How Much Money Do You Need to Start Trading Crypto: A Comprehensive Guide

As an experienced cryptocurrency enthusiast and avid trader, I understand the allure and potential rewards of venturing into the dynamic world of digital assets. In this comprehensive guide, I”ll share my insights on the financial requirements and costs associated with how much money you need to start trading crypto, equipping you with the knowledge to make informed decisions and maximize your chances of success.

Minimum Investment: How Much Money Do You Need To Start Trading Crypto?

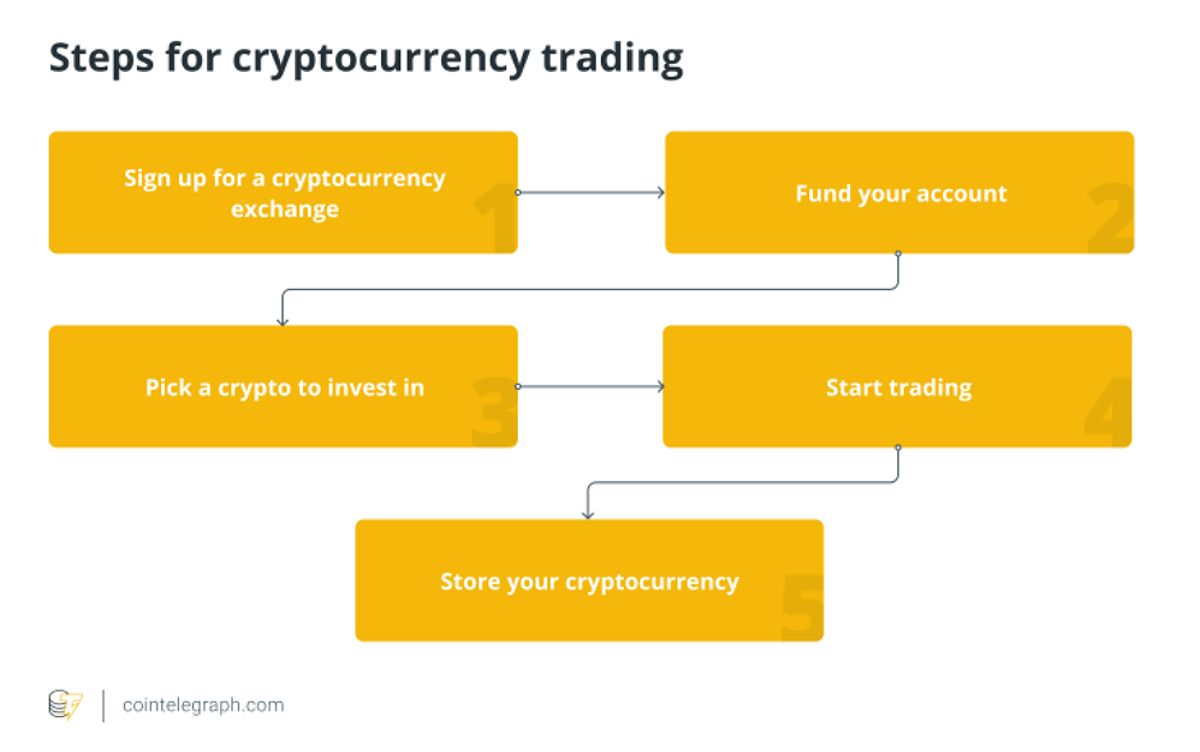

One of the first and most pressing questions aspiring crypto traders often have is: “How much money do I need to start trading?” I’m pleased to report that the barrier to entry is relatively low, with many popular cryptocurrency exchanges allowing users to get their feet wet with as little as $10 or $20.

For instance, Coinbase, one of the industry’s leading platforms, has a minimum deposit requirement of just $2 to fund your account and begin your trading activities. Similarly, Binance, another prominent exchange, accepts a minimum deposit of $10 to get you started. It’s important to note that these minimum requirements can vary across different exchanges, so I recommend thoroughly researching and comparing your options to find the one that best aligns with your needs and investment goals.

Minimum deposit for trading cryptocurrency

Minimum deposit for trading cryptocurrency

Navigating The Trading Fee Landscape

In addition to the minimum investment, the trading fees charged by cryptocurrency exchanges are another crucial consideration. These fees are applied for the execution of your buy and sell orders and can have a significant impact on your overall profitability.

Cryptocurrency exchanges typically employ a maker-taker fee model, where makers (those who provide liquidity to the market) are charged lower fees than takers (those who remove liquidity). The specific fee structures can vary widely, ranging from as low as 0.01% to as high as 0.50% or more, depending on the exchange and your trading volume.

To illustrate, Binance’s trading fees start at 0.1% for both makers and takers, but users can qualify for discounted rates based on their trading volume and the platform’s native token, BNB. Coinbase, on the other hand, charges a flat 0.50% fee for both buy and sell orders, regardless of the trading volume.

It’s essential to carefully review the fee structure of any exchange you’re considering, as the cumulative impact of trading fees can quickly erode your profits if not managed effectively. By understanding the fee dynamics, you can make more informed decisions and develop strategies to minimize the cost of your trading activities.

Additional Expenses To Consider

Beyond the trading fees, there are a few other expenses to be mindful of when venturing into the crypto trading realm:

- Withdrawal Fees: When you decide to withdraw your cryptocurrency holdings from the exchange, you’ll typically be charged a withdrawal fee. These fees can vary depending on the specific cryptocurrency and the exchange, so it’s crucial to understand the associated costs before initiating a withdrawal.

- Deposit Fees: Some exchanges may also charge fees for depositing fiat currency (such as USD or EUR) into your trading account. While these fees are often minimal, it’s still essential to factor them into your overall trading strategy.

- Gas Fees: When trading on the Ethereum blockchain, you’ll need to pay a “gas fee” to compensate the network for processing your transactions. These fees can fluctuate based on the network’s congestion and can sometimes be quite high, especially during periods of heightened activity.

By being aware of these additional expenses, you can better plan and budget for your trading activities, ensuring that your capital is being utilized efficiently and effectively.

Strategies For Minimizing Costs

To help you maximize the returns on your crypto trading endeavors, I’ve compiled a few strategies to minimize the various costs associated with your activities:

- Choose a Low-Fee Exchange: Conduct thorough research and compare the fee structures of different cryptocurrency exchanges to find the one that offers the most competitive rates. This can have a significant impact on your overall trading profitability.

- Time Your Trades Strategically: Cryptocurrency markets operate 24/7, so consider timing your trades during periods of lower activity, such as late at night or on weekends. This can help you avoid paying higher gas fees on the Ethereum network.

- Prioritize Lower-Fee Cryptocurrencies: Some cryptocurrencies, such as Bitcoin and Ethereum, have relatively high gas fees compared to other, smaller-cap altcoins. When possible, consider trading cryptocurrencies with lower network fees to reduce your overall costs.

- Utilize Limit Orders: Instead of market orders, which execute at the current market price, consider using limit orders to buy or sell at a specific price. This can help you avoid slippage and potentially save on trading fees.

- Optimize Your Trading Strategy: Develop a well-researched and disciplined trading strategy that minimizes the number of trades you need to make. Excessive trading can quickly erode your profits through the accumulation of fees.

By implementing these cost-saving strategies, you can significantly improve the efficiency of your crypto trading activities and potentially enhance your overall profitability.

Cryptocurrency trading strategies

Cryptocurrency trading strategies

Comparison Of Cryptocurrency Exchange Fees

To help you better understand the fee structures of different cryptocurrency exchanges, here’s a table that compares the trading fees of some popular platforms:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Binance | 0.1% | 0.1% |

| Coinbase | 0.5% | 0.5% |

| Kraken | 0.16% | 0.26% |

| Gemini | 0.25% | 0.35% |

| Bitfinex | 0.1% | 0.2% |

As you can see, the fees can vary significantly across different exchanges. By comparing these rates, you can make a more informed decision on which platform best suits your trading needs and budget.

Faq

Q: What is the minimum amount of money I need to start trading crypto? A: The minimum investment required to open a cryptocurrency trading account can vary, but many exchanges allow users to get started with as little as $10 or $20. Specific examples include Coinbase with a $2 minimum deposit and Binance with a $10 minimum.

Q: What are trading fees, and how do they work? A: Trading fees are the costs charged by cryptocurrency exchanges for executing your buy and sell orders. These fees typically follow a maker-taker model, where makers (those who provide liquidity) pay lower fees than takers (those who remove liquidity). The specific fee structures can vary widely between exchanges, ranging from 0.01% to 0.50% or more.

Q: What other expenses might I incur when trading crypto? A: In addition to trading fees, you may also need to pay withdrawal fees when moving your cryptocurrency out of the exchange, as well as potential deposit fees for funding your trading account. Additionally, when trading on the Ethereum network, you’ll need to pay “gas fees” to compensate the network for processing your transactions.

Conclusion

As I’ve discussed, starting to trade cryptocurrencies can be a rewarding endeavor, but it’s essential to approach it with a well-informed and prudent mindset. By understanding the minimum investment required, the trading fees you may encounter, and the various other expenses involved, you can make more informed decisions and develop a trading strategy that maximizes your chances of success.

Remember, the crypto market is highly volatile, and trading carries inherent risks. It’s crucial to conduct thorough research, start with an investment you can comfortably afford, and continuously monitor and adapt your approach as the market evolves. With the right knowledge and a well-planned strategy, you can navigate the dynamic world of crypto trading and unlock new opportunities for financial growth.