In the ever-evolving world of cryptocurrencies, a new breed of traders has emerged, seeking to capitalize on the inherent volatility of the market. Enter the realm of 60-second crypto trading, where the potential for quick profits meets the thrill of high-stakes speculation. This investigative guide will take you on a journey through the intricate workings of this fast-paced trading strategy, equipping you with the knowledge and insights to make informed decisions in this captivating, yet perilous, arena.

What is 60 Second Crypto Trading?

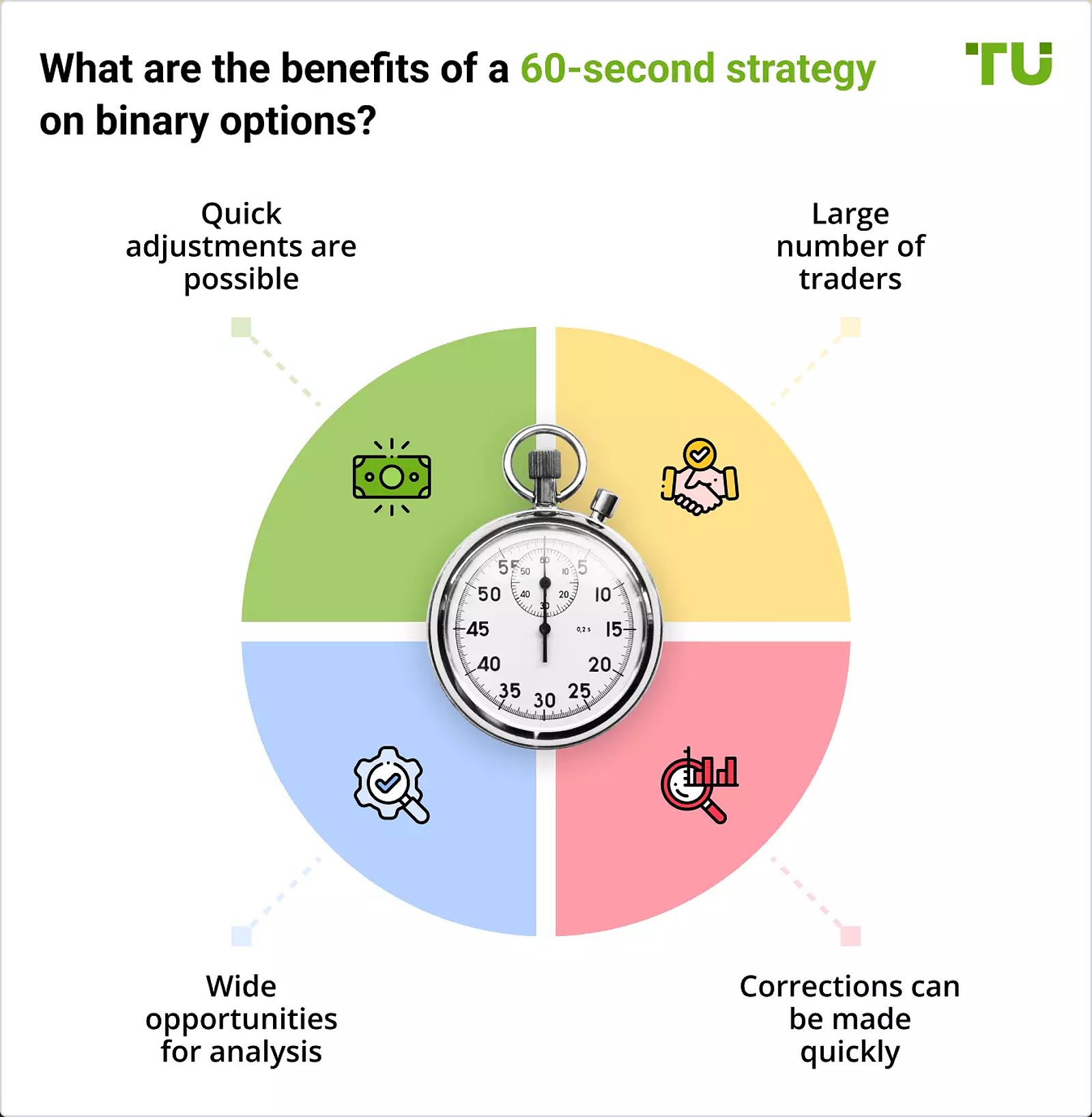

At its core, 60-second crypto trading is a form of binary options trading, where traders predict the price movement of a cryptocurrency within a 60-second timeframe. It’s a high-intensity, all-or-nothing proposition — if the trader’s prediction is correct, they receive a predetermined payout; if they’re wrong, they lose their entire investment.

The allure of 60-second crypto trading lies in its potential for rapid returns. By leveraging the market’s volatility, traders can execute multiple trades in a short period, potentially generating substantial gains. However, this speed and volatility also introduce significant risks, as a single incorrect prediction can wipe out a trader’s capital.

To navigate this high-stakes landscape successfully, traders must possess a deep understanding of market dynamics, technical analysis, and effective risk management strategies. It’s a strategy not for the faint of heart, but for the savvy speculator willing to embrace the challenges and reap the potential rewards.

Accessing the 60 Second Crypto Trading Market

Selecting a Reputable Crypto Broker

The first step in embarking on your 60-second crypto trading journey is to choose a reliable and regulated broker. Conducting thorough research is crucial, as the broker you select will ultimately determine the trading conditions, security measures, and overall user experience.

When evaluating potential brokers, look for those with a strong reputation, positive customer reviews, and the necessary regulatory licenses to operate in your jurisdiction. Compare factors such as trading fees, minimum deposit requirements, and the range of cryptocurrencies available for trading.

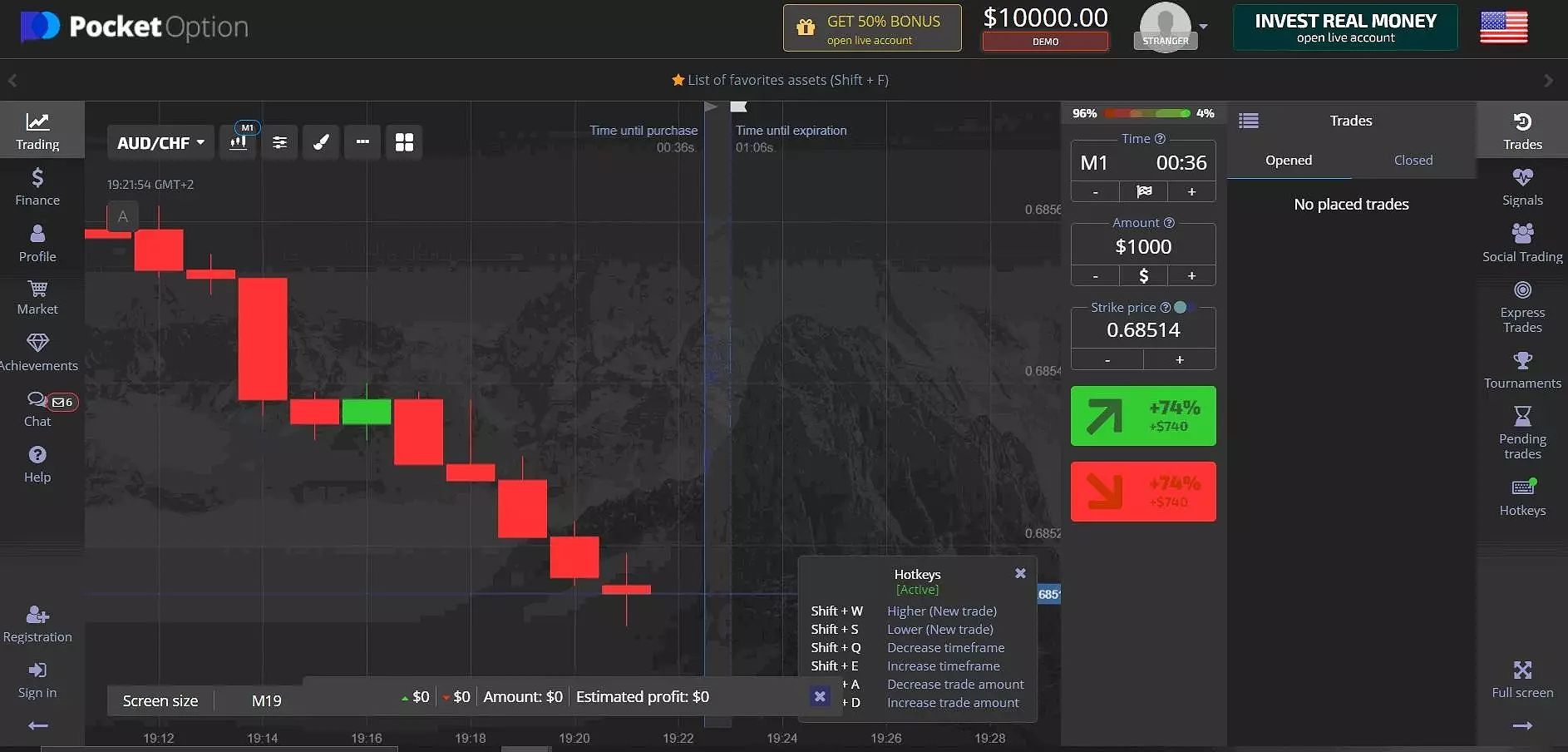

Some reputable brokers offering 60-second crypto trading include Pocket Option, Binary.com, and IQ Option, each with their own unique features and benefits.

Setting Up Your Trading Account

Once you’ve identified a suitable broker, the next step is to open a trading account and fund it. The account creation and verification process is typically straightforward, allowing you to quickly get started.

When it comes to funding your account, you’ll have access to a variety of payment methods, including credit/debit cards, e-wallets, and bank transfers. Regardless of the method you choose, prioritize security and start with a small investment as you familiarize yourself with the trading platform and its features.

Navigating the Trading Interface

The trading platform you’ll use for 60-second crypto trading will feature a user-friendly interface, enabling you to analyze charts, place trades, and monitor your positions with ease. Take the time to explore the different chart types (candlestick, line, bar), order types (buy/sell, call/put), and trade execution processes.

Familiarity with the platform’s key elements is crucial, as it will allow you to make informed decisions and execute trades with confidence. Consider practicing on a demo account to hone your skills before risking real capital.

Strategies for Navigating the 60 Second Crypto Trading Landscape

Embracing Trend Trading

One effective strategy for 60-second crypto trading is trend trading. By identifying the prevailing market direction and aligning your trades accordingly, you can increase your chances of success. Utilize technical indicators such as moving averages, support and resistance levels, and candlestick patterns to spot trends and make informed trading decisions.

Capitalizing on News-Driven Movements

Another approach is to capitalize on the impact of news and announcements on the cryptocurrency market. Stay informed about relevant events, such as regulatory changes, new product launches, or shifts in market sentiment, and analyze how they might affect the price of specific cryptocurrencies. Be prepared to act quickly on news-driven price movements to maximize your potential returns.

Leveraging Crypto Signals

Crypto signals can be a valuable tool in the world of 60-second crypto trading. These are trading alerts generated by experienced traders or algorithms, which identify potential trading opportunities. While crypto signals can provide a helpful starting point, it’s essential to use them in conjunction with your own analysis and risk management strategies.

Mitigating Risks in 60 Second Crypto Trading

Risk management is paramount in the high-stakes world of 60-second crypto trading, as the inherent volatility and rapid pace can lead to significant losses if not managed properly. Adhere to the following best practices to protect your capital:

- Never Risk More Than You Can Afford to Lose: Establish a strict limit on the amount of capital you’re willing to allocate to each trade, and never exceed it.

- Utilize Stop-Loss Orders: Protect your positions by setting stop-loss orders to limit potential losses and prevent runaway losses.

- Diversify Your Portfolio: Spread your investment across different cryptocurrencies to mitigate the impact of a single unfavorable trade.

- Maintain Emotional Discipline: Avoid letting your emotions influence your decision-making, and stick to your trading plan.

Tips for Successful 60 Second Crypto Trading

- Practice with a Demo Account: Before risking real money, hone your skills and test your strategies using a demo trading platform.

- Start Small: When you’re ready to trade with real capital, begin with small trade sizes and gradually increase as you gain experience.

- Prioritize Learning: Focus on developing your trading skills and understanding the market dynamics, rather than chasing immediate profits.

- Stay Disciplined: Resist the temptation to overtrade or chase losses, as this can quickly deplete your trading capital.

Leveraging Market Volatility

The cryptocurrency market is renowned for its high volatility, which can be both a blessing and a curse for 60-second crypto traders. While the potential for rapid price movements can create lucrative opportunities, it also increases the risk of significant losses.

To leverage market volatility effectively, it’s crucial to closely monitor market trends and news. By staying informed about the factors driving crypto prices, traders can better anticipate and capitalize on short-term price fluctuations. Additionally, the use of technical analysis tools, such as candlestick patterns, support and resistance levels, and moving averages, can assist in identifying potential entry and exit points.

However, traders must also be mindful that volatility can work against them in 60-second crypto trading. Sudden, unexpected price swings can quickly erode profits or magnify losses, emphasizing the importance of robust risk management strategies.

Emotional Control and Discipline

Successful 60-second crypto trading requires more than just technical analysis and market knowledge; it also demands unwavering emotional control and disciplined decision-making. The rapid pace of this trading strategy can be thrilling, but it can also tempt traders to make impulsive, emotion-driven decisions.

Traders who succumb to the allure of chasing losses or overtading often find themselves in a downward spiral, rapidly depleting their trading capital. To maintain a clear, rational mindset, it’s essential to develop a well-defined trading plan and adhere to it, even in the face of market uncertainty.

By cultivating emotional discipline, traders can navigate the high-stakes world of 60-second crypto trading, making calculated decisions based on market analysis rather than gut instinct.

FAQ

Q: Is 60-second crypto trading legal? A: Yes, 60-second crypto trading is generally legal, but it’s essential to choose a regulated broker and comply with local laws and regulations.

Q: How much money do I need to start 60-second crypto trading? A: The minimum deposit required varies between brokers, but you can usually start with a small amount, such as $10 or $50.

Q: What are the best cryptocurrencies to trade with 60-second options? A: Cryptocurrencies with high volatility, such as Bitcoin, Ethereum, and various altcoins, are often preferred for 60-second trading due to their potential for rapid price movements.

Q: Is 60-second crypto trading suitable for beginners? A: While 60-second crypto trading can be exciting, it is a high-risk strategy and may not be the best starting point for complete beginners. It’s recommended to first learn the basics of crypto trading and then explore this strategy as you gain more experience.

Conclusion

In the captivating world of 60-second crypto trading, the promise of quick profits meets the harsh reality of substantial risks. As you navigate this high-stakes landscape, it’s essential to approach it with a well-rounded understanding of the market dynamics, effective trading strategies, and robust risk management practices.

By selecting a reputable broker, mastering the trading interface, and implementing sound strategies, you can position yourself to capitalize on the inherent volatility of the cryptocurrency market. However, it’s crucial to maintain emotional discipline, start small, and prioritize learning over chasing immediate gains.

As the crypto industry continues to evolve, the opportunities and challenges in 60-second trading will undoubtedly evolve as well. Stay informed, adapt your approach, and approach this speculative arena with the caution and diligence it deserves. With the right mindset and tools, the potential rewards of 60-second crypto trading may be within your reach.