As the cryptocurrency market continues to captivate the attention of more and more Americans, I find myself reflecting on my own journey into this exciting, yet complex, world of digital assets. Back in 2024, when I first dipped my toes into the crypto trading waters, I was overwhelmed by the sheer number of platforms available, each promising the ultimate trading experience.

But as a beginner, I quickly realized that not all crypto trading platforms were created equal. I needed to find a solution that would not only safeguard my investments but also provide the guidance and resources I craved to make informed decisions. After extensive research and personal experimentation, I’ve compiled this comprehensive guide to help fellow crypto newcomers in the USA navigate the landscape and discover the best trading platforms tailored to their needs.

Crypto Trading Platforms: The Digital Marketplaces

Crypto trading platforms are the digital hubs where the buying, selling, and exchanging of cryptocurrencies takes place. These platforms can be either centralized, operated by a single entity, or decentralized, where the trading occurs in a peer-to-peer manner without a central authority. In the ever-evolving US crypto landscape, there are over 40 trading platforms available to investors like myself.

Binance

Binance

The Regulatory Landscape: Navigating the Crypto Maze

The cryptocurrency industry in the USA is overseen by several regulatory bodies, including the SEC, CFTC, and FinCEN. As a beginner, it’s crucial to choose a crypto trading platform that is registered with FinCEN and complies with anti-money laundering (AML) and know-your-customer (KYC) regulations. Opting for a regulated and licensed platform is essential for the safety and security of your crypto investments.

User-Friendly Experience: Simplicity for Beginners in Crypto Trading Platform USA

For someone new to the crypto world like myself, the user interface and overall trading experience of a platform are of paramount importance. I’ve found that the most beginner-friendly platforms, such as Coinbase and Robinhood Crypto, offer intuitive designs, clear instructions, and comprehensive educational resources to help newcomers like me navigate the crypto market with confidence.

Security and Trust: Safeguarding Your Crypto Assets

Ensuring the security of my crypto assets has been a top priority in my search for the right trading platform. I’ve looked for platforms that offer robust security features, including two-factor authentication, cold storage for the majority of user funds, and insurance policies to protect against hacks and theft. Platforms like Gemini and Kraken have gained my trust through their commitment to safeguarding their users’ crypto holdings.

Fees and Cost Considerations: Maximizing Your Investments

As a beginner, I’ve quickly learned that the fees associated with crypto trading can have a significant impact on the overall profitability of my investments. I’ve compared the fee structures of various platforms, and I’ve found that options like Crypto.com and Robinhood Crypto, with their low or even zero trading fees, have been particularly appealing to me.

Cryptocurrency Selection: Exploring the Digital Landscape

The range of cryptocurrencies supported by a trading platform has also been an important factor in my decision-making process. As a beginner, I’ve wanted to explore a variety of digital assets, from the well-established Bitcoin and Ethereum to the more speculative altcoins. Platforms that offer a broad selection of cryptocurrencies, such as Coinbase and Gemini, have been particularly attractive to me.

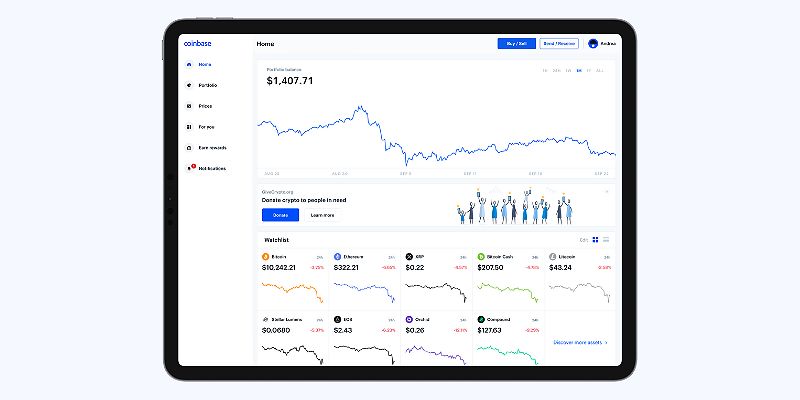

Coinbase: A Trusted Gateway to the Crypto World

Coinbase has emerged as one of the most prominent and user-friendly cryptocurrency exchanges in the USA. With its straightforward platform for buying, selling, and storing a wide range of digital assets, Coinbase has been an excellent choice for me as a beginner. The platform’s strong emphasis on security, including features like two-factor authentication and FDIC insurance for USD deposits, has earned my trust. Additionally, Coinbase’s comprehensive educational resources and tutorials have been invaluable in helping me navigate the complexities of the crypto market.

Coinbase

Coinbase

Robinhood Crypto: Simplicity and Zero-Commission Trading

As someone who values simplicity and cost-effectiveness, Robinhood Crypto has caught my attention. This commission-free trading platform allows users like myself to buy, sell, and hold cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin, with ease. The Robinhood Crypto mobile app’s intuitive interface has been a major draw for me, making it an attractive option for beginners looking to dip their toes into the crypto space. While the platform’s cryptocurrency selection may be more limited compared to dedicated crypto exchanges, its zero-commission trading and seamless integration with Robinhood’s stock trading features have been compelling factors in my decision-making process.

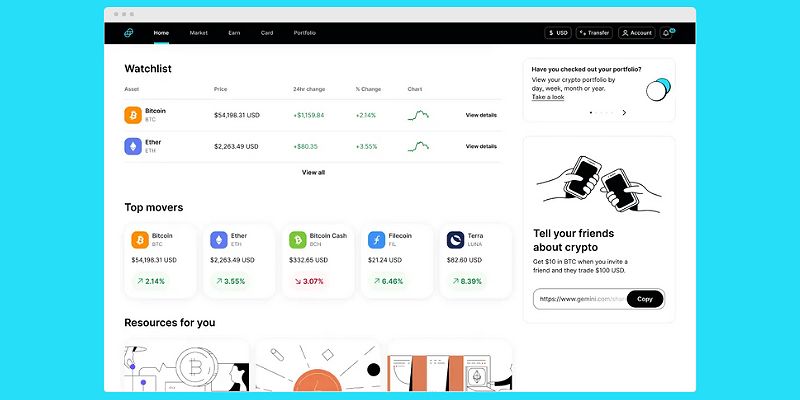

Gemini: A Secure and Regulated Crypto Exchange

Gemini, a highly regulated and secure cryptocurrency exchange, has also emerged as a strong contender in my search for the best crypto trading platform. Operating in all 50 U.S. states, Gemini offers a user-friendly platform with advanced trading tools, as well as a mobile app for on-the-go trading. The exchange’s commitment to security, with features like cold storage for the majority of user funds, two-factor authentication, and insurance coverage, has been a significant selling point for me. Gemini’s broad range of supported cryptocurrencies has also made it a versatile choice, catering to both beginners and experienced traders like myself.

Gemini

Gemini

Crypto-com: Competitive Fees and Innovative Products

Crypto.com is a global cryptocurrency exchange that has caught my attention with its wide range of features, including spot trading, margin trading, and an NFT marketplace. The platform’s competitive fee structure, with trading fees as low as 0% for high-volume traders, has been an appealing factor. Crypto.com also offers a variety of crypto-backed financial products, such as the Crypto.com Visa Card, which provides cashback rewards on purchases, further enhancing its appeal to crypto enthusiasts like myself.

Kraken: A Veterans Choice for Advanced Traders

As an experienced crypto trader, Kraken has emerged as a platform that caters to my more sophisticated needs. With its robust trading platform, advanced features like margin trading and futures trading, and a wide selection of supported cryptocurrencies, Kraken is well-suited for traders who have gained some expertise in the crypto market. The exchange’s commitment to security and its 24/7 customer support have also been key factors in my consideration.

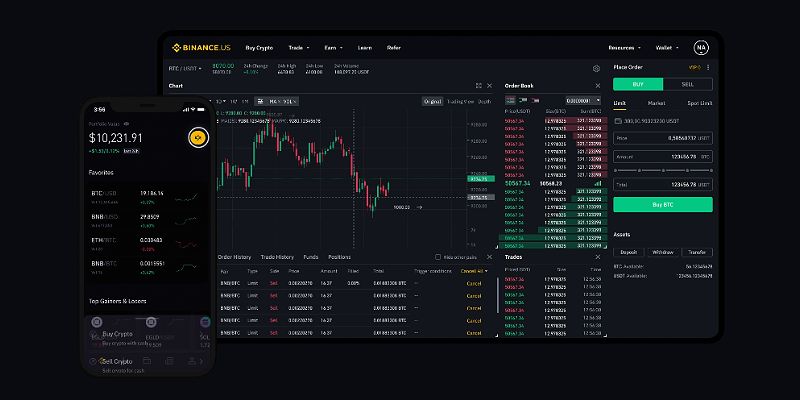

Binance-US: The US-based Offshoot of a Global Giant

Binance.US, the US-based version of the world’s largest cryptocurrency exchange, Binance, has also caught my attention. While it offers a more limited selection of cryptocurrencies compared to its global counterpart, Binance.US still provides a comprehensive trading platform with features like spot trading, margin trading, and futures trading. The exchange’s deep liquidity and advanced charting tools have made it a popular choice among more experienced crypto traders like myself.

Start Small and Learn Gradually

As a beginner, I’ve learned the importance of starting with a small investment and gradually increasing my exposure as I gain more experience and understanding of the crypto market. I’ve taken the time to educate myself on the fundamentals of cryptocurrency, the various trading strategies, and the potential risks involved, which has been crucial in building my confidence and making informed decisions.

Diversify Your Portfolio

To mitigate the risks associated with the volatile crypto market, I’ve made it a point to diversify my investments across different digital assets. This approach has helped me reduce the impact of fluctuations in any single cryptocurrency and maintain a more balanced portfolio.

Secure Your Crypto Assets

Once I’ve made my initial crypto purchases, I’ve prioritized the security of my assets by storing them in a secure wallet, either a hardware wallet (such as Ledger or Trezor) or a reputable software wallet. This has helped me protect my investments from potential hacks or third-party risks associated with centralized exchanges.

FOMO (Fear of Missing Out)

I’ve learned to resist the temptation of making impulsive decisions based on the fear of missing out on potential gains. Instead, I’ve focused on thoroughly researching and understanding the cryptocurrencies I’m considering investing in, making decisions based on my risk tolerance and investment goals.

Investing in Hype

I’ve also made a conscious effort to avoid investing in cryptocurrencies solely based on hype or social media trends. Instead, I’ve prioritized understanding the underlying technology, real-world use cases, and long-term growth potential of the digital assets I’m interested in.

Ignoring Security Risks

As a crypto trader, I understand that the security of my assets is paramount. I’ve taken the necessary precautions, such as using strong passwords, enabling two-factor authentication, and storing my crypto in secure wallets, to protect my investments from potential threats.

FAQ

Q: Is crypto trading legal in the USA? A: Yes, crypto trading is legal in the USA, but it is important to choose a regulated and licensed platform.

Q: How much money do I need to start trading crypto? A: You can start with a small amount, even as little as $10 or $20.

Q: What are the best cryptocurrencies for beginners? A: Bitcoin and Ethereum are good starting points due to their established market position and liquidity.

Q: Is it safe to store my crypto on an exchange? A: It is generally recommended to transfer your crypto to a secure wallet for long-term storage.

Conclusion

As I look back on my journey into the world of crypto trading, I’m reminded of the importance of carefully navigating the landscape and finding the right platform that meets my needs as a beginner. By considering factors like user-friendliness, security, fees, and cryptocurrency selection, I’ve been able to identify platforms that have not only safeguarded my investments but also provided the educational resources and guidance I needed to make informed decisions.

While the crypto market may seem daunting at first, I encourage fellow beginners in the USA to embark on this exciting journey, starting small, diversifying their portfolios, and prioritizing the security of their assets. By staying vigilant and learning from the mistakes of others, we can unlock the vast potential of the cryptocurrency ecosystem and reap the rewards of this dynamic and rapidly evolving financial landscape.