High-frequency trading (HFT) is a powerful, technology-driven approach that is reshaping the landscape of digital asset markets. This guide provides a comprehensive overview of HFT in the crypto space, covering its mechanics, benefits, challenges, and how retail traders can get started.

Unlocking The Advantage Of High Frequency Trading Crypto: A Captivating Journey Into Automation

In the exhilarating world of cryptocurrency, a new frontier has emerged, captivating the attention of retail traders seeking to amplify their profits. This is the realm of high-frequency trading (HFT) – a powerful, technology-driven approach that is reshaping the landscape of digital asset markets.

As we delve into the heart of this transformative strategy, one can’t help but feel a sense of excitement and anticipation. The promise of lightning-fast execution, sophisticated algorithms, and the potential to capitalize on fleeting market opportunities is truly alluring. But, of course, with great power comes great responsibility, and navigating the complexities of crypto HFT requires a keen understanding of its mechanics, benefits, and challenges.

High-frequency trading firms

High-frequency trading firms

Mastering The Heartbeat Of Crypto Hft

High-frequency trading in the cryptocurrency realm is a symphony of algorithms, data analysis, and lightning-fast reflexes. At its core, it’s the art of harnessing advanced technology to identify and exploit even the slightest of price movements, generating profits through a flurry of rapid-fire trades.

The rise of HFT in crypto markets is a testament to the growing maturity and integration of digital assets with the traditional financial landscape. As institutional investors, hedge funds, and trading firms have dived into the crypto space, they’ve brought with them the same technological prowess that has dominated other asset classes. This evolution has opened up a world of opportunities for retail traders, empowering them to access the same sophisticated strategies once reserved for the elite.

Dissecting The Mechanics Of Crypto Hft

At the heart of high-frequency trading lies the ability to process and act on vast amounts of market data in real-time. Crypto HFT algorithms scour the markets, scouring for patterns, trends, and fleeting opportunities that may not be visible to the human eye. These algorithms then execute trades with lightning-fast precision, often before the rest of the market can even blink.

Some of the key HFT strategies employed in the crypto realm include:

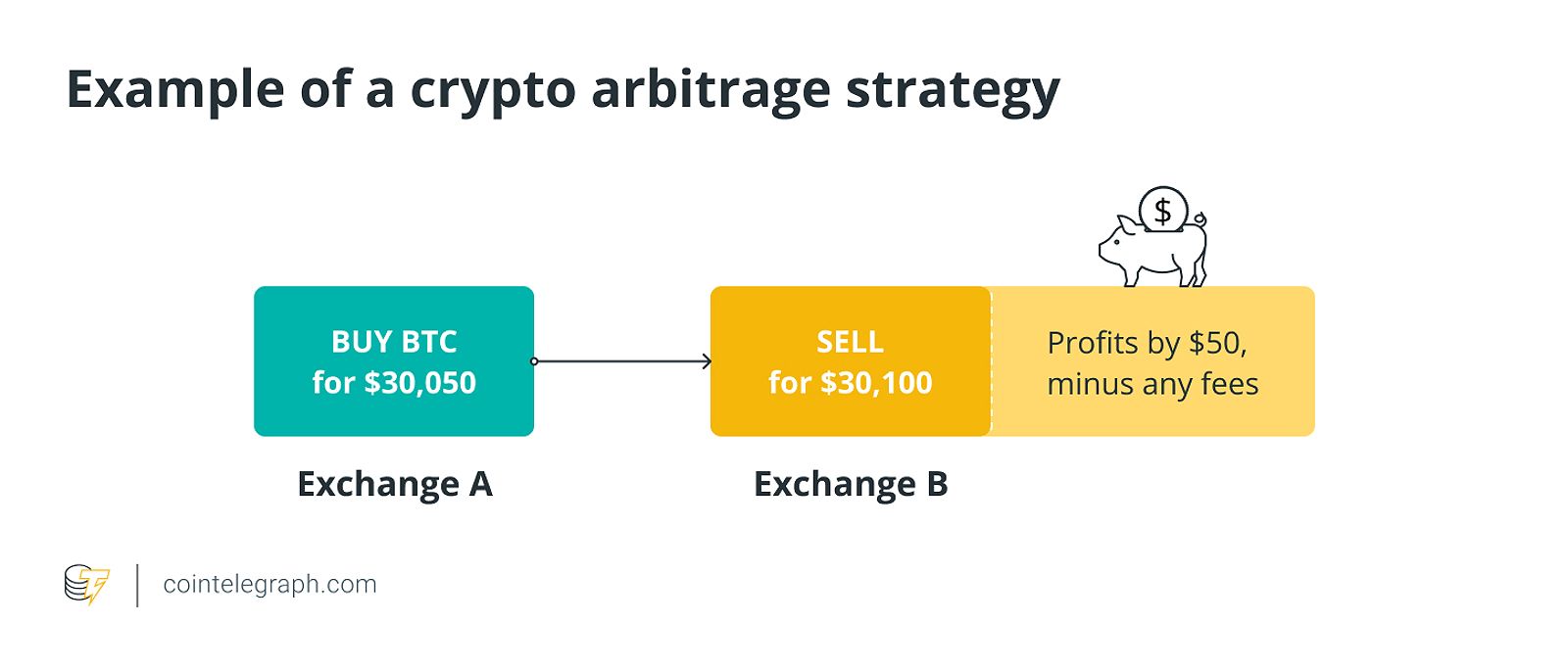

Arbitrage

By exploiting price discrepancies between different exchanges or markets, HFT algorithms can rapidly execute buy and sell orders, capturing small but lucrative profit margins.

Example of a crypto arbitrage strategy

Example of a crypto arbitrage strategy

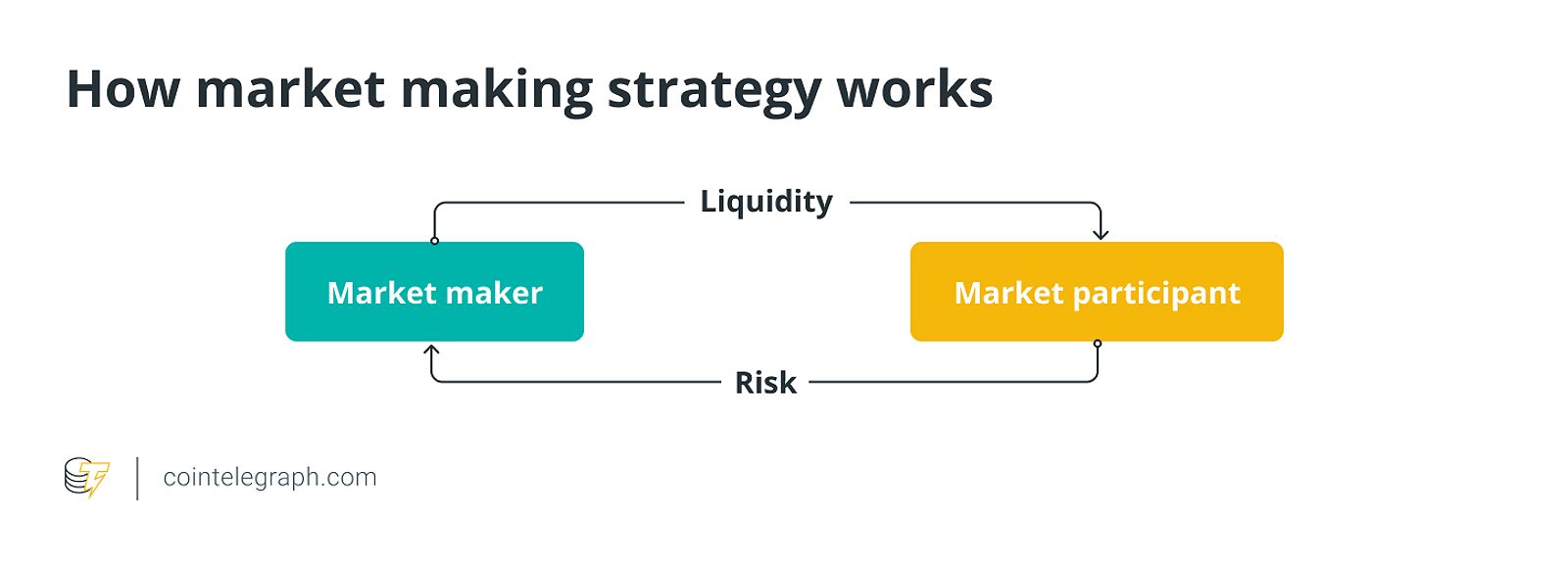

Market Making

Through the simultaneous placement of buy and sell orders at slightly different prices, HFT traders can profit from the bid-ask spread, providing much-needed liquidity to the market.

How market making strategy works

How market making strategy works

Volume Trading

Closely monitoring and capitalizing on changes in trading volume, HFT strategies aim to take advantage of the increased liquidity and reduced market impact associated with high-volume periods.

Navigating The Pros And Cons Of Crypto Hft

As with any powerful trading tool, high-frequency trading in cryptocurrencies presents both advantages and challenges for retail traders. On the one hand, the speed, efficiency, and advanced algorithms of HFT can offer a significant edge in the ever-evolving crypto markets. However, the technology-driven nature of this approach also comes with its own set of considerations.

The Allure Of Crypto Hft

- Blazing-Fast Execution: HFT algorithms can execute trades at mind-boggling speeds, enabling traders to seize upon fleeting market opportunities before their competitors.

- Reduced Latency: By utilizing cutting-edge infrastructure, such as colocation services, HFT traders can minimize the time it takes for their orders to reach the exchange, giving them a crucial advantage.

- Sophisticated Algorithms: The complexity of HFT algorithms allows for the analysis of vast amounts of data, uncovering trading signals that may elude the human eye.

Bitcoin token and a blue line sketch

Bitcoin token and a blue line sketch

The Challenges Of Crypto Hft

- High Technical Expertise: Implementing successful HFT strategies requires a deep understanding of algorithms, programming, and market microstructure – a significant barrier for some retail traders.

- Increased Market Volatility: The rapid, high-volume trading activity associated with HFT can sometimes contribute to heightened market volatility, making it more challenging for non-HFT traders to navigate the crypto landscape.

- Potential for Unfair Advantages: The ability of HFT firms to access advanced technologies and infrastructure can create an uneven playing field, potentially disadvantaging retail traders without access to similar resources.

Embarking On Your Crypto Hft Journey

For retail traders eager to explore the world of high-frequency trading in cryptocurrencies, the path forward requires a thoughtful and disciplined approach. Consider the following steps to get started on your HFT adventure:

- Choose a Reputable Automated Trading Platform: Carefully research and select a platform that offers robust HFT features, such as advanced order types, backtesting capabilities, and effective risk management tools.

- Develop a Tailored Trading Strategy: Dive deep into the various HFT strategies, such as arbitrage, market making, or volume trading, and determine the approach that best aligns with your trading goals and risk tolerance.

- Optimize Your Technical Infrastructure: Ensure that you have access to the necessary technological resources, including a high-speed internet connection and powerful computing capabilities, to support your HFT activities.

Motherboard

Motherboard

- Implement Robust Risk Management: Establish clear risk parameters, utilize stop-loss orders, and diversify your trading portfolio to mitigate the potential risks associated with high-frequency trading.

- Stay Informed and Adaptive: Continuously monitor market trends, news, and developments in the crypto space, and be prepared to adjust your HFT strategy as the landscape evolves.

Conclusion

As the cryptocurrency ecosystem continues to evolve, the integration of high-frequency trading represents an exciting frontier for retail traders seeking to elevate their trading prowess. By harnessing the power of automation, sophisticated algorithms, and lightning-fast execution, HFT in the crypto space can unlock new avenues for profit, provided that traders approach it with the necessary knowledge, resources, and risk management strategies.

However, the technology-driven nature of HFT also comes with its own set of challenges and considerations. Retail traders must be prepared to navigate the complexities of this field, seeking guidance from experienced professionals and adapting their strategies as the market and regulatory landscape continue to shift.

In the ever-changing world of cryptocurrencies, high-frequency trading stands as a testament to the growing maturity and institutional acceptance of digital assets. By embracing this powerful trading tool and leveraging its potential, retail traders can gain a competitive edge, unlock new avenues for wealth creation, and cement their place in the dynamic crypto markets of the future.