Navigating the Crypto Landscape with Perpetual Trading

As an avid trader and cryptocurrency enthusiast, I”ve been captivated by the rise of perpetual trading crypto in the digital asset markets. This innovative approach has opened up a world of opportunities, allowing traders to navigate the volatility of the crypto landscape with greater flexibility and control. Join me as I share my insights and experiences on the thrilling world of perpetual trading in the cryptocurrency realm.

Understanding Perpetual Trading Crypto

At the heart of perpetual trading crypto is a unique mechanism that keeps the contract price aligned with the underlying spot market. Unlike traditional futures contracts, perpetual trading crypto contracts don’t have an expiration date, allowing traders to hold their positions for as long as they desire. This freedom is truly liberating, as it enables us to capitalize on both short-term and long-term price movements without the constraints of a predetermined settlement date.

The absence of expiration dates in perpetual trading crypto contracts also means that traders can enjoy lower fees compared to traditional futures. Without the need to constantly roll over their positions, they can avoid the additional costs associated with that process, making perpetual trading a more cost-effective option for participating in the crypto derivatives market.

Advantages Of Perpetual Trading Crypto

One of the most compelling aspects of perpetual trading crypto is the increased flexibility it offers. As a trader, I can now speculate on both short-term and long-term price movements, allowing me to capitalize on the inherent volatility of the cryptocurrency market. Whether I’m anticipating a sudden price surge or a prolonged downtrend, perpetual trading provides me with the tools to potentially generate profits from both rising and falling prices.

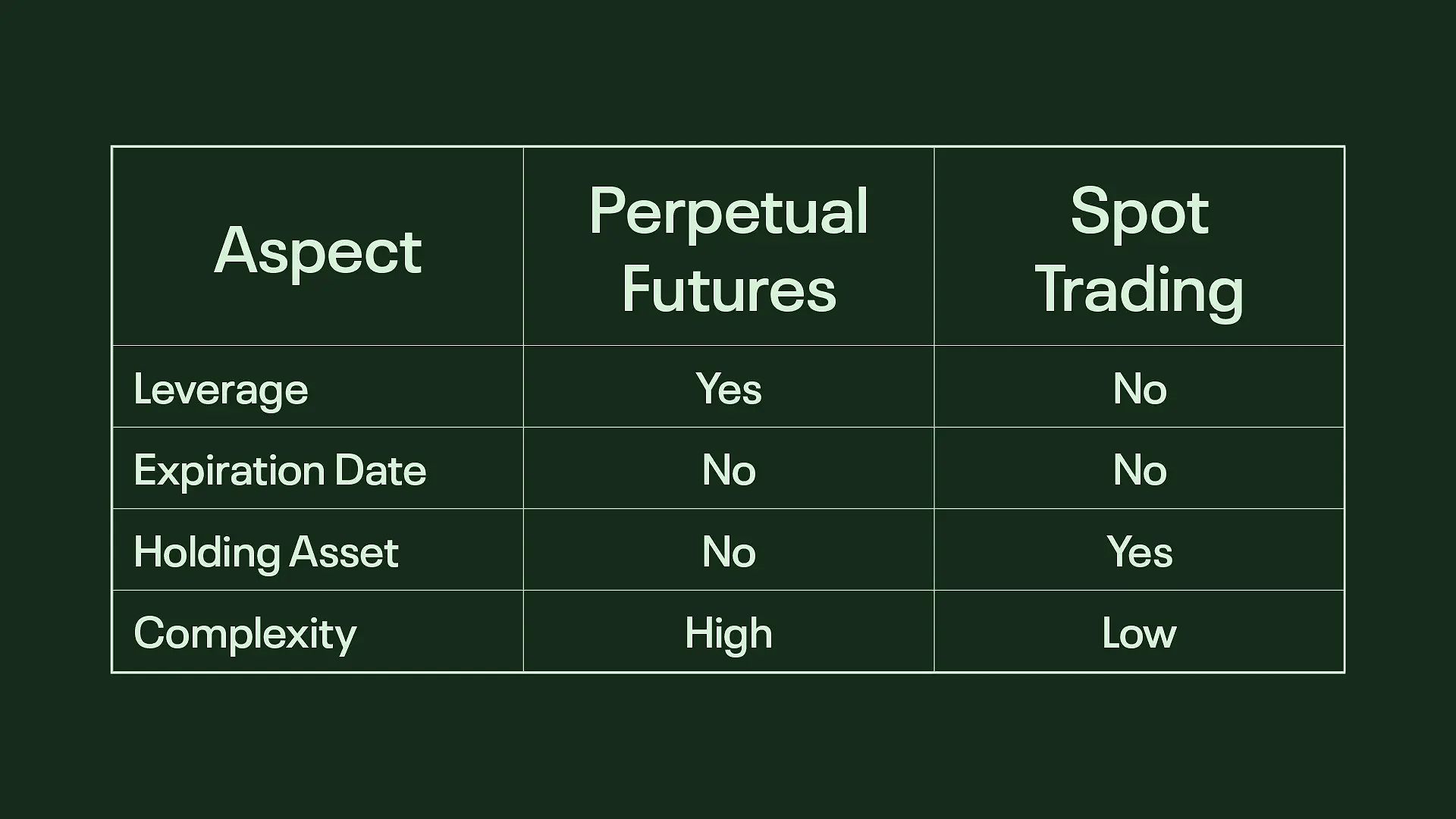

Perpetual Futures Vs. Spot Trading Comparison between perpetual futures and spot trading.

Perpetual Futures Vs. Spot Trading Comparison between perpetual futures and spot trading.

Moreover, the leverage available in perpetual trading crypto has been a game-changer. While leverage can amplify both profits and losses, I’ve learned to wield it with caution, carefully managing my risk exposure to ensure that I don’t overextend myself. By employing robust risk management techniques, such as stop-loss orders and diversification, I’ve been able to navigate the volatility of the crypto markets with greater confidence and success.

Navigating The Risks

Of course, with great opportunities come inherent risks, and perpetual trading crypto is no exception. The high volatility of the cryptocurrency market, coupled with the use of leverage, can lead to significant losses if not managed properly. That’s why it’s crucial to stay informed about the latest market trends, news, and analysis, ensuring that you’re well-equipped to make informed decisions and capitalize on emerging opportunities.

Additionally, the funding rate mechanism in perpetual trading crypto requires close attention. If the funding rate is negative, traders holding long positions will have to pay a fee to those holding short positions, and vice versa. Failing to account for these funding rate fluctuations can lead to unexpected losses, something that traders should monitor and adjust for in their trading strategies.

Crafting A Successful Perpetual Trading Crypto Strategy

As I’ve navigated the perpetual trading crypto landscape, I’ve developed a comprehensive approach that has helped me achieve consistent success. At the core of this strategy are several key elements:

- Leverage Wisely: Using leverage judiciously, understanding that while it can amplify profits, it also carries the risk of amplifying losses. By carefully considering risk tolerance and position sizes, traders can strike a balance that allows them to capitalize on the market’s volatility without overexposing themselves.

- Manage Risk: Implementing robust risk management techniques, such as stop-loss orders and diversification, is crucial in the perpetual trading crypto journey. Protecting the downside and spreading risk across multiple positions can help weather the occasional market storms and emerge stronger.

- Stay Informed: Staying up-to-date with the latest developments in the cryptocurrency market, from regulatory changes to technological advancements, can give traders a valuable edge. By continuously educating themselves and adjusting their strategies accordingly, they can adapt and capitalize on the ever-evolving landscape.

ByBit Perpetuals Example of ByBit perpetuals trading platform.

ByBit Perpetuals Example of ByBit perpetuals trading platform.

- Develop a Trading Plan: A well-defined trading plan that outlines entry and exit strategies, as well as risk management protocols, can be instrumental in keeping traders focused, disciplined, and consistent in their approach to perpetual trading crypto.

Examples Of Perpetual Trading Crypto

Popular Perpetual Trading Crypto Platforms

One popular example of perpetual trading crypto is the perpetual swap contract offered by leading crypto exchanges like Binance and FTX. These contracts allow traders to speculate on the price movements of various cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, without the need for a predetermined expiration date.

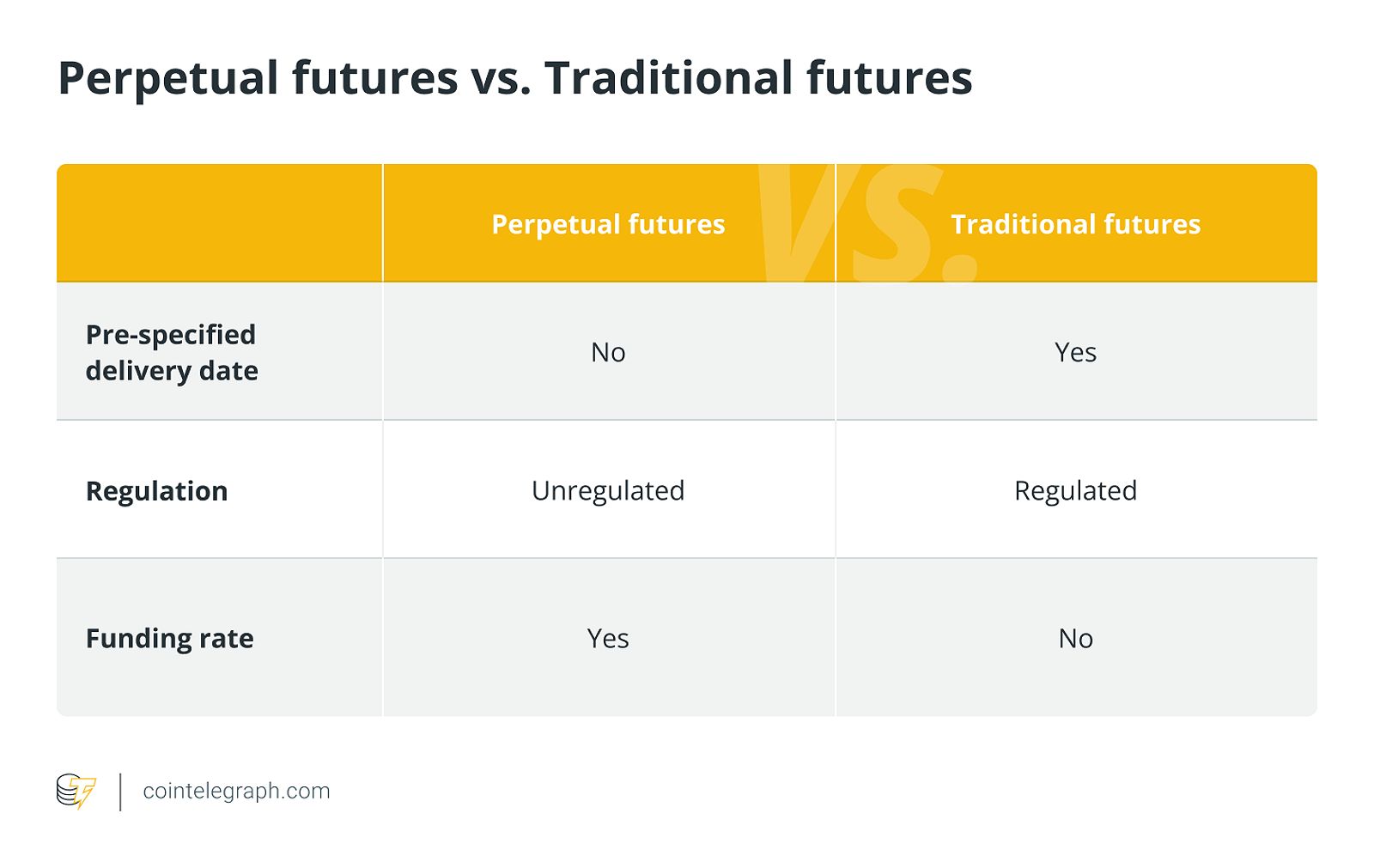

Perpetual Futures Vs. Traditional Futures Comparison between perpetual futures and traditional futures.

Perpetual Futures Vs. Traditional Futures Comparison between perpetual futures and traditional futures.

Another example is the perpetual futures contract, which combines the features of traditional futures contracts with the continuous trading of perpetual swaps. These contracts provide traders with the opportunity to leverage their positions and potentially profit from both rising and falling crypto prices.

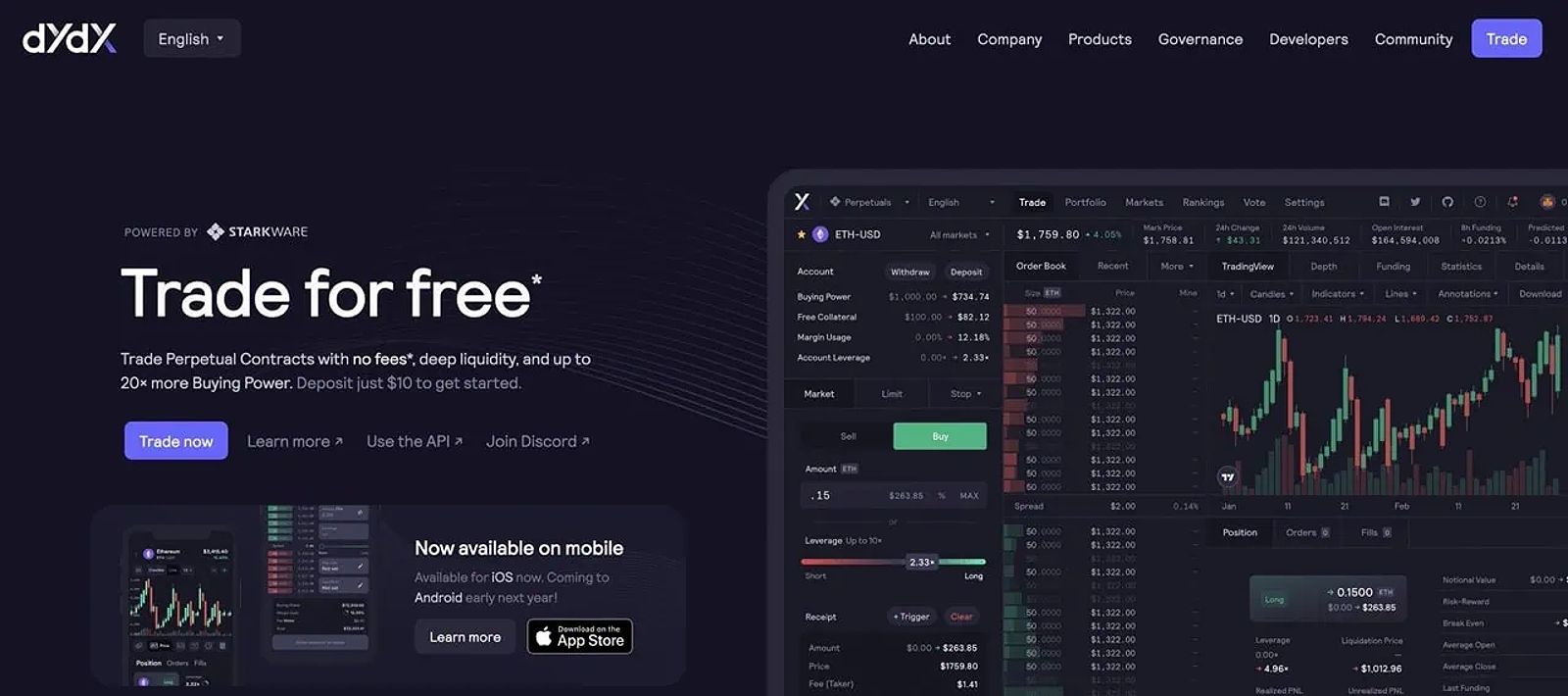

DYdX Perpetuals Example of dYdX perpetuals trading platform.

DYdX Perpetuals Example of dYdX perpetuals trading platform.

Risks Associated With Perpetual Trading Crypto

While perpetual trading crypto offers numerous advantages, it’s important to be aware of the risks involved. The high volatility of the cryptocurrency market, combined with the use of leverage, can lead to significant losses if not managed properly. Traders should be mindful of the following risks:

- Leverage Risk: Excessive use of leverage can amplify both profits and losses, potentially leading to substantial financial losses if the market moves against the trader’s position.

- Funding Rate Fluctuations: Failing to account for changes in the funding rate can result in unexpected losses, as traders may have to pay fees to those holding opposing positions.

- Market Volatility: The cryptocurrency market is known for its high volatility, which can result in sudden and unpredictable price movements that can quickly erode a trader’s capital if they are not prepared.

- Liquidity Risks: There may be instances where the perpetual trading market experiences low liquidity, making it difficult for traders to enter or exit their positions at favorable prices.

To mitigate these risks, traders should implement robust risk management strategies, stay informed about market trends, and develop a well-structured trading plan that aligns with their risk tolerance and investment objectives.

Conclusion

As the cryptocurrency market continues to evolve, perpetual trading crypto is poised to play an increasingly important role in the way traders interact with and profit from the digital asset ecosystem. By understanding the mechanics of perpetual trading, embracing its advantages, and managing the associated risks, traders can position themselves for sustained success in this exciting and dynamic space.

Whether you’re a seasoned trader or new to the world of crypto, the insights and strategies shared in this guide can serve as a valuable foundation for your journey into the frontier of perpetual trading crypto. So, let’s venture forth, explore the possibilities, and navigate the volatile crypto markets with confidence and success.