The world of cryptocurrency never sleeps, and neither does the opportunity to trade. 24/7 crypto trading offers unparalleled flexibility, but it also presents unique challenges. This guide will equip you with the knowledge and strategies needed to navigate this dynamic market.

The Boundless World of 24/7 Crypto Trading

The concept of 24/7 crypto trading refers to the ability to engage in cryptocurrency transactions at any time, day or night, without the constraints of traditional market hours. This continuous access is a direct result of the decentralized and global structure of the crypto ecosystem, which is not tied to a specific location or institution.

As the cryptocurrency market continues to evolve, the 24/7 trading model has revolutionized the way we approach financial markets. Investors and traders from all corners of the world can now participate in the crypto market, capitalizing on opportunities that may arise outside of regular trading hours in traditional markets.

Why Does Crypto Trading Never Sleep?

The 24/7 nature of the crypto market is rooted in several key factors that differentiate it from traditional financial markets. Firstly, the decentralized nature of cryptocurrencies means there is no central authority controlling the market, allowing for continuous global participation. Secondly, the rapid advancements in technology, such as automated trading bots and the availability of global crypto exchanges, have enabled seamless access and trading activity around the clock.

Additionally, the global reach of the cryptocurrency ecosystem means that traders and investors from different time zones can engage in buying, selling, and exchanging digital assets at any given moment. This constant flow of market activity, fueled by the intersection of diverse global participants, is a defining characteristic of the 24/7 crypto trading landscape.

Advantages and Disadvantages of 24/7 Crypto Trading

Advantages of 24/7 Trading

One of the primary advantages of 24/7 crypto trading is the flexibility it offers. Traders can access the market and execute trades at any time, allowing them to capitalize on market opportunities that may arise during off-peak hours in traditional financial markets. This global accessibility also provides diversification opportunities, as traders can participate in the crypto market regardless of their location.

Furthermore, the continuous trading activity in the crypto market can lead to increased liquidity, making it easier to enter and exit positions, particularly for larger trades. This increased liquidity can be especially beneficial for traders looking to execute sizable transactions without significantly impacting the market price.

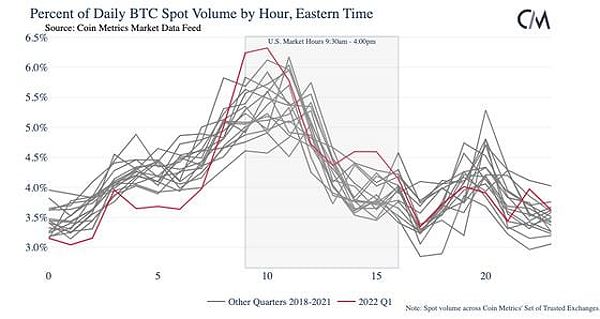

Bitcoin’s spot volume over three years

Bitcoin’s spot volume over three years

Disadvantages of 24/7 Trading

While the 24/7 nature of the crypto market presents numerous benefits, it also comes with its own set of challenges. The constant market activity can contribute to heightened volatility, as prices can fluctuate rapidly in response to global events and news. This increased volatility can pose a risk for traders, especially those with smaller portfolios or less experience in managing risk.

Additionally, the constant access to the market can tempt traders to make impulsive decisions, leading to emotional trading and potential losses. The lack of a defined trading schedule can also make it challenging to maintain a healthy work-life balance and avoid burnout, as the temptation to constantly monitor the market can be overwhelming.

Trading Strategies for 24/7 Crypto Markets

Understanding Market Cycles and Trends

To succeed in the 24/7 crypto trading environment, it’s crucial to analyze market cycles and trends. By identifying patterns in the market, traders can better time their entry and exit points, capitalizing on potential opportunities and minimizing their exposure to risk. This process involves studying historical data, monitoring news and events, and utilizing technical analysis tools to spot emerging trends.

By understanding the cyclical nature of the crypto market and recognizing the factors that drive price movements, traders can develop more informed trading strategies and make better-timed decisions. This knowledge can be particularly useful in navigating the heightened volatility that often characterizes the 24/7 crypto trading landscape.

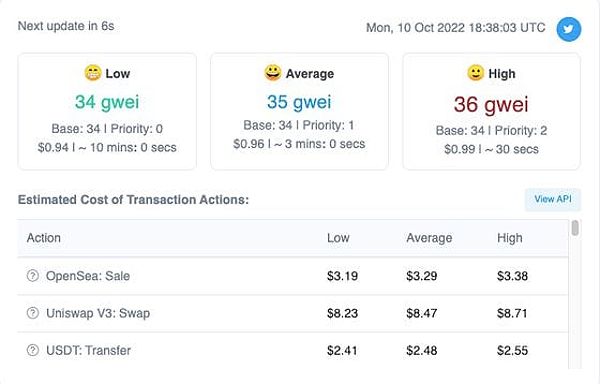

EtherScan display of Ethereum gas fees on October 10, 2022

EtherScan display of Ethereum gas fees on October 10, 2022

Managing Risk and Setting Stop-Losses

In the fast-paced world of 24/7 crypto trading, risk management is paramount. Traders should prioritize the use of stop-loss orders to protect their positions against significant losses. By setting predetermined price levels at which their trades will be automatically closed, they can limit their downside exposure and maintain a disciplined approach to their trading strategy.

Additionally, diversifying their portfolio and employing proper position sizing has been instrumental in mitigating the risks associated with the high volatility of the crypto market. By carefully managing their risk exposure, traders can navigate the 24/7 crypto trading environment with greater confidence and resilience.

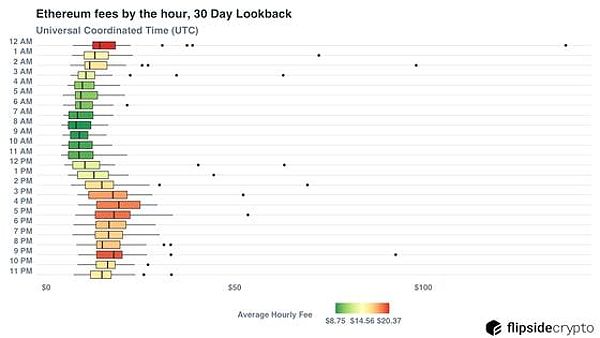

Hourly ETH fees

Hourly ETH fees

Choosing the Right Exchange and Trading Tools

Selecting a reputable and reliable cryptocurrency exchange is a critical step in the 24/7 trading journey. Traders should research and compare various exchanges, considering factors such as security, liquidity, fees, and user-friendly trading platforms. Leveraging advanced trading tools and resources, such as charting software, market data analytics, and portfolio management tools, can also be crucial in helping traders make more informed decisions and navigate the 24/7 crypto market effectively.

Cryptocurrencies

Cryptocurrencies

Tips for Beginners

As you embark on your 24/7 crypto trading journey, consider the following tips:

- Start small and invest only what you can afford to lose. Cryptocurrency trading carries inherent risks, and it’s essential to manage your exposure carefully.

- Educate yourself on the fundamentals of cryptocurrencies, market dynamics, and various trading strategies. Continuous learning is key to developing a successful trading approach.

- Choose a reputable and secure cryptocurrency exchange that aligns with your trading needs and preferences.

- Utilize trading tools and resources to analyze market trends, manage risk, and make informed decisions.

- Maintain patience, discipline, and a long-term perspective. Avoid impulsive trading decisions, and focus on developing a consistent and well-thought-out trading strategy.

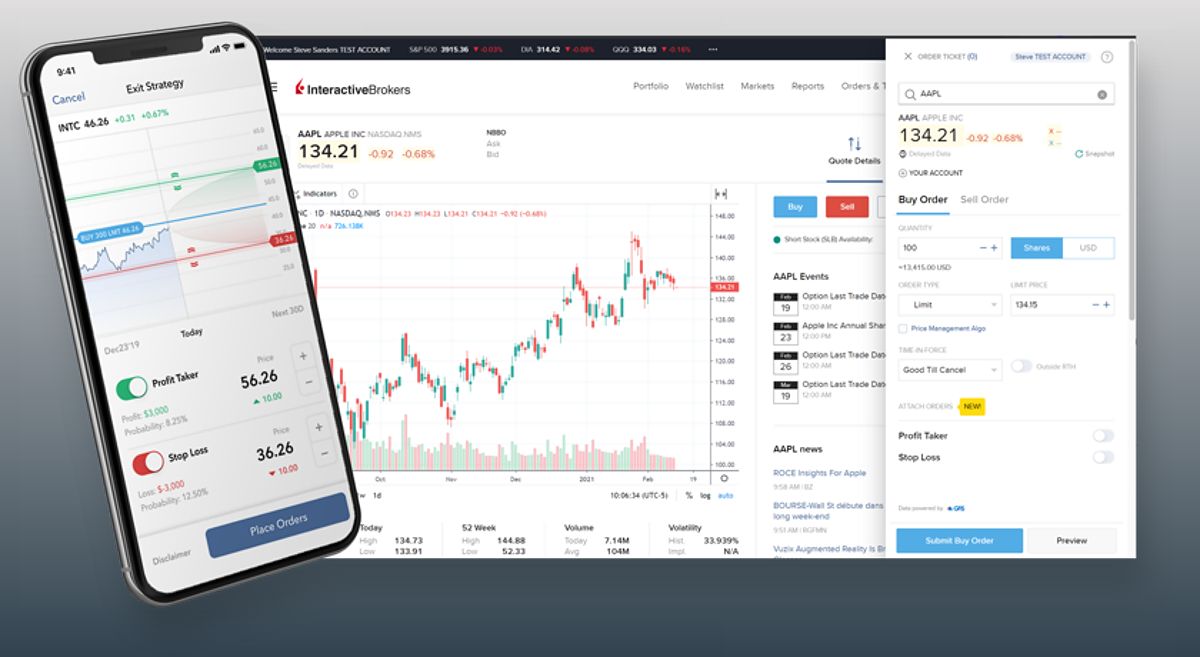

Stocks ETFs trading platform

Stocks ETFs trading platform

FAQ

Q: Is it safe to trade crypto 24/7?

A: Trading crypto 24/7 can be safe if you choose a reputable exchange with strong security measures and practice good risk management. However, it’s important to be aware of the inherent risks associated with cryptocurrency trading.

Q: Can I make money trading crypto 24/7?

A: Cryptocurrency trading is inherently risky, and there is no guarantee of making money. While some traders do profit from the 24/7 nature of the crypto market, success depends on your knowledge, trading strategy, and risk management skills. It’s essential to approach crypto trading with a balanced and disciplined mindset.

Q: What are the best crypto exchanges for 24/7 trading?

A: Some of the reputable crypto exchanges that offer 24/7 trading include Coinbase, Binance, Kraken, and Gemini. When selecting an exchange, consider factors such as fees, security, user interface, and the range of cryptocurrencies available for trading.

Conclusion

24/7 crypto trading offers unique opportunities and challenges for traders of all experience levels. By understanding the dynamics of this constantly evolving landscape, developing effective trading strategies, and prioritizing risk management, traders can navigate this exciting financial frontier with confidence.

Whether you’re a seasoned trader or a newcomer to the crypto space, equipping yourself with the right knowledge and tools can help you unlock the full potential of 24/7 crypto trading. As we move forward into the second half of 2024, the importance of adapting to the 24/7 nature of the crypto market will only continue to grow.

Remember to approach this market with patience, discipline, and a long-term perspective. By doing so, you’ll be well on your way to achieving your trading goals and capitalizing on the boundless opportunities that 24/7 crypto trading has to offer.