In the ever-evolving world of cryptocurrency, institutional investors are increasingly recognizing the power and potential of over-the-counter (OTC) trading platforms. These specialized venues offer a unique opportunity to execute large-scale transactions with minimal impact on the broader market, making them a compelling choice for savvy investors seeking to capitalize on the digital asset revolution.

As we delve into May 2024, the crypto OTC trading landscape has matured significantly, with a growing number of legitimate platforms catering to the needs of institutional clients. However, with this expansion comes the challenge of identifying the right partner — one that prioritizes security, compliance, and the specific requirements of sophisticated market participants. In this comprehensive guide, we’ll embark on a journey to uncover the secrets of legitimate crypto OTC trading platforms, arming institutional investors with the knowledge and tools necessary to navigate this dynamic space with confidence. By understanding the key factors to consider and the steps to take, you’ll be empowered to make informed decisions and leverage the unique benefits that crypto OTC trading has to offer.

Unveiling The Allure Of Crypto Otc Trading

The cryptocurrency market has come a long way since its inception, and with this maturation has come the increasing involvement of institutional players. These savvy investors, with their vast resources and deep pockets, have recognized the transformative potential of digital assets and are now actively seeking ways to integrate them into their portfolios.

Enter the world of crypto OTC trading — a realm where large-volume transactions are executed outside the confines of traditional exchanges. Unlike exchange-based trading, where orders are visible to the broader market and can potentially cause significant price fluctuations, OTC trading allows for direct negotiations between buyers and sellers. This unique approach offers several distinct advantages that have captured the attention of institutional investors.

Crypto OTC Trading Platform

Crypto OTC Trading Platform

Executing Large Trades With Minimal Market Impact

Foremost among these advantages is the ability to execute sizable trades with minimal impact on the overall market price. By avoiding the order book and the associated liquidity challenges, institutional investors can enter and exit positions efficiently, without the risk of slippage that can often plague exchange-based transactions. This, in turn, allows them to better manage their portfolios, mitigate market volatility, and capitalize on emerging opportunities.

Customizable Transactions For Institutional Investors

Moreover, the customizable nature of OTC trades is a game-changer for institutional investors. These sophisticated market participants can tailor the transaction to their specific needs, whether it’s related to pricing, settlement terms, or other critical factors. This level of flexibility and control is a hallmark of the crypto OTC trading landscape, catering to the unique requirements of institutional clients.

Best crypto OTC trading platform: Two man shaking hands

Best crypto OTC trading platform: Two man shaking hands

Navigating The Crypto Otc Landscape: Separating The Legitimate From The Dubious

As the crypto OTC trading space continues to evolve, institutional investors are faced with the challenge of identifying legitimate and trustworthy platforms. With a proliferation of new players entering the market, it’s crucial to exercise due diligence and ensure that the platform you choose prioritizes security, compliance, and the specific needs of institutional clients.

Regulatory Compliance

One of the primary considerations when evaluating a crypto OTC trading platform is its regulatory compliance. Institutional investors must ensure that the platform adheres to all relevant regulations in their jurisdiction, including stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. This not only safeguards the integrity of transactions but also provides an added layer of assurance for investors seeking to navigate the complex regulatory landscape.

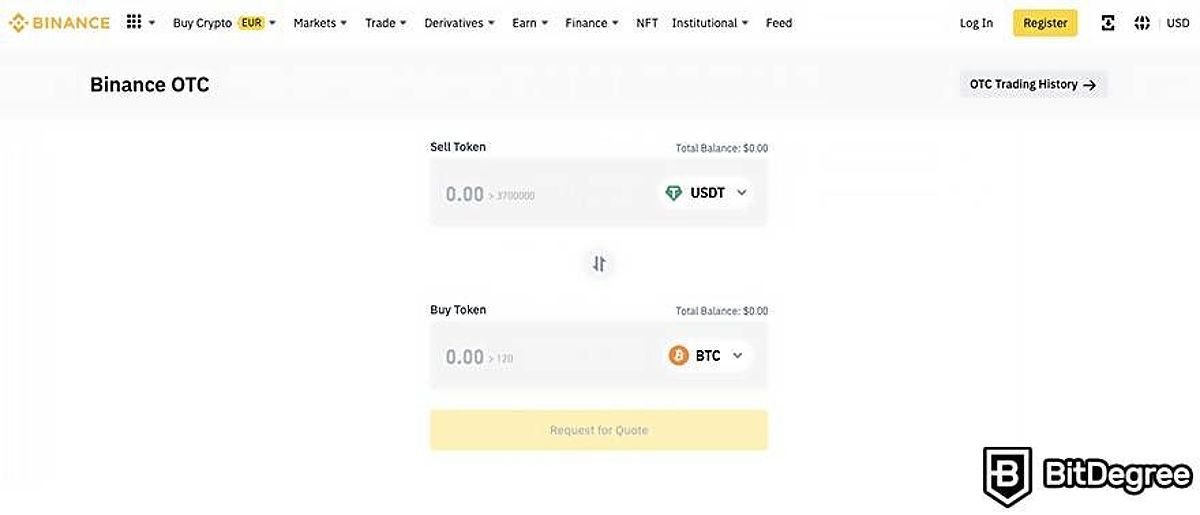

Best crypto OTC trading platform: Binance OTC

Best crypto OTC trading platform: Binance OTC

Security

Security is another paramount concern when it comes to crypto OTC trading. Institutional investors must scrutinize the platform’s security protocols, including multi-factor authentication, cold storage solutions, and regular security audits. These measures are essential in safeguarding the investors’ digital assets and instilling confidence in the platform’s ability to protect their funds.

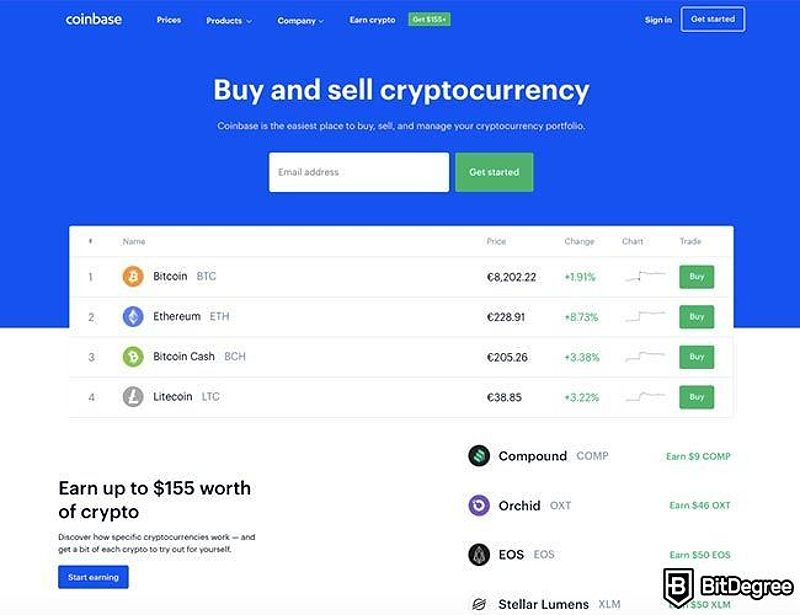

Coinbase – Secure Trading

Coinbase – Secure Trading

Liquidity And Trading Volume

Liquidity and trading volume are also critical factors to consider when selecting a crypto OTC trading platform. Institutional investors must ensure that the platform can accommodate their large-scale trading needs without causing significant price impact or slippage. By partnering with platforms that boast deep liquidity and a proven track record of facilitating high-volume transactions, investors can execute trades efficiently and minimize the risks associated with market volatility.

Best crypto OTC trading platform: Crypto charts

Best crypto OTC trading platform: Crypto charts

Personalized Customer Support

Personalized customer support is another hallmark of a legitimate crypto OTC trading platform. Institutional investors should look for platforms that offer dedicated account managers and 24/7 assistance to address their unique needs and concerns, ensuring a seamless and responsive trading experience.

Best crypto OTC trading platform: Binance

Best crypto OTC trading platform: Binance

Identifying Legitimate Crypto Otc Trading Platforms: A Step-by-step Approach

To navigate the crypto OTC trading landscape effectively, institutional investors should follow a comprehensive approach to identify legitimate and trustworthy platforms. By taking the time to conduct thorough research, verify regulatory compliance, and assess the platform’s security and liquidity, investors can ensure that they are partnering with a provider that aligns with their investment goals and risk management strategies.

- Conduct thorough research: Begin by exploring online reviews, industry publications, and regulatory reports to gain a comprehensive understanding of the platform’s reputation, track record, and overall credibility.

- Verify regulatory compliance: Ensure that the crypto OTC trading platform is registered and licensed to operate in your jurisdiction, adhering to all relevant regulations and industry standards.

- Evaluate security protocols: Assess the platform’s security measures, including encryption, multi-factor authentication, and cold storage solutions, to ensure the protection of your digital assets.

- Analyze liquidity and trading volume: Examine the platform’s order book depth, execution speed, and overall trading volume to gauge its ability to accommodate your investment needs without causing significant price impact.

- Engage with customer support: Reach out to the platform’s customer support team to evaluate their responsiveness, professionalism, and ability to address your inquiries and concerns.

- Consider third-party audits: Look for platforms that have undergone independent security and compliance audits, as this can provide an additional layer of assurance and validation.

Navigating crypto exchange_Featured_image

Navigating crypto exchange_Featured_image

Recommended Legitimate Crypto Otc Trading Platforms

Based on the criteria outlined in this guide, here are some examples of legitimate crypto OTC trading platforms that institutional investors can consider:

- Coinbase Prime: Coinbase’s institutional-grade trading platform that offers deep liquidity, robust security measures, and a dedicated team of account managers.

- Genesis Trading: A leading crypto OTC provider with a strong track record of facilitating large-volume transactions and a focus on regulatory compliance.

- Kraken OTC: Kraken’s OTC desk, known for its competitive pricing, customizable trade options, and commitment to client confidentiality.

- Cumberland: A well-respected crypto OTC firm that specializes in serving institutional investors, with a focus on risk management and execution quality.

- Huobi OTC: Huobi’s OTC trading platform, which offers a wide range of digital assets, competitive rates, and a user-friendly interface for institutional clients.

It’s important to note that this list is not exhaustive, and institutional investors should still conduct their own due diligence to identify the platform that best aligns with their specific needs and preferences.

Maximizing Your Crypto Otc Trading Success

As institutional investors venture into the world of crypto OTC trading, it’s essential to keep a few key tips in mind to ensure a successful and rewarding experience.

- Maintain a deep understanding of the evolving market dynamics: Stay informed about the latest trends, volatility patterns, and regulatory changes in the cryptocurrency space, as this knowledge will inform your trading decisions and help you capitalize on emerging opportunities.

- Leverage the platform’s expertise and negotiation prowess: Work closely with the OTC trading platform to negotiate favorable pricing, settlement conditions, and customization options that align with your investment strategy.

- Implement robust risk management strategies: Conduct thorough due diligence on potential counterparties and consider leveraging escrow services or other risk mitigation strategies to safeguard your assets and minimize exposure to counterparty risk.

- Embrace the power of data and analytics: Utilize the platform’s market insights and trade execution data to fine-tune your strategies, identify patterns, and make informed decisions that drive sustainable growth in your digital asset portfolio.

By keeping these tips in mind, institutional investors can navigate the crypto OTC trading space with confidence, unlocking the unique benefits it offers and positioning themselves for long-term success in the dynamic and ever-evolving world of digital assets.

Fees And Risks Associated With Crypto Otc Trading

While the benefits of crypto OTC trading for institutional investors are significant, it’s important to be aware of the associated fees and risks as well.

Fees

Crypto OTC trading platforms typically charge a combination of spreads, commissions, and other fees, which can vary depending on the platform and the specific trade parameters. Institutional investors should carefully review the fee structure and negotiate favorable terms to minimize the overall cost of their transactions.

Risks

The crypto OTC trading landscape is not without its risks. Counterparty risk is a significant concern, as investors must trust that their trading partners will fulfill their obligations. Additionally, the lack of price transparency and the potential for market manipulation in the OTC space can present challenges. Institutional investors should implement robust risk management strategies to mitigate these risks and protect their portfolios.

Faq

Q: How can institutional investors ensure the security of their assets when trading on crypto OTC platforms? A: To ensure the security of their assets, institutional investors should choose crypto OTC trading platforms that have implemented robust security measures, such as multi-factor authentication, cold storage solutions, and regular security audits. Additionally, platforms should adhere to strict KYC and AML protocols to mitigate the risk of fraud or illicit activities.

Q: What are the regulatory considerations for institutional investors engaging in crypto OTC trading? A: Institutional investors must ensure that the crypto OTC trading platform they choose complies with all relevant regulations in their jurisdiction. This includes verifying that the platform has the necessary licenses and registrations, and that it follows KYC/AML procedures to prevent money laundering and other financial crimes.

Q: How can institutional investors mitigate counterparty risk in OTC trades? A: To mitigate counterparty risk, institutional investors should conduct thorough due diligence on potential trading partners, including verifying their financial stability, reputation, and track record. Additionally, they should consider using escrow services or other risk management tools to ensure the successful completion of trades and the protection of their assets.

Conclusion

As the cryptocurrency market continues to evolve and mature, the role of legitimate crypto OTC trading platforms has become increasingly vital for institutional investors seeking to navigate the digital asset landscape. By understanding the unique benefits and potential pitfalls of this specialized trading environment, and by carefully evaluating the platforms available, savvy investors can leverage the power of crypto OTC trading to diversify their portfolios, manage risk, and capitalize on the growth of the digital asset ecosystem.

By following the comprehensive guidance outlined in this article, including the recommended list of legitimate crypto OTC trading platforms, institutional investors can confidently identify and engage with providers that prioritize security, compliance, and the specific needs of sophisticated market participants. With the right approach and a keen eye for detail, these investors can unlock the full potential of crypto OTC trading and position themselves for success in the dynamic and rapidly evolving world of digital assets.