Greetings, fellow crypto enthusiasts! As an avid investor and self-proclaimed algorithm whisperer, I’m thrilled to share with you the power of algorithms in navigating the ever-changing landscape of cryptocurrency trading. The crypto market is a wild ride, full of both incredible opportunities and daunting risks, but by harnessing the potential of algorithms, we can unlock new pathways to consistent profits.

This comprehensive guide will delve into the world of algorithms for crypto trading, exploring the most popular strategies, their benefits and drawbacks, and how you can select the right approach to align with your investment goals and risk tolerance. By the end of this article, you’ll be equipped with the knowledge and confidence to leverage the full potential of algorithms in your crypto trading journey.

Understanding the Role of Algorithms for Crypto Trading

Let’s start by demystifying the concept of algorithmic trading, also known as “algo trading.” In simple terms, these are computer programs designed to automate the process of buying and selling cryptocurrencies. These algorithms are programmed to analyze market data, identify patterns, and execute trades in a matter of milliseconds, far outpacing the capabilities of manual trading.

The primary advantages of using algorithms in crypto trading are speed, efficiency, and emotional detachment. Algorithms can monitor the markets 24/7 and seize fleeting market opportunities that might slip through the fingers of even the most seasoned human traders. And let’s not forget the most critical aspect — algorithms make decisions based on predefined rules, eliminating the emotional biases that can often lead to suboptimal trading decisions.

But it’s not all sunshine and rainbows — algorithms also come with their fair share of risks, such as the possibility of programming errors, market volatility, and the need for constant monitoring and refinement. As an experienced crypto trader, I’ve learned to navigate these challenges and harness the power of algorithms to my advantage.

What is Crypto Algo Trading

What is Crypto Algo Trading

Popular Crypto Trading Algorithm Strategies

As the crypto market continues to evolve, a diverse array of algorithmic trading strategies have emerged, each with its unique strengths and applications. Let’s explore some of the most popular and effective strategies that I’ve personally implemented in my trading portfolio.

Trend Following

Trend-following algorithms are designed to identify and capitalize on the prevailing market trends, whether they are bullish or bearish. These algorithms analyze various technical indicators, such as moving averages, to detect the direction and strength of the market’s momentum, and then execute trades accordingly.

For example, let’s say I’ve programmed a trend-following algorithm to monitor the price of Bitcoin. If the algorithm detects a sustained upward trend, it will automatically place buy orders to take advantage of the bullish sentiment. The algorithm will continue to hold the position until it identifies a shift in the trend, at which point it will execute a sell order to lock in the gains.

Moving Average Crossover Crypto

Moving Average Crossover Crypto

Mean Reversion

Mean reversion algorithms, on the other hand, focus on the notion that asset prices tend to fluctuate around their long-term average or “mean” value. These algorithms look for temporary deviations from the mean and execute trades with the expectation that the asset’s price will eventually revert to its historical average.

Imagine a scenario where the price of Ethereum has experienced a temporary dip, pushing it below its 30-day moving average. My mean reversion algorithm would detect this deviation and automatically place a buy order, anticipating that the price will eventually correct and return to its normal range.

Reversion to Mean Crypto

Reversion to Mean Crypto

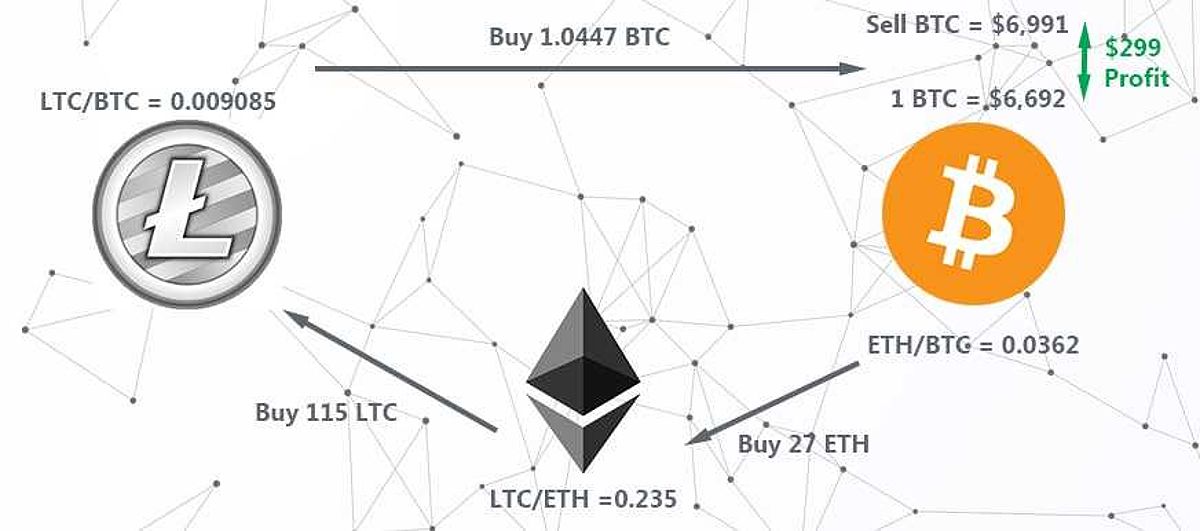

Arbitrage

Arbitrage algorithms are designed to capitalize on price discrepancies between different cryptocurrency exchanges or trading platforms. These algorithms rapidly execute trades to take advantage of these temporary inefficiencies, effectively eliminating the price gaps and generating risk-free profits.

For instance, my arbitrage algorithm might identify a situation where the price of Bitcoin is slightly higher on Binance than on Coinbase. The algorithm would then automatically execute a buy order on Coinbase and a sell order on Binance, locking in the price difference and earning a small but consistent profit.

Crypto Trading Algorithms

Crypto Trading Algorithms

Choosing the Right Crypto Trading Algorithm for You

Selecting the most suitable crypto trading algorithm for your investment strategy and risk profile is a crucial step. As an experienced crypto trader, I’ve learned that there is no one-size-fits-all solution, and the key is to carefully evaluate your unique circumstances.

When it comes to choosing the right algorithm, I always start by clearly defining my investment goals. Am I looking for short-term profit maximization, long-term wealth creation, or a balanced approach? I then assess my risk tolerance — am I willing to accept higher volatility in pursuit of greater returns, or do I prefer a more conservative, risk-averse strategy?

Another important factor is my technical expertise. Do I have a solid understanding of the crypto market, data analysis, and programming concepts? Some algorithmic strategies may require a higher level of technical proficiency, so it’s essential to be honest with myself about my capabilities.

Finally, I consider the resources I have available, such as time, capital, and computing power. Implementing and monitoring the performance of an algorithm can be a time-consuming and resource-intensive task, so I need to ensure that I have the necessary resources to support my chosen strategy.

The Future of Algorithms in Crypto Trading

As we move into the future, the role of algorithms in crypto trading is only going to become more prominent. The rapid advancements in artificial intelligence (AI) and machine learning (ML) are already making waves in the industry, with algorithms that can adapt to changing market conditions and refine their trading strategies accordingly.

These advanced algorithms leverage vast amounts of data, complex mathematical models, and self-learning capabilities to identify and capitalize on subtle market patterns that may be invisible to even the most experienced human traders. As the adoption of AI and ML in crypto trading grows, I anticipate a significant increase in market efficiency, liquidity, and stability.

However, the regulatory landscape surrounding algorithmic trading in cryptocurrencies is still evolving, and investors must remain vigilant in ensuring their practices comply with relevant laws and exchange rules. Additionally, the ongoing arms race between algorithm developers may lead to increased market volatility and the potential for disruptive events, underscoring the need for continuous monitoring and risk management.

FAQ

Q: Are algorithms for crypto trading legal? A: Yes, algorithmic trading in cryptocurrencies is generally legal, but investors must ensure compliance with relevant regulations and exchange rules. It’s important to stay informed about the evolving regulatory landscape and seek professional guidance if needed.

Q: How can I learn more about developing my own crypto trading algorithms? A: There are numerous online resources, courses, and communities dedicated to algorithmic trading in the crypto space. Consider exploring platforms like Coursera, Udemy, or online forums like Reddit to expand your knowledge and skill set.

Q: Is algorithmic trading suitable for all investors? A: Not necessarily. While algorithms can be a powerful tool, they require a certain level of technical expertise, market understanding, and risk management capabilities. It’s essential to carefully assess your own skills, resources, and investment goals before delving into algorithmic crypto trading.

Conclusion

As I reflect on my journey as a crypto trader, I can confidently say that algorithms have been a game-changer in navigating the volatile and captivating world of cryptocurrencies. By harnessing the power of these computer programs, I’ve been able to execute trades with lightning-fast speed, make emotionally-detached decisions, and generate consistent returns that have exceeded my expectations.

However, the crypto market is an ever-evolving landscape, and the role of algorithms will only continue to grow in the years to come. As AI and ML technologies advance, we can expect to see even more sophisticated algorithms that can adapt to changing market conditions and uncover hidden opportunities.

While the path ahead may not be without its challenges, I’m excited to see what the future holds for algorithmic trading in the crypto space. By staying informed, adaptable, and diligent in our risk management, we can unlock the full potential of algorithms and achieve our financial goals in this dynamic and rewarding market.

So, my fellow crypto enthusiasts, let’s embrace the power of algorithms and embark on a journey of profitable and sustainable crypto trading. The future is ours for the taking!