, volatility, and risk tolerance, ensuring that each position aligns with the trader’s risk management plan.

Stop-loss And Take-profit Orders

The strategic placement of stop-loss and take-profit orders is a fundamental risk management technique in crypto quantitative trading. These automated orders help limit potential losses and secure profits, providing a safeguard against adverse market movements.

Best Practices For Crypto Quantitative Trading

As you embark on your crypto quantitative trading journey, consider the following best practices:

- Continuous Learning: Stay up-to-date with the latest developments in quantitative trading techniques, market trends, and regulatory changes affecting the cryptocurrency ecosystem.

- Diversification: Spread your investments across various cryptocurrencies and trading strategies to mitigate overall risk and enhance the stability of your portfolio.

- Emotional Discipline: Maintain a disciplined, unemotional approach to trading, as quantitative strategies are designed to operate objectively, free from the biases that can impair human decision-making.

Faq

Q: Is quantitative trading suitable for all cryptocurrency traders?

A: While quantitative trading can be highly beneficial, it requires a solid understanding of technical analysis, statistics, and risk management. Traders should assess their skills and experience before implementing quantitative strategies, as the level of complexity can be challenging for those new to the cryptocurrency markets.

Q: How much historical data is needed for effective backtesting?

A: The amount of data required for backtesting depends on the complexity of the trading strategy. Generally, a minimum of 2-3 years of historical data is recommended to ensure the reliability and statistical significance of the results.

Q: Can quantitative trading strategies guarantee profits?

A: No trading strategy, including quantitative trading, can guarantee profits. However, by following sound principles of risk management and continuous improvement, traders can increase their chances of success in the volatile cryptocurrency markets.

Conclusion

In the ever-evolving world of cryptocurrency trading, the strategic use of quantitative analysis has become an increasingly valuable tool for traders seeking to navigate the markets with greater precision and confidence. By leveraging the power of data-driven decision-making, automated trading systems, and sophisticated risk management techniques, crypto quantitative traders can unlock new opportunities for profitable and sustainable trading in the cryptocurrency ecosystem.