Crypto Trading Tips: Navigating the Dynamic World of Digital Assets

The dynamic world of digital assets has captivated the attention of investors, both seasoned and novice alike. As the crypto market continues to evolve, the allure of potential profits has drawn numerous individuals to explore this captivating financial landscape. Successful crypto trading, however, requires a strategic approach and a deep understanding of the underlying principles.

This comprehensive guide aims to equip readers with the knowledge and tools necessary to navigate the crypto trading arena with confidence. From mastering the fundamentals to exploring effective trading strategies, we’ll delve into the key elements that will empower you to make informed decisions and manage the inherent risks associated with this rapidly changing market.

This comprehensive guide aims to equip readers with the knowledge and tools necessary to navigate the crypto trading arena with confidence. From mastering the fundamentals to exploring effective trading strategies, we’ll delve into the key elements that will empower you to make informed decisions and manage the inherent risks associated with this rapidly changing market.

Mastering The Foundations Of Crypto Trading

The first crucial step in the crypto trading journey is to develop a solid understanding of the underlying principles. This involves familiarizing oneself with the diverse array of cryptocurrencies, the structure of the crypto market, and the mechanics of trading digital assets.

Cryptocurrencies, such as Bitcoin, Ethereum, and a myriad of altcoins, each with their unique characteristics and use cases, present a wide range of investment opportunities. Exploring the technological foundations, market dynamics, and real-world applications of these digital currencies will provide a comprehensive perspective on the crypto ecosystem.  Cryptocurrency market

Cryptocurrency market

Additionally, understanding the various trading platforms, known as crypto exchanges, and the process of opening and managing a trading account will be essential in navigating the crypto trading landscape. By familiarizing oneself with the user interfaces, security protocols, and trading features of these exchanges, individuals can execute their trading strategies with greater confidence and control.

Navigating Crypto Exchanges

Crypto exchanges are the platforms where individuals can buy, sell, and trade digital assets. Understanding the features, security protocols, and user interfaces of these exchanges is crucial for navigating the crypto trading landscape.

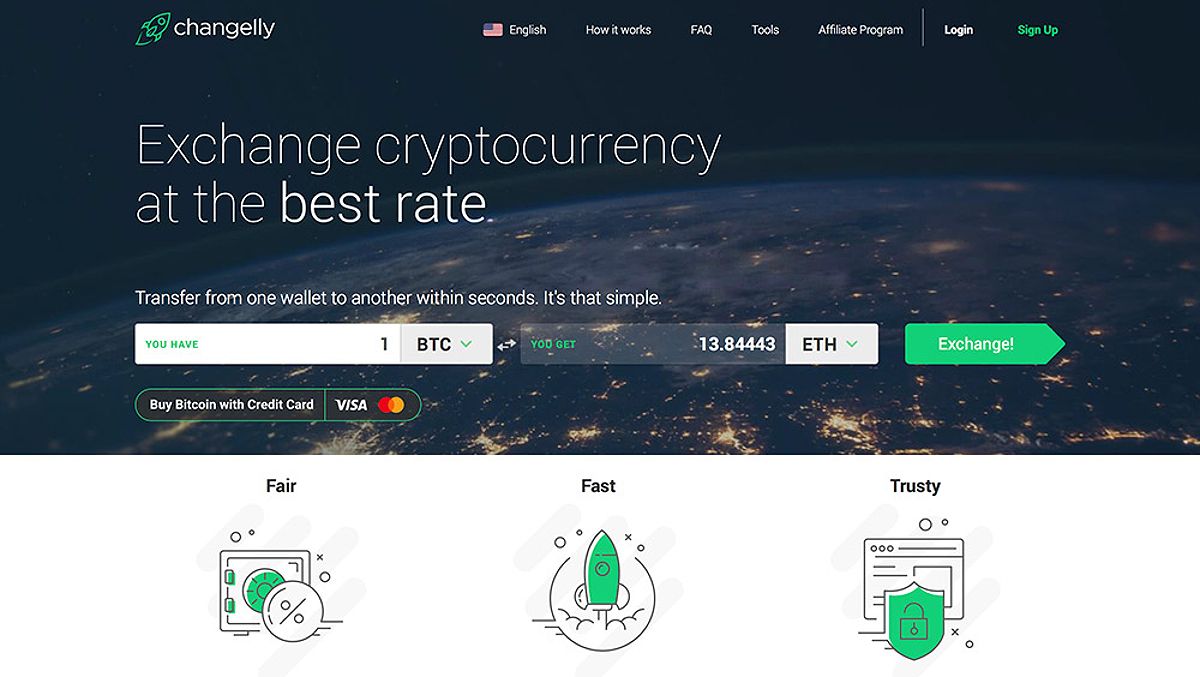

When selecting a crypto exchange, it’s important to research the platform’s reputation, regulatory compliance, and the range of cryptocurrencies offered. Factors such as trading fees, withdrawal options, and customer support should also be considered.  Changelly

Changelly

Familiarizing oneself with the trading tools and indicators available on the exchange can also help traders make more informed decisions. Leveraging features like price charts, order books, and technical analysis indicators can provide valuable insights into market trends and price movements.

Exploring Effective Crypto Trading Strategies

One of the key aspects of successful crypto trading is the ability to identify and implement effective trading strategies. Whether one is drawn to the fast-paced world of day trading or the more measured approach of long-term investing, understanding the nuances of each strategy will empower traders to make more informed decisions.

Day Trading: Capturing Short-term Opportunities

Day trading, with its focus on capturing short-term price movements, can be a thrilling but demanding endeavor. Mastering the art of technical analysis, utilizing tools such as price charts and indicators, can help traders identify entry and exit points within the market’s volatility.  Trading crypto for short-term profit

Trading crypto for short-term profit

Swing Trading And Long-term Investing

In contrast, swing trading and long-term investing strategies may offer a more measured and less demanding approach. These strategies involve holding positions for longer periods, allowing traders to capitalize on broader market trends and potentially mitigate the impact of short-term price fluctuations.

Regardless of the strategy chosen, it is essential to develop a well-structured trading plan that aligns with one’s risk tolerance, investment goals, and personal trading style. Consistency, discipline, and a willingness to adapt to market conditions will be key to navigating the crypto trading arena successfully.

Managing Risks In The Crypto Trading Arena

The crypto market is renowned for its volatility, and with great potential rewards come significant risks. Effective risk management is a crucial aspect of crypto trading, as it can help individuals navigate the market’s unpredictability and protect their hard-earned capital.

Diversification: Spreading Your Investments

One of the fundamental risk management strategies is diversification. By allocating investments across a range of cryptocurrencies, traders can mitigate the impact of individual asset volatility and potentially enhance the overall stability of their portfolio.  Market prices of cryptocurrencies are highly volatile

Market prices of cryptocurrencies are highly volatile

Implementing Stop-loss Orders

Additionally, understanding and implementing stop-loss orders can help limit downside exposure. These orders automatically execute a sell transaction when a cryptocurrency’s price reaches a specific threshold, preventing further losses.

Staying informed about the latest developments in the crypto market, including regulatory changes, industry trends, and potential security threats, will also be essential in managing risks. Regular monitoring and adaptation of trading strategies can help individuals navigate the dynamic landscape with greater resilience.

Practical Crypto Trading Tips For Beginners

As the crypto trading landscape continues to evolve, the following practical tips can help beginners navigate this dynamic market with greater confidence and success:

- Start small and gradually increase investment: Given the inherent risks associated with crypto trading, it is advisable to begin with a modest investment and gradually scale up as one gains experience and confidence.

- Conduct thorough research: Before investing in any cryptocurrency, it is crucial to research the project, its underlying technology, the team behind it, and the market trends. Informed decisions are the foundation of successful trading.

- Utilize stop-loss orders: Implementing stop-loss orders can help limit downside exposure and protect capital from unexpected market downturns.

- Avoid impulsive trading: Emotions can often lead to poor trading decisions. Stick to the trading plan and resist the temptation of making impulsive trades based on hype or fear of missing out.

- Continuously educate oneself: The crypto market is constantly evolving, and staying up-to-date with the latest developments, news, and market analysis will help make more informed trading decisions.

- Diversify the portfolio: Spreading investments across a range of cryptocurrencies can help mitigate risk and potentially enhance overall returns.

- Prioritize security: Ensuring the safety of crypto assets by using secure wallets, enabling two-factor authentication, and practicing good digital hygiene is crucial.

Remember, navigating the crypto trading landscape is a journey of continuous learning and adaptation. By embracing these practical tips and developing a disciplined approach, beginners can increase their chances of achieving their financial goals in the ever-changing world of digital assets.

Faqs

Q: Is crypto trading suitable for beginners? A: Crypto trading can be suitable for beginners, provided they approach it with caution, educate themselves thoroughly, and implement effective risk management strategies.

Q: What is the best crypto trading strategy for beginners? A: For beginners, long-term investing or swing trading strategies may be more suitable than high-frequency day trading, as they tend to be less demanding and can help mitigate the impact of short-term volatility.

Q: How can one avoid scams in crypto trading? A: To avoid scams, it is crucial to research any cryptocurrency or platform thoroughly, use reputable and regulated exchanges, and never share private keys or personal information with anyone.

Conclusion

As the crypto market continues to evolve and present new opportunities, the potential for successful crypto trading remains enticing. By mastering the fundamentals, exploring effective trading strategies, and prioritizing risk management, individuals can navigate the crypto landscape with greater confidence and increase their chances of achieving their financial objectives.

Remember, the crypto trading journey is one of continuous learning and adaptation. By embracing the insights and practical tips outlined in this comprehensive guide, beginners can embark on their trading adventures with a solid foundation and the resilience to navigate the dynamic and ever-changing world of digital assets.